The European Union and its member states have committed to make their economies practically carbon-neutral by 2050 or shortly after. To achieve this goal, much of our energy consumption will have to come from renewables, in particular electricity generated by the wind and the sun. A new type of contract, the “Green PPA”, is taking hold, but its financial risks are often not fully appreciated.

We argue that (i) the different types of risks entailed by green electricity generation need to be properly identified and assessed; (ii) the specific contract terms determine how risks will be shared between the contracting parties; and (iii) these Green PPAs must be integrated into the existing risk management frameworks of buyers and sellers of electricity.

Why Green PPAs? Renewable generators seek new marketing opportunities, buyers look for new ways to source (green) power

A power purchase agreement (PPA) is a contract between an electricity generator (the seller) and a utility, trader or commercial customer (the buyer). The PPA defines the commercial terms for the trade of power between the two parties, e.g. price, quantity, the consequences of technical disruptions and credit conditions. These terms determine how risks are shared between the buyer and the seller.

“Green PPAs” are purchase agreements for electricity generated from renewable energies such as wind and solar. The market for Green PPAs is only just emerging. Buyers and sellers are still testing different design options on the go, often without explicitly accounting for associated financial risks.

Power purchase agreements are not a new phenomenon. Long-term bilateral contracts were used for the sale of electricity long before power markets were gradually opened up to competition. In liberalised markets, where the risk of recovering the cost of capital of a new generation plant tends to be comparatively high, independent, non-incumbent power producers used PPAs as a longer-term hedge to facilitate project finance.

Neither is green power new – renewable power has expanded rapidly in many European countries since the early 2000s thanks to government support schemes. In many countries, renewables account for the vast bulk of newly built generation capacity.

So why the recent interest in Green PPAs? The explanation lies with developments on both the supply and the demand side:

- Supply side – Historically, renewables typically received a regulated feed-in tariff (FIT) that fully insured them against market price risks for the duration of the support period, which usually covered the first 15-20 years of operation. Now, many renewable plants are still running at the end of the support period. Most modern wind farms can produce electricity for 25 years or longer. In Germany alone, more than 20,000 megawatts of wind generation capacity are set to leave the country’s renewable support scheme. As the end of the support period approaches, operators have the choice either to “go merchant” and sell their power long term via a Green PPA or to “repower” and build a new turbine on the same site, potentially benefiting from fresh financial support. Further interest in Green PPAs stems from operators of new wind plants who would be eligible for financial support but prefer to sell their power on the free market. This is because generation costs for renewable technologies like wind and solar have fallen significantly over the last two decades, such that new installations may be viable without any additional subsidy. For example, in recent tenders for the construction of new offshore wind farms in Germany and the Netherlands, some bidders submitted zero bids for government support; as a result, these projects need to be fully financed with market revenues. Financing such projects typically requires stable long-term income flows, which can be facilitated by selling the output through a Green PPA.

- Demand side – Utilities enter into a Green PPA as an alternative to building and operating a renewable plant themselves. Green PPAs also allow large electricity customers to buy renewable energy directly from producers. There is increasing demand to procure renewable power via Green PPAs as part of corporate “greening” strategies. Green PPAs establish a direct contract between the generator and the buyer verifying that the power comes from a specific renewable technology or region. This can have purely reputational benefits or it can pave the way for services that can officially be labelled “renewable”. This trend is driven both by tech companies with power-hungry data centres and by traditional industrial users of electricity that want to show their clients that their products and services have a green life cycle. According to Bloomberg NEF, the top five corporate PPAs in Europe have been signed by three tech companies (Google, Facebook and Microsoft) and two aluminium producers (Norsk Hydro and Alcoa).

- Intermediaries – Green PPAs in Europe often involve traders and utilities as intermediaries. These can either act as the “handler” of electricity or provide energy management services (so-called “sleeved corporate PPAs”).

But are buyers and sellers fully aware of the risks they are getting into?

Reading and understanding the small print is a must

Risk means uncertainty over future outcomes. “Market risks” means uncertainty over future market outcomes – what quantity will be traded at which price?

Engagement in renewable power comes with different types of market risks, some of which are well known from conventional energy sources like gas and coal. They include the volume of green electricity produced at any point in time, the price for energy on the wholesale market (in case you buy/sell the shortfall/surplus of power) and combinations of both:

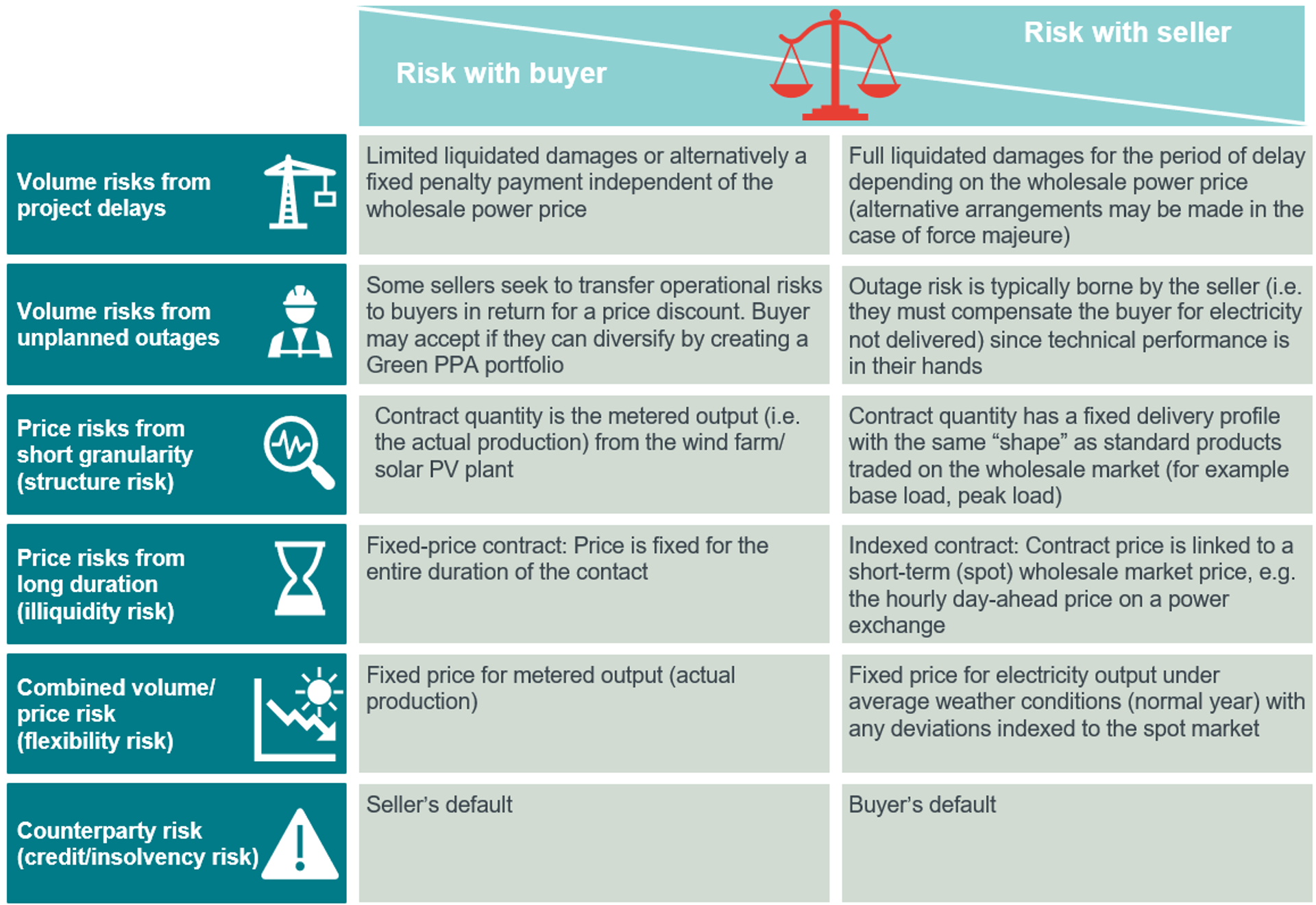

- Volume risks from project delays (project development risk) – If a Green PPA is signed for a specific renewable project which has not been commissioned yet, there is a risk that the scheme will be held up, for example by delays in construction or acquiring the necessary permits. Since the delay typically concerns a single plant (unless there is an industry-wide event like the default of a turbine manufacturer), the only relevant risk relates to volume. Under a Green PPA the buyer may share this risk, sometimes without being aware of it.

- Volume risks from unplanned outages (operational risk) – Like conventional power plants, wind and solar installations can suffer from technical failures. Since unplanned outages occur randomly, this risk is uncorrelated with short-term power market prices during the period in question. The seller of green electricity can diversify this risk by putting a portfolio of different renewable plants in a Green PPA. Similarly, the buyer of green electricity can spread their risk by procuring a portfolio of different Green PPAs.

- Price risks from short granularity (structure risk) Wind and solar electricity generation is typically broken down into granular time units of a quarter-hour or an hour. Even if this generation profile, or “shape”, were perfectly foreseeable (which it is not), it cannot be perfectly hedged. Contracts available for hedging are less granular (e.g. they are for constant production every quarter-hour in a month). Contracting parties bear the price risk of output variations around the volume agreed in a standard hedging contract.

- Price risks from long duration (illiquidity risk) – Wind and solar generators are assets with long lives which stretch beyond the time scale of standard traded products on wholesale markets (typically four to six years into the future). From a risk perspective, this means that the long-term price risk over the full lifetime of a wind farm or solar plant cannot be hedged. Green PPAs can be signed for long enough periods to share this risk, at least between the two parties who sign the contract.

- Combined volume/price risk from fluctuating weather conditions – The output from wind farms and solar PV plants depends directly on fluctuating weather conditions (therefore this type of generation is called “intermittent”). Looking at a single plant in isolation, intermittency seems random. However, this is not the case anymore in a world where renewables account for a large share of the generation mix and thus affect wholesale market prices for electricity. Wind and solar power generation in one region correlates with that of other plants using the same technology. Together, many small wind farms have a significant influence on the wholesale market, pushing up the price for electricity on a still day and collapsing the price on a very windy day.

This relationship between wind and solar generation and wholesale prices for electricity creates a combined volume/price risk: if green power production is higher than expected, this surplus is sold when market price decline; and if output is unexpectedly low, electricity prices in the traded market will spike. The shortfall of green power (relative to the expected production under normal weather conditions which are the basis for hedges) must then be purchased in the wholesale market at high prices. The provisions in the Green PPA determine how the buyer and the seller share this combined price/volume risk.

These types of risk apply in principle to any traded commodity (e.g. natural gas, oil and power from conventional sources). Even the combined volume/price risk from fluctuating weather conditions, which seems specific to renewable electricity, occurs in the market for natural gas where demand and prices vary with changes in temperature during the heating season.

When signing a Green PPA (or choosing another type of engagement, such as buying physical assets or building a new renewable plant), the parties involved must be conscious of the different types of market risk involved and consider ways or remedying or consciously accepting the risk.

Tailoring Green PPAs to your needs

There is no one-size-fits-all solution for how the risks from green electricity generation should be shared. The buyer can be a big international corporation, like Google, which has a large portfolio of Green PPAs in many countries spanning numerous generators. Or the seller may be a large energy company with an international renewable portfolio that is selling Green PPAs to small and medium-sized businesses.

In June 2019, the European Federation of Energy Traders (EFET) published a contract template for Green PPAs which provides guidance for buyers and sellers. Green PPAs can still take very different forms. For example, the contract can stipulate physical delivery or it can be designed as a purely financial product. The buyer and seller can agree on different ways to determine the contract price and the quantity of green electricity.

When settling these terms, both parties should bear in mind the following options for sharing different types of risks:

A green PPA can also be designed as a blend of the two sets of options listed above. For example, the contract price can be only partly linked to a short-term wholesale price for electricity (partly indexed) or it can be fixed for only a portion of the contract quantity (tranche model).

In addition to general provisions on how to share risks between the seller and the buyer, a PPA will specify further contractual obligations, e.g. a requirement to forecast production or to give notification of planned outages.

Manage the risks

Dealing with risks does not stop once a Green PPA is signed. Buyers and sellers both need to manage risks continuously. There is a vast literature on risk management in energy and other sectors. In a basic version, this requires the following steps:

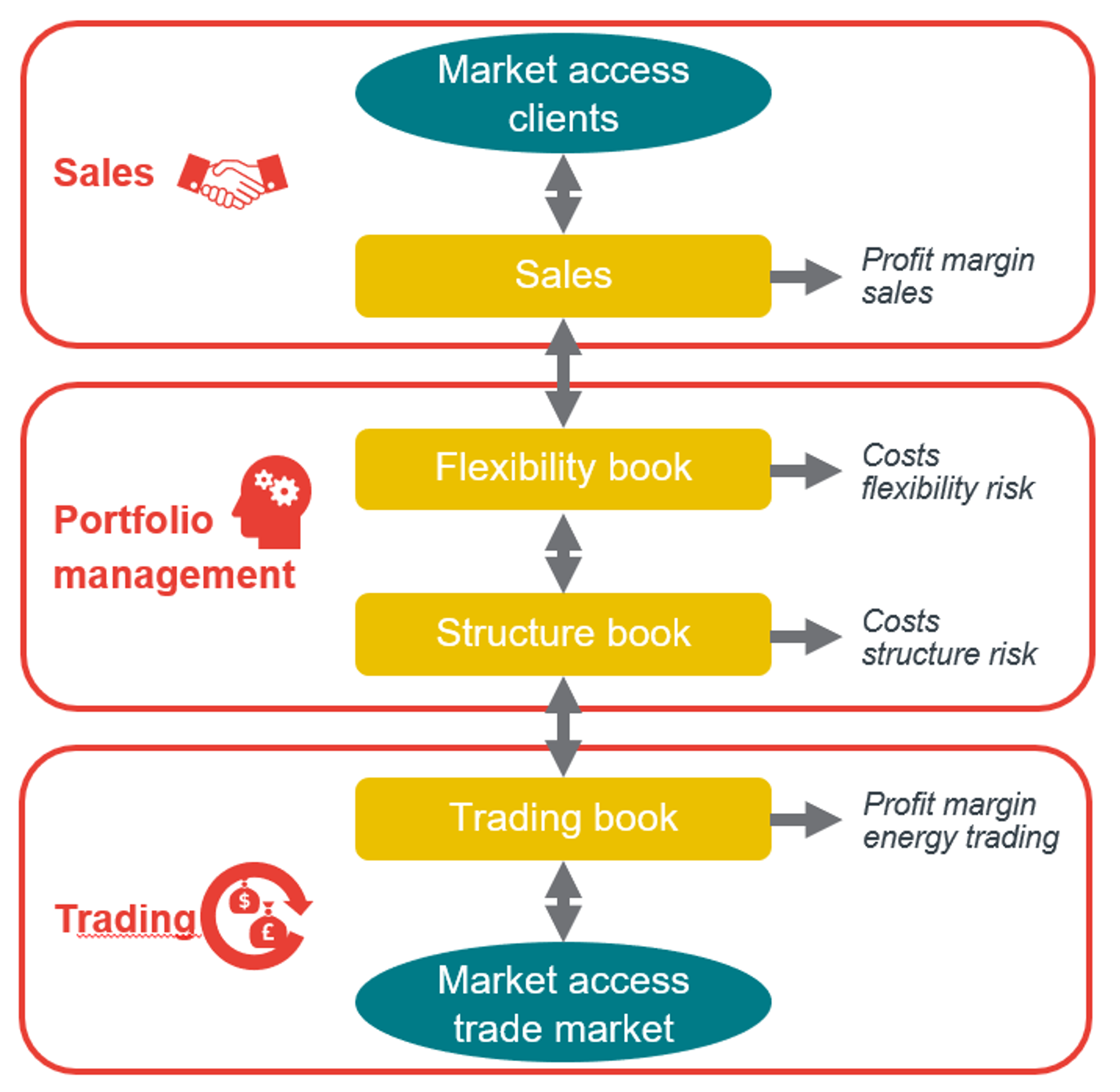

- Identifying risks – What types of risk do I assume in my business? Energy companies often use a specific book structure to identify and distinguish between different types of risk (see diagram below).

- Reporting risks – How much risk do I take? Risks need to be measured and reported regularly to react to changing market conditions. Best-practice approaches for measuring risks are often borrowed from the financial sector. These approaches have to be adapted to the specific risks in the electricity sector.

- Mitigating risks – How can I handle risks? They can be mitigated by hedging or by not entering into contracts deemed too risky.

- Limit risks – How much risk do I want to accept? Risky activities, such as trading, are often subject to various limits. These may apply to specific commodities, restrict the volume of risk (e.g. the MW quantity of green power) or its value (in €).

Book structure for energy company

Risk management should not be confined to making risks transparent. It lets you put a price on the risks you take and allocate that price to the underlying activity (internal transfer prices). Risk management also allows you to embed the cost of assuming the risks in your final products (pricing).

Taking a broad view of risk management improves your business decisions. It does not matter whether you run an energy company that signs a Green PPA to sell renewable electricity to final customers or whether you produce flat-rolled aluminium.

The best solution for risk management is tailor-made. The same goes for the Green PPAs you sign.