The restrictions imposed to contain the spread of Covid-19 are causing major economic disruption. Governments everywhere have quickly put in place measures to help manage the impact of the pandemic and protect those who are hardest hit.

But there is huge uncertainty about how the disease will develop and how deep the economic shock will be. Who should bear the risk of this uncertainty – investors, creditors, taxpayers? - is a difficult question that policymakers will need to answer. In the first of a series of articles on the economics of risk-sharing through the crisis, we consider here the nature of these risks and the choices for policymakers.

The uncertainty of Covid-19 restrictions

Covid-19 is unlike any previous crisis. Entire sectors of the economy have been closed down completely and almost without warning. Tens of thousands of non-essential businesses - from restaurants to hairdressers, gyms to cinemas – have no revenue. The knock-on effects for suppliers to these firms are substantial. Without help, many do not have the financial resources to survive for more than a few weeks. It is not surprising therefore that the economic policy response is being tailored to meet this challenge.

If we consider the policy response, there is an important distinction between cost and risk. The costs – whether incurred by the health system or the financial support to firms and employees – are already accumulating.

But the size of the ultimate bill is currently unknown. Such uncertainty applies at the beginning of all economic shocks. No one knew how the Global Financial Crisis would turn out when Lehman Brothers collapsed in 2008. However, the ‘all or nothing’ impact that the lockdown is having on many sectors means that the degree of risk and uncertainty is profoundly different to previous shocks.

An optimistic (but increasingly unlikely) scenario is that the impact will be material but temporary, with a swift bounce-back in activity once the restrictions are lifted (the V-shaped scenario). At the other end of the spectrum of possible outcomes, the curbs stay in place for longer and are followed by a significant recession (the L-shaped scenario).

Choices about allocating risk

Businesses are used to facing uncertainty over costs – from employee accidents to a decline in demand for their core products. These risks are borne by their insurers, owners, investors and creditors, who, if the worst comes to the worst, must meet the cost of unforeseen events.

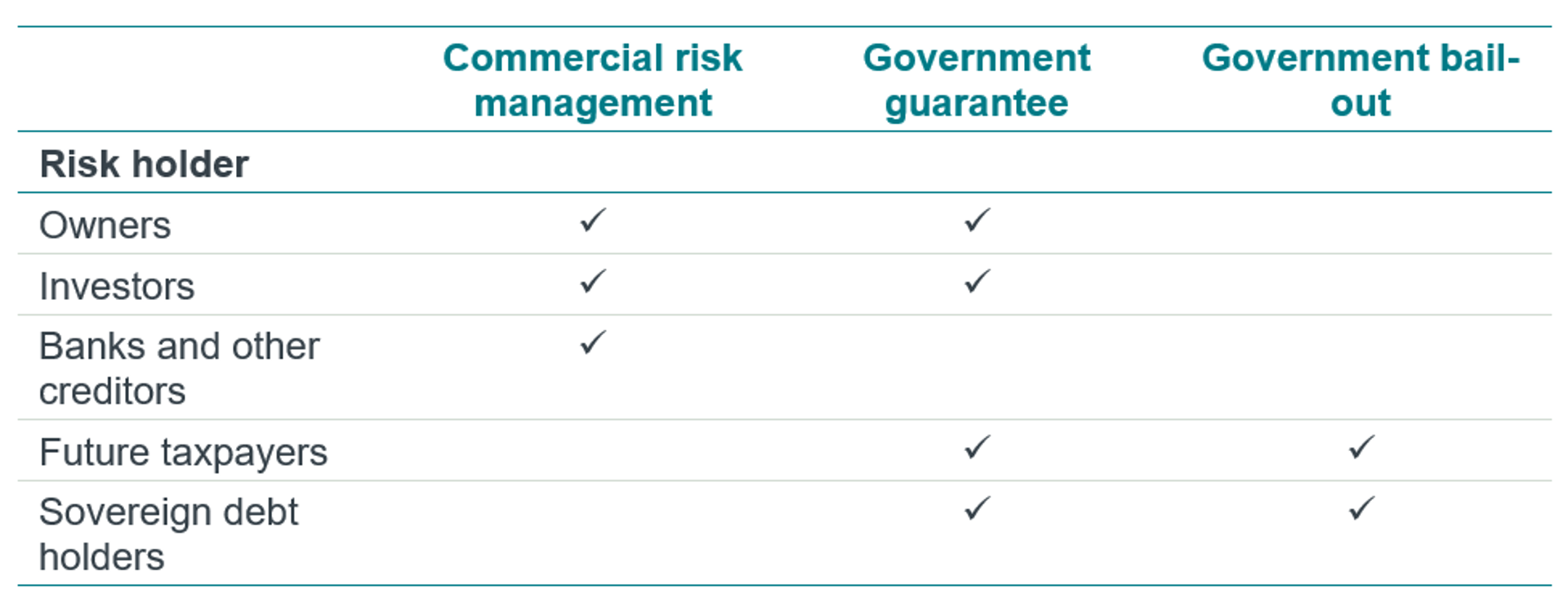

But in exceptional crises, policymakers can choose to take on some of this risk. At the very least, they have an active decision to make about how the economy will bear these additional risks. There are broadly three options, as illustrated below.

- Commercial risk management. Governments could choose to leave it to the market to manage these risks. Firms could seek additional funding from owners/investors. Low equity prices would reflect the value of the risk today, and investors could make significant returns or losses depending on how the crisis plays out. Creditors could also lend to firms, charging interest rates that reflect the increased credit risk. But under a commercial model, some firms may not be able to get this support and they will fail.

- Government lending. The government could offer guarantees to investors and creditors so that firms can access financial support more easily. Risk is still shouldered by owners/investors, who remain responsible for repaying the debt. But to the extent that businesses fail or are unable to repay, the risk is shared by taxpayers and sovereign debt holders.

- Government bail-out. The government could commit to take on all the ongoing costs of the crisis. Taxpayers (of the future) and investors in sovereign debt assume the risk of how much financial support is ultimately needed.

Policymakers may combine these options. The UK government is currently offering to guarantee 80% of loans to tide businesses over the crisis, with commercial lenders taking on the remaining 20%. There may also be different solutions for different sectors. The balance of these options may shift as the crisis develops and we learn more about the final extent of the costs. And while employees do not assume these risks, they bear much of the cost if the worst happens and businesses fail or scale down.

How should these risks be shared?

Given that governments have this choice, how should they allocate the risks of Covid-19? In our next article, we will discuss some of the economic criteria used to answer this question.