COMPETITION AND CHANGE IN TELECOMS

Of all regulated sectors of the economy, telecoms has seen the most dramatic change, in both its technology and its economics. At the beginning of 1999, there were about 300 million cellular phone subscribers worldwide: in 2019, the number passed five billion. A businessman’s status symbol has become one of life’s necessities, critical to people’s well-being and prosperity. And yet telecoms operators have struggled to translate increasing demand into higher revenues, and thus finance the high levels of investment needed to take the industry to the next stage. This article explores the ways in which regulators can encourage investment in this vital industry while ensuring the benefits of competition are maintained.

Over the past 20 years, the critical role played by telecoms in economic development has become ever more apparent. A recent report by Frontier for GSMA (the industry body) and the Inter-America Development Bank highlighted the link between telecoms investment and the UN’s sustainable development goals – including poverty alleviation, good health and well-being. Studies by the World Bank and others have shown the close relationship between telecoms investment and growth. Whether as the gateway to the new economy, or as a facilitator of the old, electronic communications have become integral to economic success.

So what have policy-makers been doing to support this? In advanced economies, they have sought to drive innovation and efficiency by introducing competition into previously monopolistic fixed-line markets and in mobile markets. They have progressively liberalised the supply chain. And as competition has intensified, the regulation of fixed telecoms has been scaled back.

Twenty years ago most fixed telephone prices were capped by the regulator. Today it is very rare to find any retail-level regulation, with the majority of regulation focused on facilitating competitive access to and use of fixed networks. Meanwhile, in mobile, the main way in which policy-makers have introduced competition has been through the periodic process of assigning spectrum/airwaves to operators.

NEXT QUESTION, PLEASE

The speed of technological development has been impressive – analogue networks have been digitised, narrowband has been replaced by broadband and wireless networks have provided access in places which fixed networks never reached (and never will). The amount of information that is now transmitted over telecoms networks was unimaginable two decades ago. Box 1 traces the history of services provided by fixed networks, from voice to internet; Box 2 the development of mobile services. But the introduction and spread of internet use, leading to ever-increasing demand for data and technology progress, have also raised new policy issues.

Policy-makers are now setting ambitious targets for the roll-out of “next-generation” ultra-fast fibre broadband (UFBB) fixed networks, and want to facilitate mobile (5G) investment, offering significant increases in the benefits of broadband to both end-users and the wider economy. However, to achieve this, investment is needed. Within the European Union, it was estimated in 2017 that the coverage of fibre for homes or business premises (FTTH/FTTP) ranged from 89% in the best-connected country to 0% in the worst.

In its 2018 announcement of agreement on new rules to create the “Gigabit Society”, the European Commission estimated that investment of €500 billion would be needed to meet its connectivity targets by 2025. In that same report, the EC concluded that, at current rates of investment, there would be a shortfall on its investment estimate of €155 billion. It is questionable how and when this gap is going to be filled, especially given that telecom operators also face other challenges, such as WhatsApp messages having increased from one billion to 65 billion in seven years, which are likely to have, at least partially, substituted for “traditional” mobile messaging services.

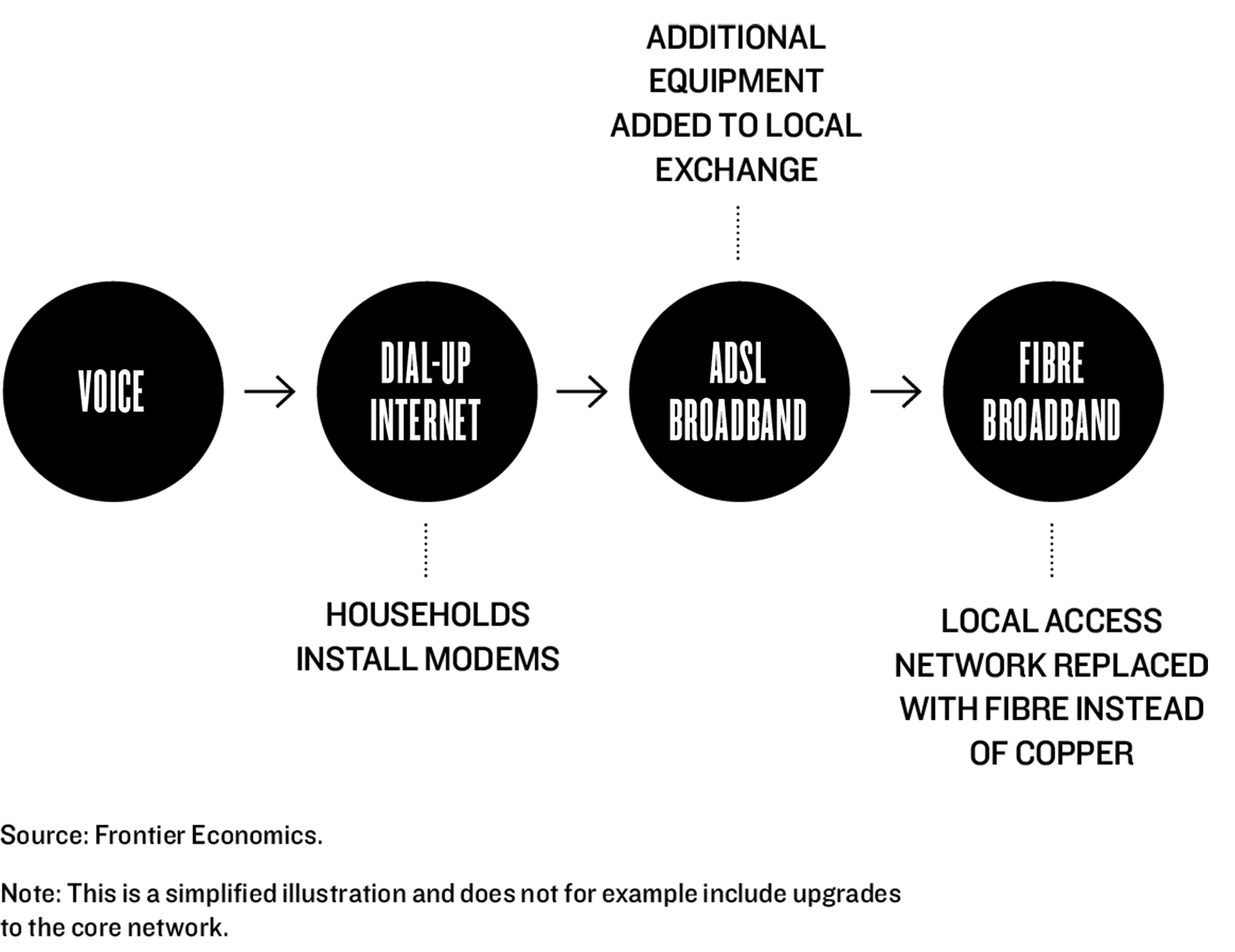

FIGURE 4.1: EVOLUTION OF FIXED NETWORKS

BOX 1

FROM VOICE TO INTERNET

Fixed telephone networks date back to the late nineteenth century in the US and Europe. The main service offered over such networks was, of course, voice calls. This “access network” was expensive to replicate, which meant that typically, it was only viable for a single state-owned operator (what came to be known as a “fixed incumbent”) to provide widespread coverage.

Until the 1990s fixed networks developed at a fairly gradual pace. Then internet use started to gain momentum. To begin with, the internet was mainly accessed via a “dial-up connection”: the modem on a computer “called” the internet service provider (ISP), allowing data to be transmitted over the fixed telephone network. This was a major development, but with plenty of shortcomings: speeds were slow, connections unreliable, and it was impossible to make a telephone call at the same time.

The key technological development was the introduction of “asymmetric digital subscriber lines” (ADSL) broadband, which has increased internet speeds spectacularly, while allowing simultaneous voice calls. Crucially, this technology did not require replacement of the underlying copper local-access network. Rather, it required operators to put new equipment into local exchanges. So it was relatively cheap for them to upgrade to ADSL, rolling out services to meet the growing demand for broadband, without the need for significant regulatory intervention.

But ADSL also has limitations in terms of capacity and reliability for data-intensive services, making it less than perfect for watching movies, participating in video conferencing, playing games online, sharing videos or sending e-mails with large attachments. It meanwhile proved relatively cheap for cable operators to upgrade their TV networks to offer voice services and broadband internet, putting competitive pressure on fixed incumbents. Cable operators typically use hybrid fibre-coaxial (HFC) networks.

Broadband services are delivered along the fibre cable to a cabinet and are then carried to the home via a coaxial copper connection. In the UK, cable franchises were issued from 1984 onwards as regional monopolies in order to promote investment, and by 1991 a total of 135 franchises, covering 70% of the population, had been issued. But cable coverage remains far from universal. Some countries have none, a few have near-complete coverage, and many are only covered in more densely populated urban areas.

Meanwhile fixed operators have been investing in fibre broadband, offering much higher speeds and greater reliability over time, and increasingly in fibre to the home/building (FTTH/B) that can deliver broadband speeds of 1 Gbps (or even higher). However, this upgrade requires substantial investment, which helps explain why fibre broadband coverage is still patchy in many countries.

How to incentivise investment is an important issue for policy-makers. The issue is that revenues can no longer be counted on to rise automatically with advancing take-up. The past 20 years have seen mobile and broadband services become almost as ubiquitous as traditional utilities, such as water and energy, especially in developed countries. Indeed, the number of mobile SIM cards far exceeds the size of the population in developed countries,as some consumers use one mobile for work and another for private use.

Fixed broadband take-up has also increased significantly, and although there is still some room for further increase, this is unlikely to be an important driver of future revenue growth. Demand for data (over both fixed and mobile networks) has still plenty of headroom for further growth, but telecoms operators seem to have had difficulty extracting sufficient revenue from this to finance the next step in investment.

Telecoms operators in Europe now have falling average revenues per user (ARPU, in telecoms jargon). In fact, the (unweighted) ARPU in the EU has been decreasing for the last ten years. One possible explanation is simply that the later subscribers to mobile and broadband are less intensive users, dragging down the average. But this cannot be the full explanation, as total revenues for both fixed and mobile services have also been falling since 2009. In this context, how can policy-makers create an environment which is conducive to telecoms investment, while maintaining the extraordinary benefits that have been achieved from the liberalisation efforts of the last 20 years?

The EU and other developed countries have taken a variety of different approaches to the liberalisation of fixed services. This reflected the extent of the natural monopoly enjoyed by fixed incumbents, as well as regulators’ varying views of the incentives to enter fixed markets.

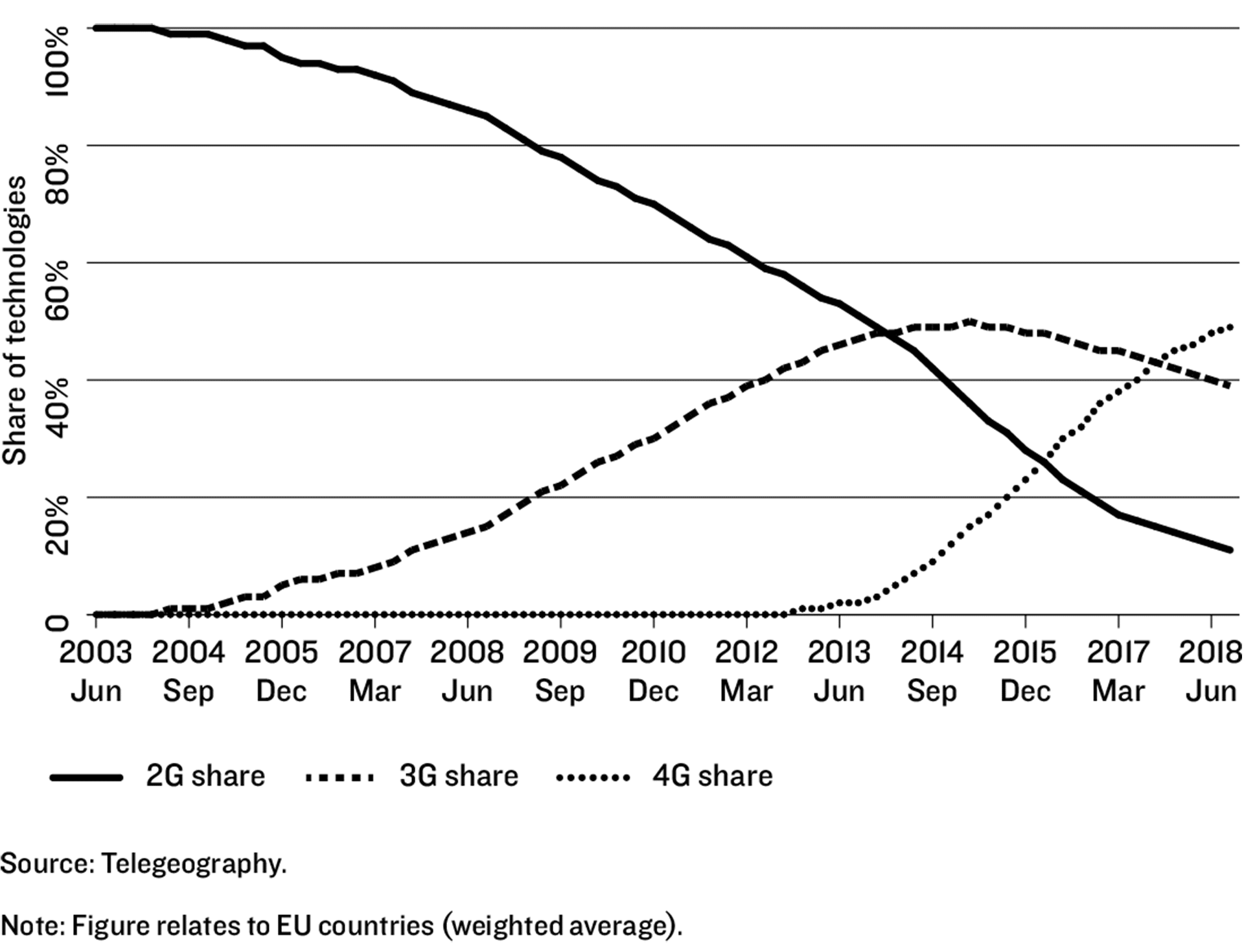

FIGURE 4.2: SHARE OF 2G, 3G AND 4G OVER TIME

BOX 2

COUNTING FROM TWO TO FIVE

Mobile networks have developed much faster than fixed or cable. A new generation of mobile services has been launched every eight to ten years. The first generation of cellular networks (1G) included a range of incompatible technologies that were rolled out on a national, or sometimes regional, basis. Second generation digital networks (2G) were designed to address some of the shortcomings of analogue 1G, increasing network capacity, introducing greater standardisation across countries and increasing security. But 2G technologies were still mainly designed for voice services. Messaging was an unanticipated success.

So the focus of 3G was on better support for data services. Although this generation had a slow start, the growth of smartphones after the launch of the iPhone in 2007 led to a rapid increase in data usage.

The current generation of technology – 4G – offers higher speeds and a more reliable connection. Its launch suffered some delays; but roll-out and take-up have been much more rapid and widespread than for 3G. And mobile operators will soon start rolling out 5G on a commercial basis. As well as even higher speeds, it will also provide shorter delays, greater reliability, better security and the opportunity to connect a lot more devices. This will open the door to a whole range of new potential uses, including driverless cars and virtual reality, and connecting “things” to the internet after connecting nearly all humans. But it is likely to be very costly to roll out, largely because of the density of base stations required to deliver the necessary capacity.

EU RELIES MAINLY ON THE LADDER...

The EU’s liberalisation model promoted new market entry through access to the incumbents’ infrastructure, intended to provide a “ladder of investment” to infrastructure-based competition in future. The idea was to provide new entrants with the opportunity to build up a subscriber base before risking substantial investments in networks of their own.

The impact of this approach has been mixed. There is wide variation across the EU. Still, the policy can, on the whole, be seen to have been successful in encouraging entry.

But the fall in incumbent market shares masks significant differences in the reliance of new entrants on access to the incumbents’ infrastructure (rather than their own). In general, there has been more reliance on the incumbents in Western Europe (WE) than inCentral and Eastern Europe (CEE). By and large, in CEE, incumbents’ networks had a lower quality and lesser reach; liberalisation (allowing access to these) came later; and the costs of rolling out alternative networks was lower.

...WITH DIFFERENT APPROACHES FOLLOWED BY OTHERS

In Australia, New Zealand and Singapore, the authorities have opted for a single monopoly wholesale fixed network. In all three countries, there is separation between the wholesale network and retail providers, which removes the incentives that wholesale networks may have to favour their own downstream retail operations. And they are all subject to regulation to help facilitate competition downstream. In all three countries, governments have also provided funding to help ensure widespread coverage.

By contrast, in the US the focus has been on promoting competition between separate infrastructure providers. The US was one of the first countries to regulate access to the fixed incumbents’ last mile networks, by unbundling the local loop (LLU) in 1996.However, it deregulated LLU in 2001, when it decided that the incentive to invest would be higher without access obligations.

The US is unusual in that it was cable operators that initially had the largest share of broadband subscribers (and still have nearly two-thirds). This put pressure on the traditional telecoms companies, AT&T and Verizon, to respond by rolling out their own DSL broadband, and more recently fibre, networks. Some 70% of the population is able to choose between two or more broadband network providers, with a small proportion having access to three or more.

Japan has a wholesale access regime, with more light-touch regulation imposed on fibre than on copper. However, in reality, there is limited take-up of wholesale access opportunities. Instead, access to poles (and sewers) has helped to promote infrastructure-based competition, mostly between fixed network fibre providers (there is very little cable). A high proportion of Japanese live in blocks of flats and/or cities, and the government has funded the roll-out of fibre in less easy-to-cover areas, also putting in place a number of measures to boost take-up.

In Korea, where the population is also concentrated in densely populated areas, LLU was introduced in 2002, although take-up has been minimal. Fibre networks rolled out after 2004 have not been subject to access regulation to help incentivise investment. There is strong infrastructure-based competition, with the state also providing some financial support for broadband roll-out.

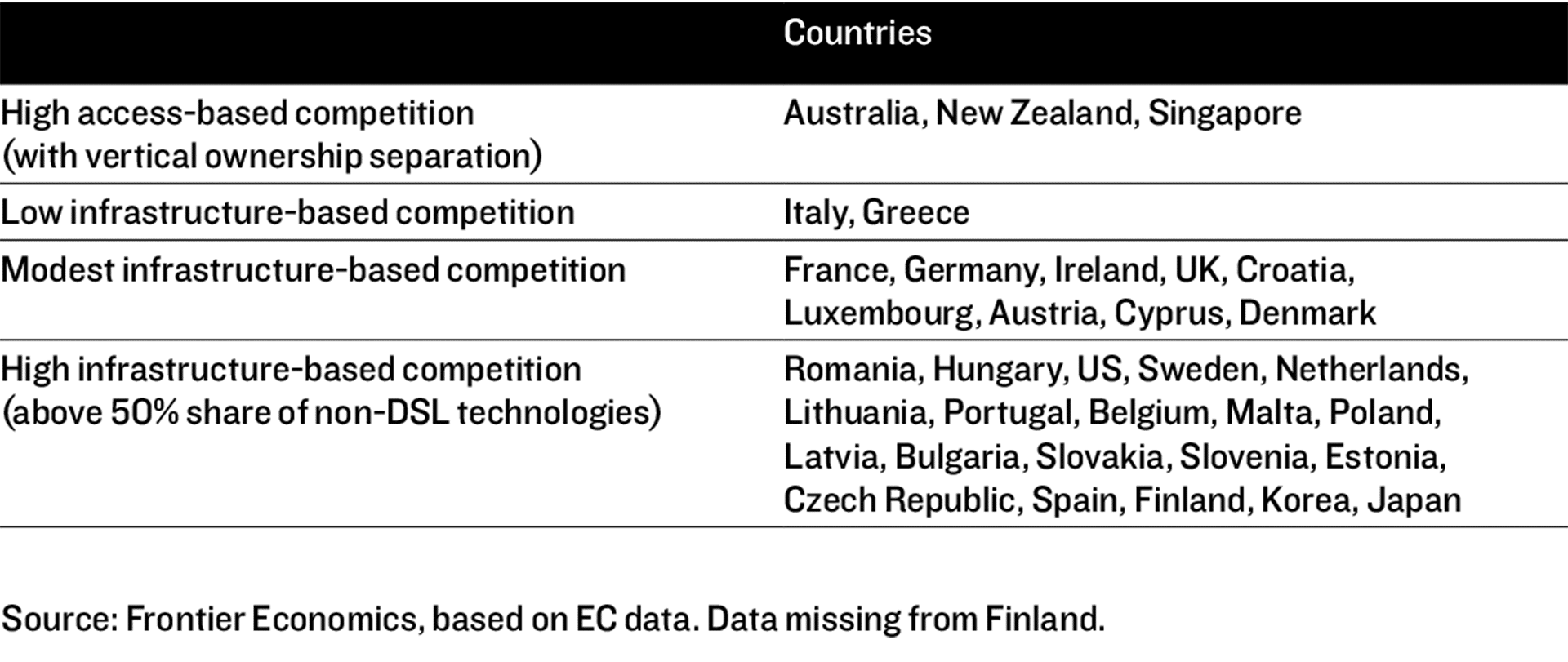

FOUR-WAY SPLIT IN FIXED MARKETS

However different these markets, they have all been shaped by government intervention, affecting the ways in which competition has developed, both within the EU and elsewhere. To attempt an assessment of the impact on consumer outcomes, we have grouped these markets into four broad categories:

- High access-based competition (with vertical ownership separation)

- Low infrastructure-based competition

- Modest infrastructure-based competition

- High infrastructure-based competition.

The first group includes Singapore, New Zealand and to a significant extent Australia. The approach has been quite different in EU countries where there are varying degrees of infrastructure-based competition, but no vertical separation of ownership.

We have partly inferred the level of infrastructure-based competition from the share of different technologies. Greece and Italy have no cable, so their level has been classified as “low”. The UK, Germany and France have a mixture of access-based and infrastructure-based competition – so their level has been classified as “modest”. The US, Korea, Japan, the Netherlands and CEE have almost exclusively infrastructure-based competition – their level has been classified as “high”.

FIGURE 4.3: CATEGORISATION OF COUNTRIES

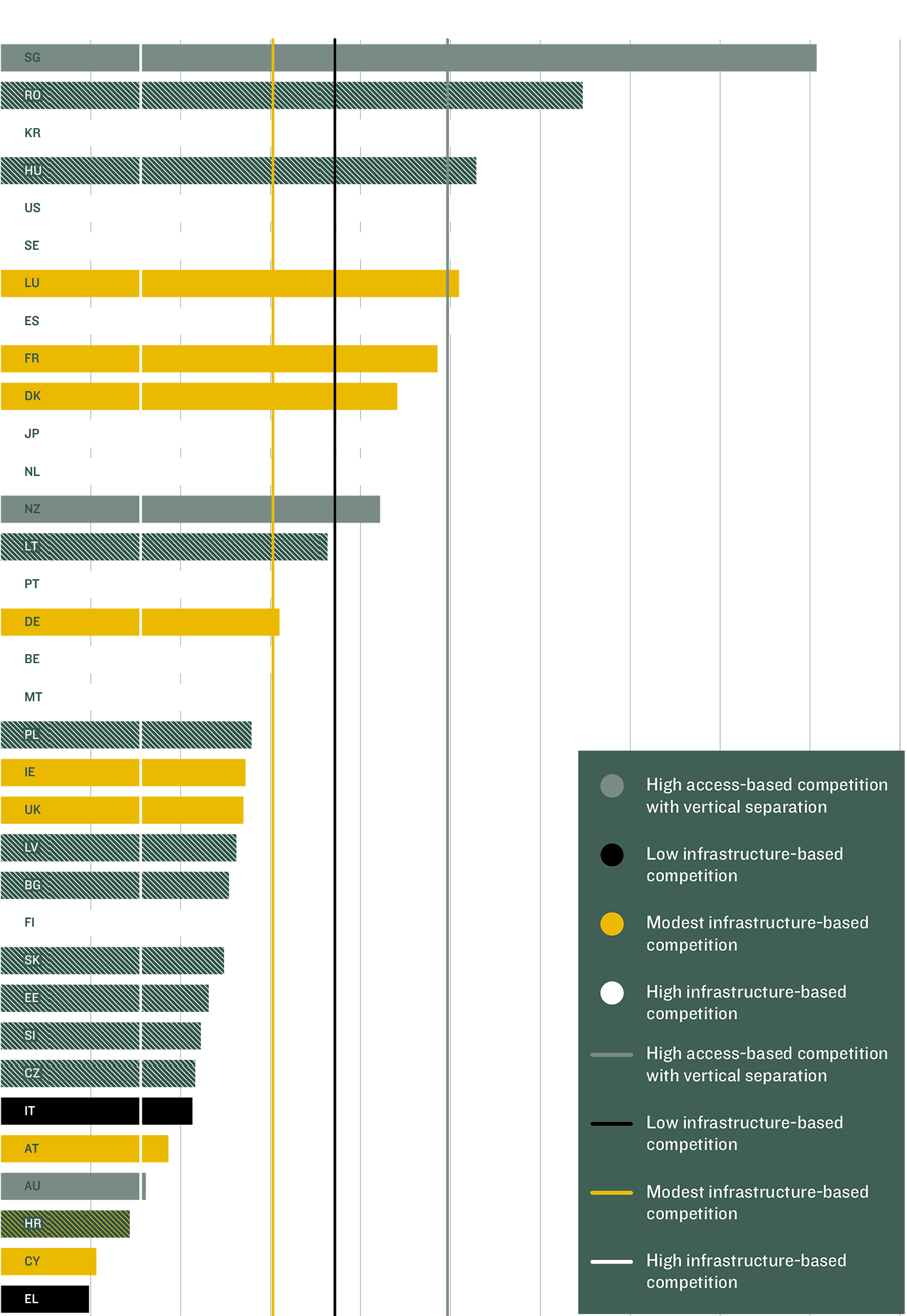

How do they compare? Starting with download speeds: after Singapore, the five best performers (Romania, Korea, Hungary, US and Sweden) all have high levels of infrastructure-based competition. A few countries with more modest competition levels have still managed to deliver good speeds – Luxembourg, France and Denmark. And not all countries with high levels of competition achieve high average download speeds (e.g. Latvia, Bulgaria, Slovakia, Estonia and Slovenia); but then, in these CEE countries, infrastructure-based competition is largely limited to urban areas. Meanwhile, the slowest speeds tend to be in countries with limited infrastructure-based competition – Italy, Austria, Croatia, Cyprus and Greece.

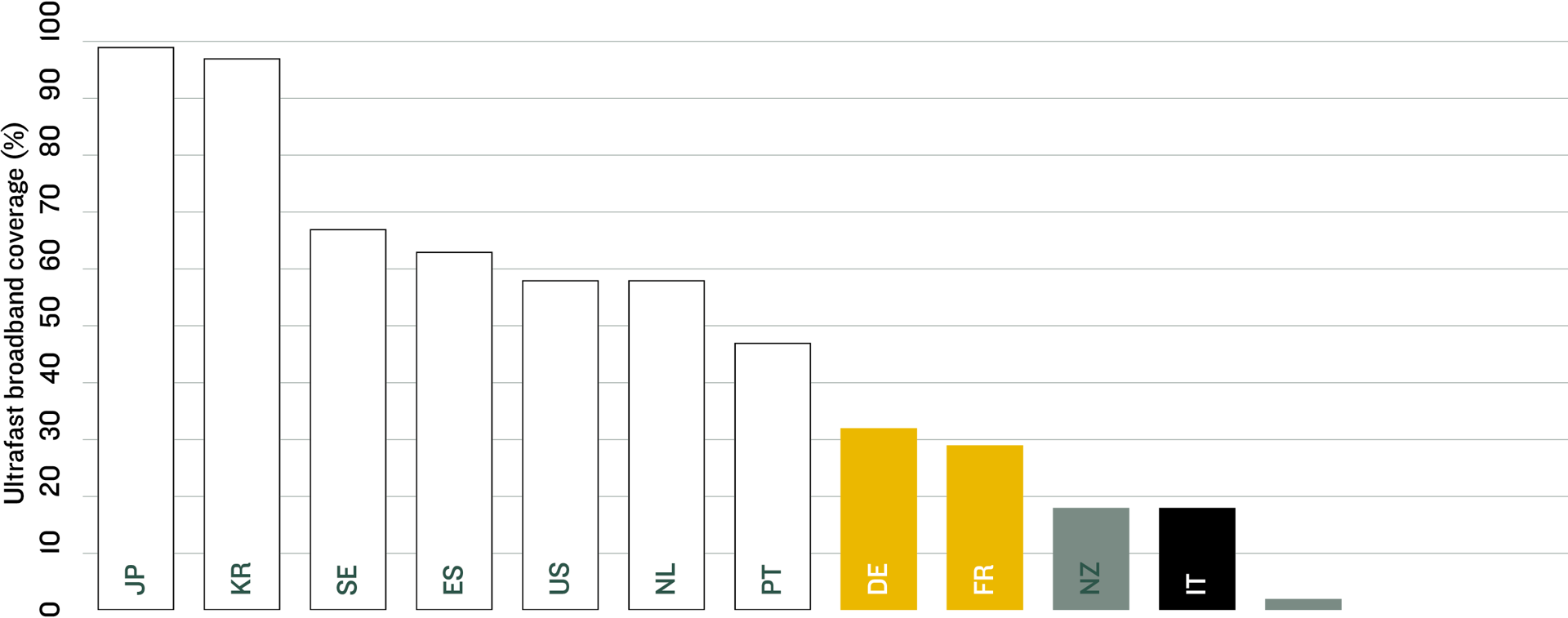

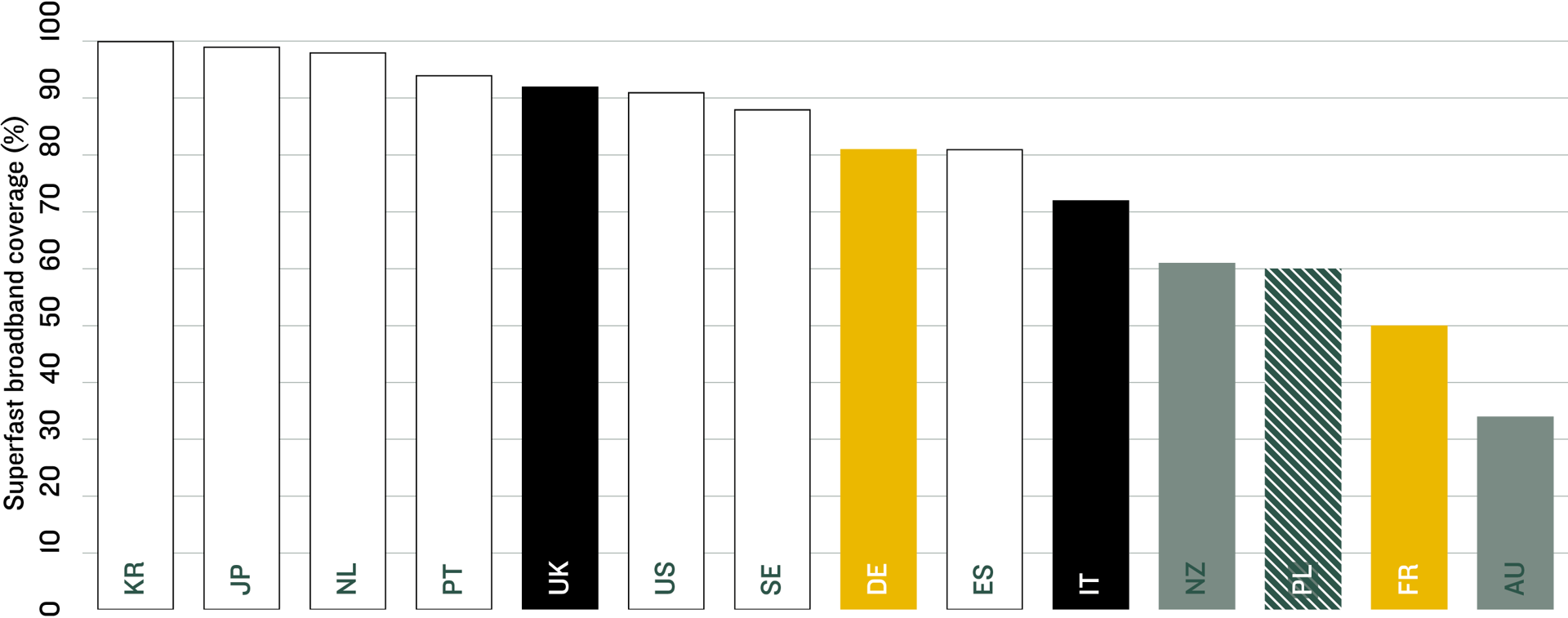

Countries with high infrastructure-based competition also tend to have much greater ultra-fast broadband coverage (speeds above 300 Mbps) – particularly Korea and Japan. While the differences are less stark for super-fast broadband (speeds above 30 Mbps), countries with high infrastructure-based competition still tend to have higher coverage. Not surprisingly, given their high performance on speeds and fibre coverage, high infrastructure-based competition countries also perform well in terms of data consumption, with the US (255 GB per month), Korea (171 GB per month) and Sweden (141 GB per month) all having significantly higher data consumption per capita than the average of the other countries in the sample (83 GB per month).

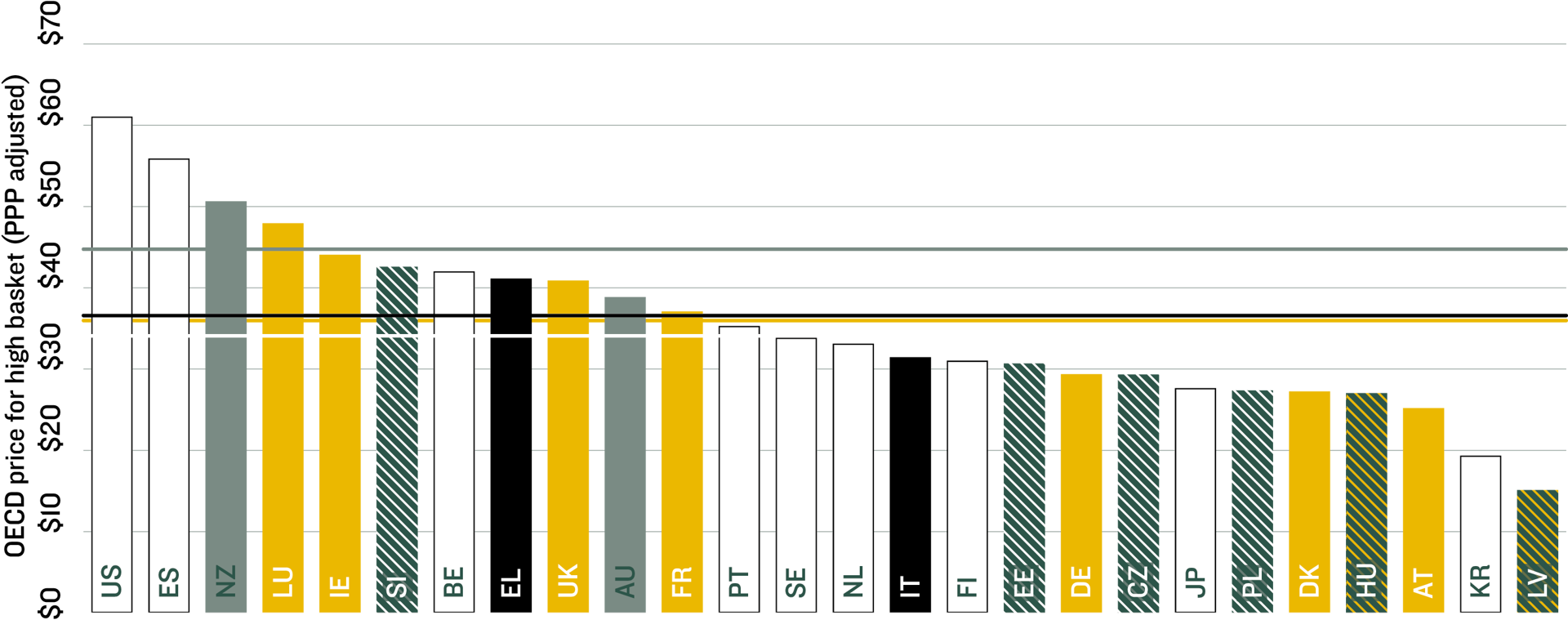

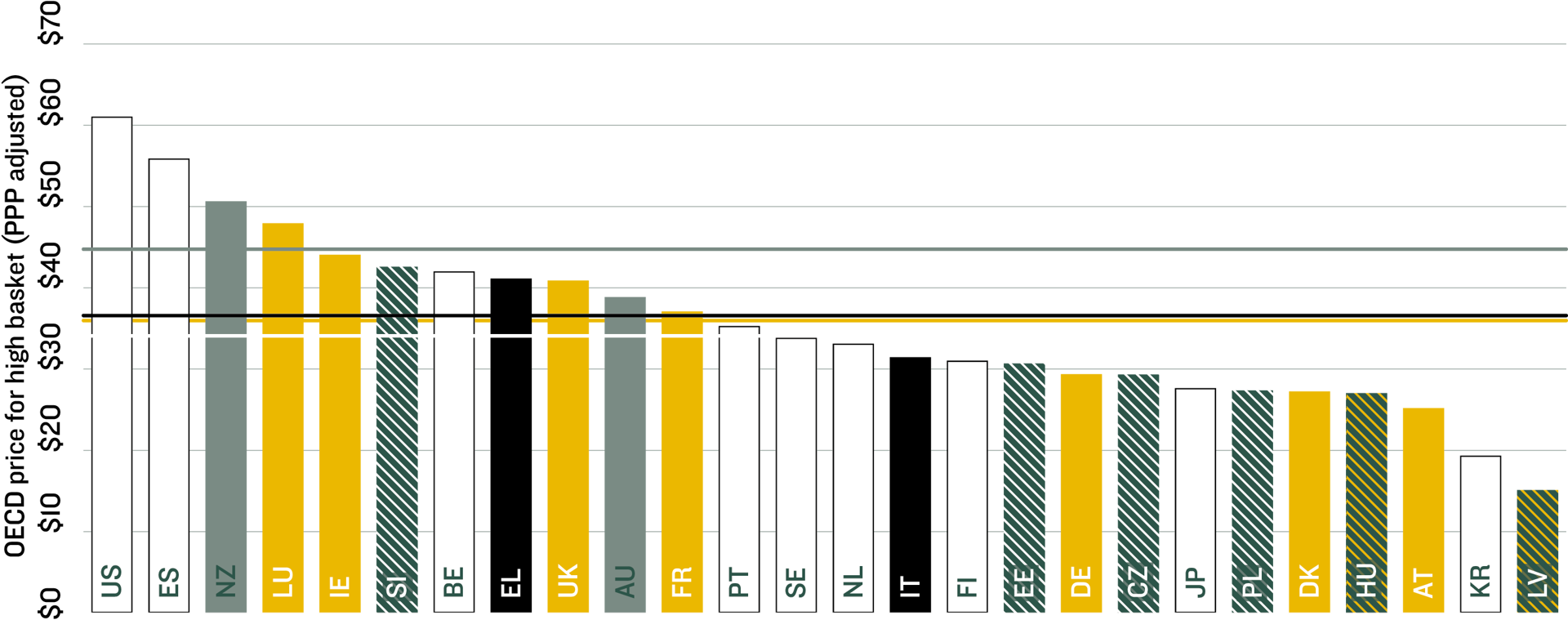

The evidence on pricing is more mixed, not least because international pricing comparisons in fixed telecoms are inherently challenging – there are a variety of different speed packages, data consumption varies, and broadband access is typically bundled with voice, and often with pay-TV. The two most popular measures of telecoms prices are based on (i) a basket of consumption, and (ii) an average price paid per gigabyte of data consumed.

Using OECD data, the basket approach suggests that the US and Spain, both countries with relatively high infrastructure-based competition, have relatively high prices. Japan and Korea, on the other hand, appear to have relatively low prices, as well as high speeds and good coverage. This may reflect government funding to assist further roll-out of UFBB, and, relatively speaking, lower FTTH roll-out costs.

On the other hand, both the Netherlands and Sweden (with high levels of infrastructure based-competition) and Denmark and Austria (with modest levels) have relatively low prices. And in countries with higher levels of access-based competition, an important driver of prices is obviously the regulatory approach taken to setting access prices.

FIGURE 4.4: COMPARISON OF DOWNLOAD SPEEDS WITH AVERAGES

Source: Ookla

Note: Assessed in 2018. The lines denote the average for each model of competition. The bars with patterns denote CEE countries.

FIGURE 4.5: ULTRAFAST BROADBAND COVERAGE

Source: Ofcom (International Communications Market Report 2017)

Note: Data for end of 2016

FIGURE 4.6: SUPERFAST BROADBAND COVERAGE

Source: Ofcom (International Communications Market Report 2017)

Note: Data for end of 2016

FIGURE 4.7: HIGH-END BASKET OF PRICES FOR FIXED BROADBAND (PPP ADJUSTED)

Source: OECD

Note: High user, including 200 GB/month, 25 Mbps and above, June 2017. The lines denote the average for each model of competition. The bars with patterns denote CEE countries.

FIGURE 4.8: OECD PRICES FOR LOW-END BASKET FOR FIXED BROADBAND (PPP ADJUSTED) WITH AVERAGES

Source: OECD

Note: Low user, including 20 GB/month. 0.250 Mbps and above, June 2017. The lines denote the average for each model of competition. The bars with patterns denote CEE countries.

Both New Zealand and Australia, relying mainly on the access-based approach, are fairly expensive for both high-end and low-end users. While New Zealand may compensate for this with relatively higher speeds, this does not seem to be the case for Australia. This illustrates the fact that migration to a vertically unbundled market structure can entail risks, such as to service quality, that need to be managed.

As well as looking at bundled pricing, we can also compare how the average price per GB varies across countries. High infrastructure-based competition tends to perform the best, as although ARPUs are not necessarily lower in such countries, usage tends to be much higher (i.e. users are getting more for their money). The UK is a bit of an exception, as it has low prices per GB despite having relatively modest infrastructure-based competition.

So stronger infrastructure-based competition seems to have delivered faster and further roll-out of ultra-fast infrastructure. The relationship between the degree of infrastructure-based competition and the level of prices is more complex – partly because stronger infrastructure-based competition may mask lower levels of overall retail competition. Moreover, because such competition is associated with higher-quality services, it may also be consistent with higher (quality-adjusted) prices and ARPUs, while still delivering a benefit to consumers.

Moreover, infrastructure-based competition in urban areas may still help keep prices in rural areas down, as operators often price nationally. However, if high-end services are only available in cities, prices for low-end packages may be driven by weaker competition in rural areas. And even if rural consumers are paying similar prices to urban consumers, they may be getting much lower speeds, as the UK regulator, Ofcom, has vividly demonstrated. This supports the case for regulators adopting a more geographically disaggregated approach – relying on infrastructure-based competition where possible, but using access-based competition in areas where it is not.

COMPETITION EMERGED QUICKLY IN MOBILE...

Economies of scale (to cover a given area) are generally lower in the mobile sector than the fixed, as mobiles rely on spectrum (i.e. airwaves) rather than having to roll out an expensive wireline access network. Although spectrum is scarce, enough has been available to enable the viable national entry of a number of mobile network operators.

As a result, monopoly quickly disappeared in most countries. Regulators have encouraged entry through the award of additional spectrum licences, often also promoting competition by setting spectrum caps and/or reserving spectrum for new entrants. Policy-makers have often required existing operators to offer national roaming to new 3G and 4G entrants, to allow them to roll out networks gradually. All OECD countries now have three or four MNOs, and some had, at the peak, up to five or six. Many of these also have mobile virtual network operators (MVNOs) who rely on wholesale access to the MNOs’ networks, with the terms often determined by commercial negotiations rather than regulation.

Competition helped stimulate the widespread take-up of mobile and the roll-out of new mobile technologies. Empirical analysis by Frontier, using data from more than 200 countries over a 15-year period, showed that 3G population coverage was 36% higher and had increased three times faster in countries with network competition than in countries served by a single network.

However, the vast majority of price reductions were accounted for by the transition to next-generation technologies, not by competition alone.

THE TITANS ARE HERE

No discussion of the evolution of the telecoms sector can be complete without reference to the impact of online service providers (OSPs). In a period when telecoms operators have seen incomes and market values sag, companies such as Google, Apple, Amazon and Facebook, which rely on the networks built by telecoms operators, have emerged as some of the largest companies in the world, with spectacular rates of revenue growth.

Some OSPs deliver benefits to telecoms operators, as consumers’ use of OSP services increases their demand for data, so this is likely to increase how much consumers are willing to pay for their telecoms subscription and any out-of-bundle data usage. It may also increase consumers’ demand for high-quality services, e.g. willingness to pay for high speeds.

Operators on the other hand have complained that some OSPs are “free-riding” on their network investments. How could Netflix develop its successful business model, challenging the traditional cable-based pay-TV subscription model, without the network investments of the telecoms operators?

Moreover, other OSPs also compete directly with the services offered by telecoms operators. WhatsApp, which has substituted its “chats” for traditional text messaging on mobile, is an obvious example. If MNOs attempt to restrict their customers’ ability to access services such as WhatsApp, mobile operators risk losing them to competitors. So instead, they have restructured many of their packages, to include high/unlimited allowances for messaging and voice services.

So has the increased demand for data as a result of OSPs’ services outweighed any adverse substitution impact that OSPs have had on telecoms operators? Where substitutability is likely to have been high, such as with messaging services, it seems fair to assume that such OSP services have had an adverse impact on mobile operators, reducing their traditional revenues while having a minimal impact on data usage, as they “consume” relatively limited amounts of capacity.

It is much less clear that OSPs have had an adverse effect on telecoms operators in cases where there is no substitutability: as a general principle, an increase in demand (in this case for data usage) should lead to an increase in revenues for telecoms operators that outweighs related cost increases, otherwise telecoms operators should not invest in additional network capacity. There are two possible caveats to this. First, the provision of substitutable services for “free” has led mobile operators to offer much “flatter/eat what you can” pricing structures. Under such a pricing structure, consumers may increase their data usage even if they attach relatively little value to it – this is because they face a zero marginal price for additional data usage. Second, even if OSP services do not substitute for telecoms operators’ traditional services, OSPs could have made it more difficult for telecoms operators to enter and expand into adjacent markets. While this could not explain the fall in revenues, it may help explain why telecoms operators have struggled to grow revenues.

SO WHAT IS THE RIGHT POLICY MIX?

Policy makers are considering the right policy mix to maintain the gains delivered by competition while dealing with the challenge of investment in the telecoms sector. Too little competition may deter investment, since monopolies hesitate to cannibalise their existing revenues. By contrast, next-generation technologies have been rolled out faster where incumbents faced competition from cable networks.

However, you can have too much of a good thing: in the mobile sector, one of the key debates of the last few years has been whether some market consolidation might actually stimulate higher investment (or at least higher “efficient” investment, as there would be less duplication) by improving the investment returns.

A wider point is that the social and economic “externalities” from telecoms development may not be fully factored into operators’ investment decisions, and so without government intervention they will naturally tend to “under-invest”: the variation in degrees of subsidy between countries serves to illustrate this.

Finally, current uncertainty around future demand, competition and technologies (and to a lesser extent costs) may create an incentive to delay – operators may anticipate an increase in net present value (NPV) from investment if they wait until things become clearer.

These issues have led to a debate as to whether policy in the sector should focus more on dynamic efficiencies. In mobile, there has been an extensive debate around whether a more concentrated market could boost investment incentives and drive greater consumer benefits. As reflected in a range of merger decisions, the jury is still out on whether three or four MNOs are best for consumer welfare: for example, according to the OECD’s broadband data, mobile data consumption per subscriber in Austria, the country that started the more recent mobile four-to-three consolidation wave in Europe in 2012, was in 2017 the second highest in the OECD, after Finland, a country with three MNOs. In Evaluating market consolidation in mobile communications, a report published by the Centre for Economic Performance in 2017, the economists Christos Genakos, Tommaso Valletti and Frank Verboven found that:

…a merger will have static price effects to the detriment of consumers, but also dynamic benefits for consumers as investment can enhance their demand for services.

The debate over mobile consolidation is particularly hot given that 5G pressures may lead to another push for consolidation. In merger investigations, the burden of proof of these on merging parties is increased by the brevity of the time horizon (one to two years) within which they have to be demonstrated. Both the scale and the time-scale involved in the creation of a dense network of sites for the roll-out of 5G technology suggest competition authorities should take a longer view – this would be consistent with proposals for competition authorities to focus more on potential longer-term impacts of strategic acquisitions in the tech sector. And, in mobile, spectrum auctions provide policy-makers with regular opportunities to promote entry to the mobile market, which could reasonably be balanced by a more accommodating approach to mergers – although the fact that the EC typically reviews these while national governments allocate spectrum does not make such a balancing act easy.

On the fixed side, the EU is moving towards a more light-touch approach, in the hope of encouraging UFBB roll-out. In September 2016, as part of its Connectivity Package, the EC’s new European Electronic Communications Code explicitly expressed the objective of boosting investment in ultra-fast networks. However, that does not mean losing sight of competition: indeed, one of the ways that the EC plans to update its approach is by facilitating access to ducts and poles to encourage non-incumbent roll-out, although it also wants to encourage co-investment.

Its hope is to:

…encourage market-driven solutions leading to infrastructure deployment re-using

existing civil engineering wherever possible, and encouraging commercial agreements, including co-investment or access agreements, between operators, where these have a positive effect on competition.

However, in most countries there will still be areas where the roll-out of next-generation fixed networks simply does not look commercially viable. So in the EU, and indeed elsewhere, we may end up with two strands in policy: deregulation in cities, where there may be effective competition between (say) three players; with regulated (and probably subsidised) monopolies operating in rural areas. That still leaves open the question of whether there are other sources of profits for the telecoms operators that could contribute to strengthened investment incentives.

And while investment incentives are important, as mobile and fixed broadband penetration reach saturation and the desirable 5G and FTTH roll-out materialises, policy-makers in Europe are also likely to switch their attention to the downsides for consumers from oligopolistic market structures and risks from more co-ordinated behaviour, which may in some cases be enabled by technology and pricing algorithms.

TAKING ON THE TITANS

Telecoms operators’ biggest fear isrelegation to the status of wholesale suppliers of a commoditised product (data capacity). This fear is sharpened by the fact that operators do not themselves develop the equipment from which their networks are built, restricting their ability to gain a non-replicable advantage.

There are broadly two strategies that could help telecoms operators:

- Enter the OSP markets by developing their own (partial?) substitutes for OSP services.

- Changes in the relative bargaining power of the larger OSPs.

There are two main types of substitutes telecoms operators could develop: first, content related, which they can bundle with their access services. The problem with this, especially for non-US operators, is that now the big fish are in this pond, organic growth is challenging (Amazon and Netflix spent more than $10 billion on content in 2017, up from $3.5 billion in 2015) and acquisitions are expensive (note Comcast’s $40 billion acquisition of Sky). The second type of substitute would be services that would be funded by advertising. But here, scale and network effects are key: Facebook had 2.3 billion users at the end of 2018, and YouTube close to two billion. By contrast, Vodafone Group had 404 million subscribers, Telefonica 256 million and Deutsche Telekom 159 million. In 2011 Google spent $12.5 billion to buy Motorola’s mobile-producing arm, on top of $1.7 billion to buy YouTube in 2006. Facebook famously bought WhatsApp for $19 billion in 2014. While Vodafone has made major acquisitions in the past, it is hard to see telecoms operators competing in the market for OTT services today.

Competition authorities are gearing up to try to limit the market power of OSPs in the future:

- The EC has brought a number of abuse of dominance cases against OSPs (e.g. Google).

- The EU has recently introduced the General Data Protection Regulations, which mean that OSPs face greater restrictions on what they can do with personal data.

- OSPs may face larger tax bills.

- Competition authorities are weighing up whether digital mergers require increased scrutiny.

- Some authorities are considering whether large OSPs should be forced to share some of their data and/or increase users’ ability to port their data between platforms.

Greater regulatory scrutiny of OSPs may, by increasing competition between them, alter the bargaining power between them and telecoms operators. For example, if competition in the market for mobile operating systems were to increase materially, this would likely benefit mobile operators.

While consolidation between telecoms operators within one country might help tip the balance, competition between OSPs would be likely to have a far more powerful effect. Even cross-border consolidation is unlikely to create telecoms operators on the same scale as some of the larger OSPs.

But: the types of OSPs that are facing increased scrutiny from authorities are search engines, operating systems, browsers, app stores, digital advertising and marketplaces. These are not particularly bandwidth-hungry services, so even if their bargaining power was dampened, it is still not clear how much this would increase the operators’ investment incentives.

Is there a “third way” in which telecoms operators could try and capture a bigger share of the supply chain? For example, at present, OSPs’ services are generally carried over telecoms networks free of charge to the OSPs, while end-users pay for using the network. By contrast, broadcasters sometimes charge TV channels for carrying their content, as well as charging subscribers (e.g. as much as 3–5% of the revenues of a cable operator (and a higher share of profits) can come from such charges). Telecoms operators in Europe are however subject to “net neutrality” rules, which restrict their ability to discriminate between the traffic of different OSPs – and this may limit any revenue-generating potential from such charging. Even if they were able to levy such charges, some of the OSPs that generate a significant share of the traffic, such as Netflix, charge subscribers directly for their services. Such OSPs could therefore pass any “carriage charges” on to final consumers, reducing demand for the telecoms operators’ services. And, while in the US similar restrictions have been removed recently, there is little evidence that this has prompted US telecoms operators to change much.

And technology developments may also bring risks for the telecoms operators. “Network virtualisation” involves the separation of a telecoms network’s intelligence from the underlying hardware, with the latter becoming even more of a commoditised product, driving production cost efficiencies from scale. This will not only reduce costs, but potentially enable operators to run different virtual networks over a single physical infrastructure: this should create opportunities for greater innovation. This is not just a vision – AT&T has announced plans to “virtualise” 75% of its network by 2020, predicting (capex and opex) cost efficiencies of 30–50%. The technical work required to develop virtualisation involves a range of different types of organisation – with significant involvement from OSPs such as Facebook and Google. This is not surprising as both can be expected to benefit if the costs of internet access are reduced. Will the telecoms operators have the core skills that will be required to develop the IT and software that will be necessary to control the network operating system that will sit at the heart of the platform? This is a space to be watched!

CONCLUSION

The telecoms sector has undergone remarkable change over the past 20 years. The mobile sector quickly transitioned to effective competition, largely removing the need for economic regulation. Fixed networks have been moving towards effective competition, although they are still reliant on economic regulation in several markets. However, despite rapid increases in take-up and usage, revenues have fallen, leading to question marks about the attractiveness of future investment.

Policy-makers are already thinking about adopting a more light-touch approach towards regulation of fixed network markets in order to incentivise greater investment. But this will inevitably need to be coupled with public subsidies, especially in rural areas where next-generation technologies are unlikely to be commercially viable.

However, these two changes alone may not increase investment to the required level. We may need competition policy to pay greater regard to the possibility of long-term dynamic efficiencies from mergers. The roll-out of 5G may re-open the debate around the benefits of consolidation, as 5G may require higher levels of investment than previous technology shifts.

The telecoms industry has faced increasing direct competition from some OSPs (WhatsApp, Skype), while likely benefiting from others (Google, YouTube). The asymmetry in bargaining power between major OSPs and telecoms operators may have allowed the former to capture an “unfair” share of the jointly generated value. Increasing scrutiny of OSPs may reduce that asymmetry by lessening their market power. This may help telecoms operators to secure a bigger slice of the value in the supply chain, though this will only incentivise network investment if it increases the expected returns.