Competition authorities are increasingly grappling with mergers in dynamic industries characterised by high levels of innovation and technological change.

However, their existing tools are poorly suited to working through these questions, which has led to concerns that harmful mergers are slipping through the antitrust net. Some commentators are now calling for a radical overhaul of merger assessment to address this issue, with a change in the burden of proof to reduce the risk of underenforcement. But is this the right solution? In this article, we argue that there are new tools that competition authorities can develop to sharpen their evaluation of such mergers without tilting the playing field.

Antitrust … or augury?

Trustbusters in America and Europe are increasingly scrutinising mergers in industries characterised by high levels of innovation. Among the most prominent examples of this trend are investigations into acquisitions of start-ups with innovative products and business models by the so-called Big Tech firms such as Google, Apple, Meta, Amazon and Microsoft. Often these targets are tech firms, but they bear little resemblance to their acquirers in terms of their current range of products and services or how they monetise them.

Traditionally transactions in highly innovative and rapidly evolving industries have tended not to attract much attention from trustbusters: technological development can act as a disruptive force that lowers barriers to entry and keeps market leaders on their toes. However, some authorities have expressed concerns that this disruptive dynamic might no longer apply to Big Tech, where market leaders may benefit from other advantages – such as economies of scale and network effects – that impede the rate at which innovative new entrants can grow. These advantages, some argue, buy the incumbents extra time, which they can use to identify start-ups that could one day pose a threat and snap them up before they can disrupt the status quo. If left unchecked, the thinking goes, this could result in a wave of “killer acquisitions”.

Reading the tea leaves

This shift in focus is creating a challenge for competition authorities since their traditional toolkit is not well suited to evaluate mergers of firms in dynamic markets. For example, when considering whether an acquisition will directly reduce competition, authorities will typically start by defining the markets in which the two merging firms are active today and then identifying whether they are significant competitors in these markets. However, market definition is an inherently static concept: it marks out fixed boundaries that do not help in understanding the dynamic forces that shape the long-term evolution of competition. This may not matter in long-established markets, where the same firms have played the same roles for years, but it is a problem in fast-growing industries where innovation keeps shaking up the kaleidoscope.

This has led several competition authorities to fret about systematic underenforcement of merger control in tech-heavy sectors. To illustrate their concern, antitrust watchdogs routinely reel off statistics comparing how many acquisitions Big Tech firms have made in recent years (hundreds) to the number of deals that have been blocked on competition grounds (until recently, zero).

New rules being introduced in the EU, the UK and elsewhere are designed to tighten scrutiny by requiring leading tech firms to notify authorities of acquisitions that would previously have passed under the radar. However, some are calling for bold changes to how such mergers are assessed once they have been notified, shifting the burden of proof for showing the pro-competitiveness of a merger onto the merging businesses. In other words, rather than having to evaluate whether a transaction will “more likely than not” lead to a significant reduction in competition (as per the current framework), competition authorities would block any deal that could potentially fuel killer-acquisition concerns unless the merging businesses can prove that such worries are unfounded.

Such proposals have unsurprisingly – and understandably – met resistance from leading tech firms, which point out that shifting the burden of proof in this way would require them to prove a negative. This is challenging at the best of times and an even taller order in rapidly evolving, innovative markets where the future is inherently uncertain. Such a regime could amount to a de facto ban on acquisitions in all but exceptional circumstances.

A false prophesy?

Would this matter? Changing the burden of proof could reduce the risk of failing to block harmful transactions. But, by the same token, it could increase the risk of prohibiting transactions that could have generated benefits for consumers.

This matters because there are no grounds for thinking that mergers in innovative sectors are, on average, more likely to harm consumers than mergers in sectors where changes occur at a snail’s pace. While mergers in fast-evolving industries can give rise to new competition concerns, dynamic considerations can also temper or eliminate misgivings that might otherwise lead an authority to prohibit a deal.

Recent decisional practice corroborates this reasoning. In the UK, for example, dynamic considerations played an important role in leading the Competition and Markets Authority (CMA) to clear a number of recent transactions.

- For instance, in late 2022 the CMA cleared the merger between NortonLifeLock and Avast, two leading international providers of cyber safety software. The CMA found that while Norton and Avast have traditionally been two of three leading international suppliers of such software (alongside McAfee), it cleared the deal on the grounds that the market was evolving. Specifically, Microsoft – the operator of the Windows operating system on which many of the software solutions are designed to operate – was improving its built-in, bundled security application. The CMA concluded that these market developments meant that the merged firm was likely to face more effective competition in the future than a historical competition assessment would suggest.

- Dynamic developments also played a role in the CMA’s decisions to clear the London Stock Exchange Group's acquisition of Quantile (an innovative provider of services to help banks and other traders optimise their balance sheets) and Sony’s acquisition of AWAL (an emerging music distributor). In the case of LSEG/Quantile, the CMA explored whether the merged business could attempt to foreclose competitors. However, it concluded that it would not want to do this, in part because it could be unpopular with its customers and deter them from taking up new products that LSEG and Quantile were looking to develop. In the case of Sony/AWAL, the CMA assessed whether AWAL a could pose a future threat to Sony, but found that there were a number of emerging competitors with similar business models that could also provide this threat.

These cases are not isolated exceptions in a sea of clearance decisions. On the contrary, they are the only mergers that the CMA has cleared unconditionally over the course of the past year after carrying out an in-depth Phase 2 investigation. Dynamic considerations also look set to play a critical role in the CMA’s forthcoming decision on the merger between satellite communications firms Immarsat and Viasat, with the CMA emphasising the role of new competitors and the rapidly evolving nature of the sector in its provisional clearance decision.

Time for a new toolkit?

While the existing framework for assessing mergers is not well suited to dynamic sectors, shifting the burden of proof onto the businesses risks displacing the problem. A better approach would be to redesign the tools that competition authorities can use to evaluate such mergers. While the precise effects of mergers in rapidly evolving industries may be inherently uncertain, it should still be possible to assess this uncertainty systematically.

There is a rich academic literature on the connection between market structure, firm structure and innovation that could serve as a starting point in developing such a framework. These relationships are not always straightforwardly linear. For example, an influential paper published by Aghion et al. (2005) found that there to be an “inverted-U” shaped relationship between the level of product market innovation in a market and the level competition. However, one persistent and important insight to come out of the literature (see for example Chen et al. (2016)) is that a firm’s capabilities – rather than its existing suite of products – can play a critical role in determining whether it has a competitive advantage in a dynamic industry.

What is a capability?

- Capabilities are defined as expertise in a particular area, for example biotechnological research.

- A firm’s competitiveness in a specific market is determined by the combination of capabilities it can deploy and how they compare to those of rival firms.

- Different capabilities may be more or less valuable in any given market. They may also be more or less scarce. In general, scarcity increases the competitive advantage associated with possessing a particular capability.

On one level, the idea that capabilities are important in enabling a firm’s ability to compete is obvious: firms naturally think and talk about their capabilities when identifying their recruitment targets, designing staff training programmes and investing in equipment. However, the academic literature also provides useful insights into how thinking systematically about firms’ respective capabilities can indicate whether a merger is likely to increase or decrease competition. Three important questions to consider are as follows:

- Do the firms’ capabilities overlap or not? Innovation can arise when distinct but complementary capabilities are combined. Hence mergers that bring together firms with non-overlapping capabilities could create more innovation opportunities and, thereby, more opportunities to bring new products and services to market. By contrast, where the two firms with much the same capabilities, the merger is unlikely to enhance their ability to innovate. Indeed, the merger may disincentivise innovation if it removes a competitive threat.

- How scarce are the firms’ overlapping and non-overlapping capabilities?

- If the firms’ capabilities materially overlap, the next question would be whether those capabilities are scarce. If a number of rival firms have these capabilities and/or if they are easy to acquire, then the merger would be unlikely to give rise to competition concerns. By contrast, a red flag would be raised if the overlapping capabilities are unique or hard to acquire.

- Conversely, if the firms have non-overlapping capabilities that are scarce and difficult to acquire, the merger could bring about innovations that it would be difficult for either firm to achieve as a standalone business. This in turn could strengthen the case for clearing the transaction.

- Where the firms have non-overlapping capabilities, do they have a convincing plan for integrating them? The fact that firms have complementary strengths does not guarantee that creative sparks will fly: to unlock the potential benefits, some degree of integration between the two teams is required. In this regard, a merger that holds the two businesses as separate ringfenced subsidiaries or units might stand less chance of unlocking innovation than a merger that – say – brings together the R&D teams of the two businesses into a single new department.

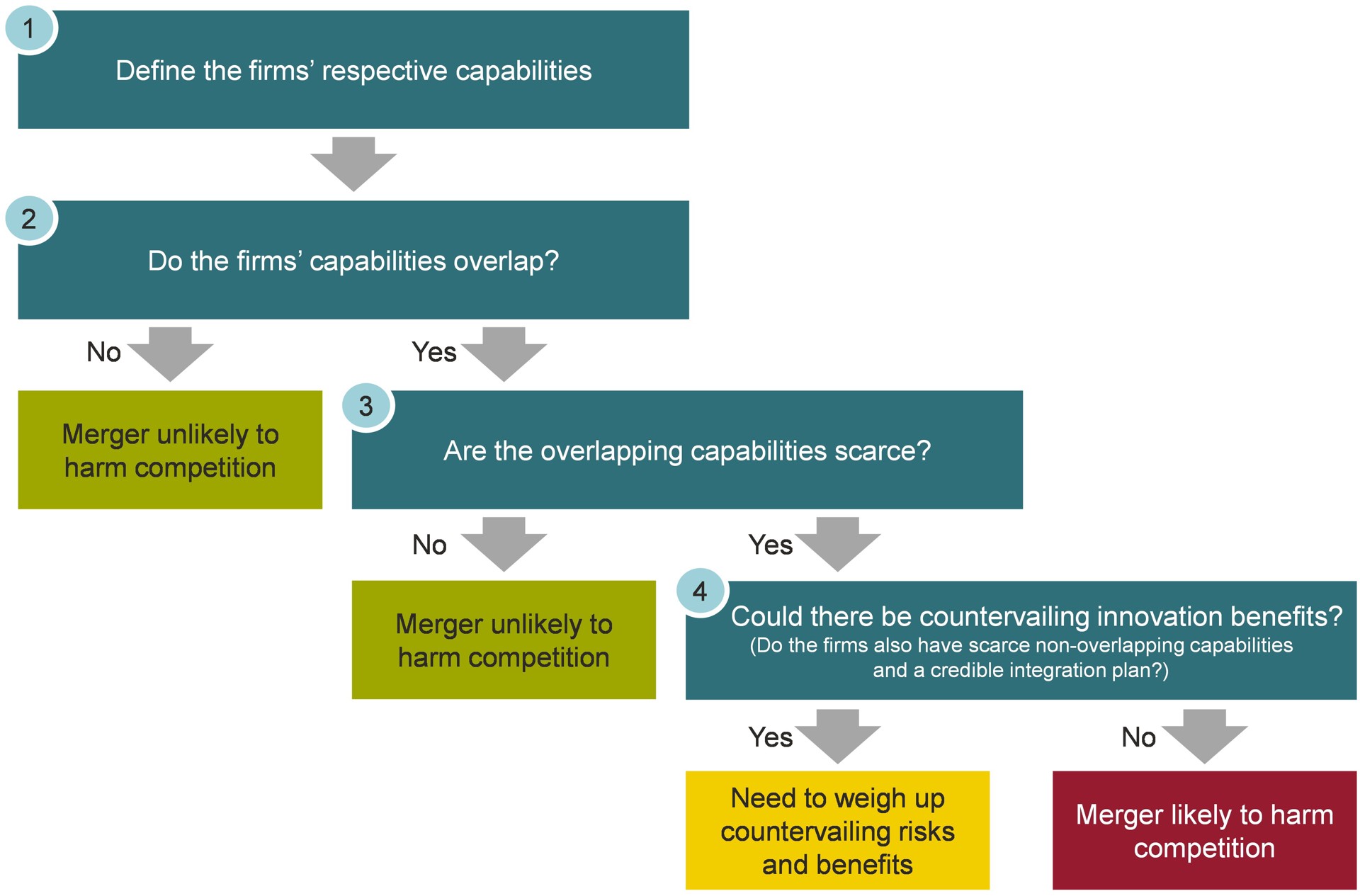

These insights suggest that there could be a practical framework for systematically assessing the impact of mergers on innovation along the lines set out in the diagram below.

Figure [1] – a capabilities-based approach to merger assessment

In some mergers both overlapping and non-overlapping capabilities could be scarce (the amber scenario in the diagram). In these circumstances, the transaction could either boost or stifle innovation, and competition authorities would need to weigh up the evidence to judge which effect would likely dominate. However, in this regard, the proposed framework mirrors the existing framework that antitrust authorities use to assess standard horizontal mergers in traditional “static” markets. Under this approach, they first evaluate whether the merger could harm competition and then consider whether there could be countervailing efficiency benefits that would be passed onto consumers.

Looking to the future

Further work would be needed to operationalise this framework, especially to ensure that capabilities were consistently and systematically defined (Stage 1 in the diagram above). However, regulators already gather much of the relevant data in the course of their reviews. For example, Holberg and Phillips (2017) employ a text-based analysis of 10,000 product descriptions to assess the similarity of different companies by extracting and comparing common phrases that they use to describe their products. This systematic approach could be applied to annual reports, in which firms set out their own core capabilities.

Such an approach merits further exploration, not least because it provides a framework for assessing the dynamic effects of mergers in a way that does not introduce a bias towards under- or overenforcement. It would give competition authorities a set of tools with which to examine concerns about killer acquisitions in a structured way while at the same time allowing businesses to provide evidence of pro-competitive effects.