Commercial aviation is no stranger to demand shocks, whether caused by economic downturns, terrorism or dangers to public health. But Covid-19 presents it with a challenge unlike anything seen in peacetime. The current shutdown, damaging as it is, is only the first act in an drama that will end with an aviation sector categorically different from the one we knew only a few months ago.

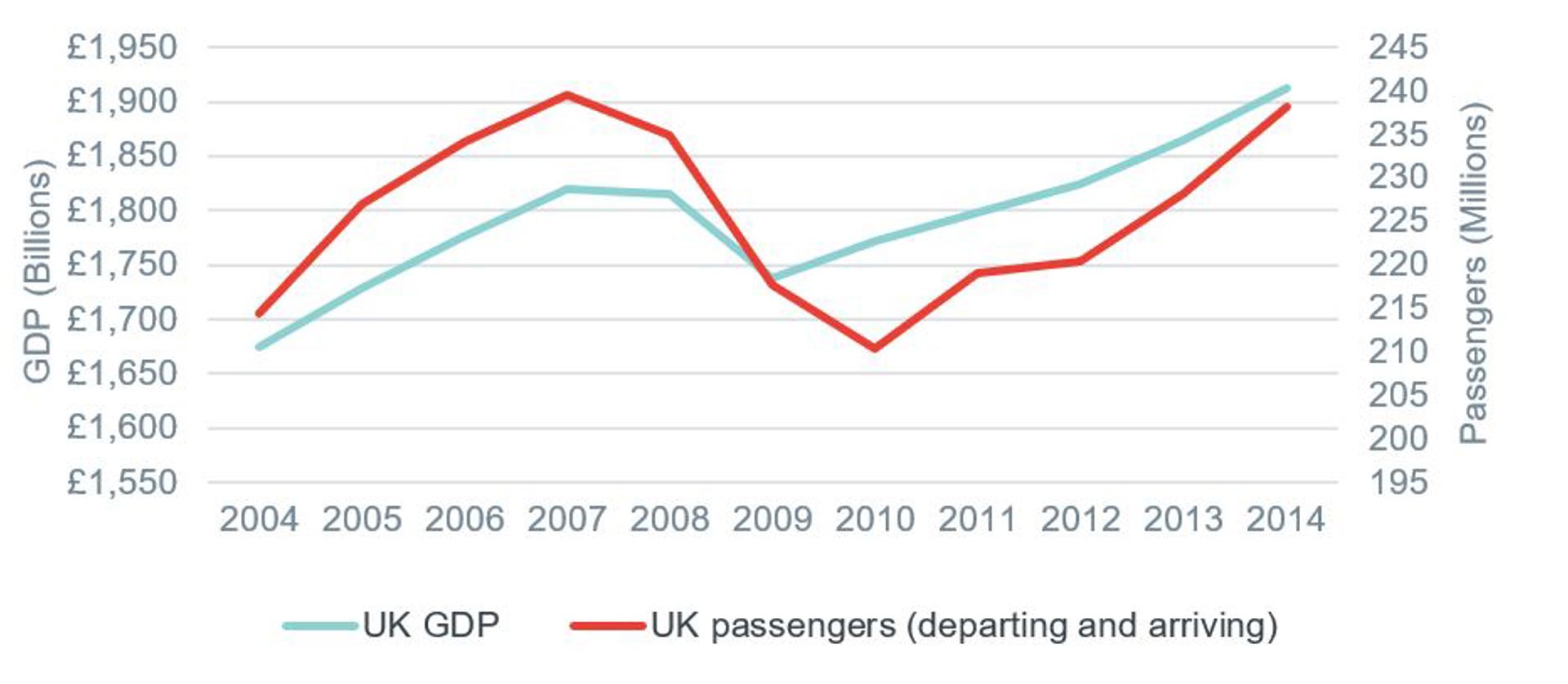

Air travel is so closely linked to economic growth (with an income elasticity of demand that has remained consistently a bit over one for the past thirty years) that it is used to business fluctuations. When the Global Financial Crisis struck in 2008, global air revenues fell by 16%.

Figure 1 – impact of Global Financial Crisis on UK air travel

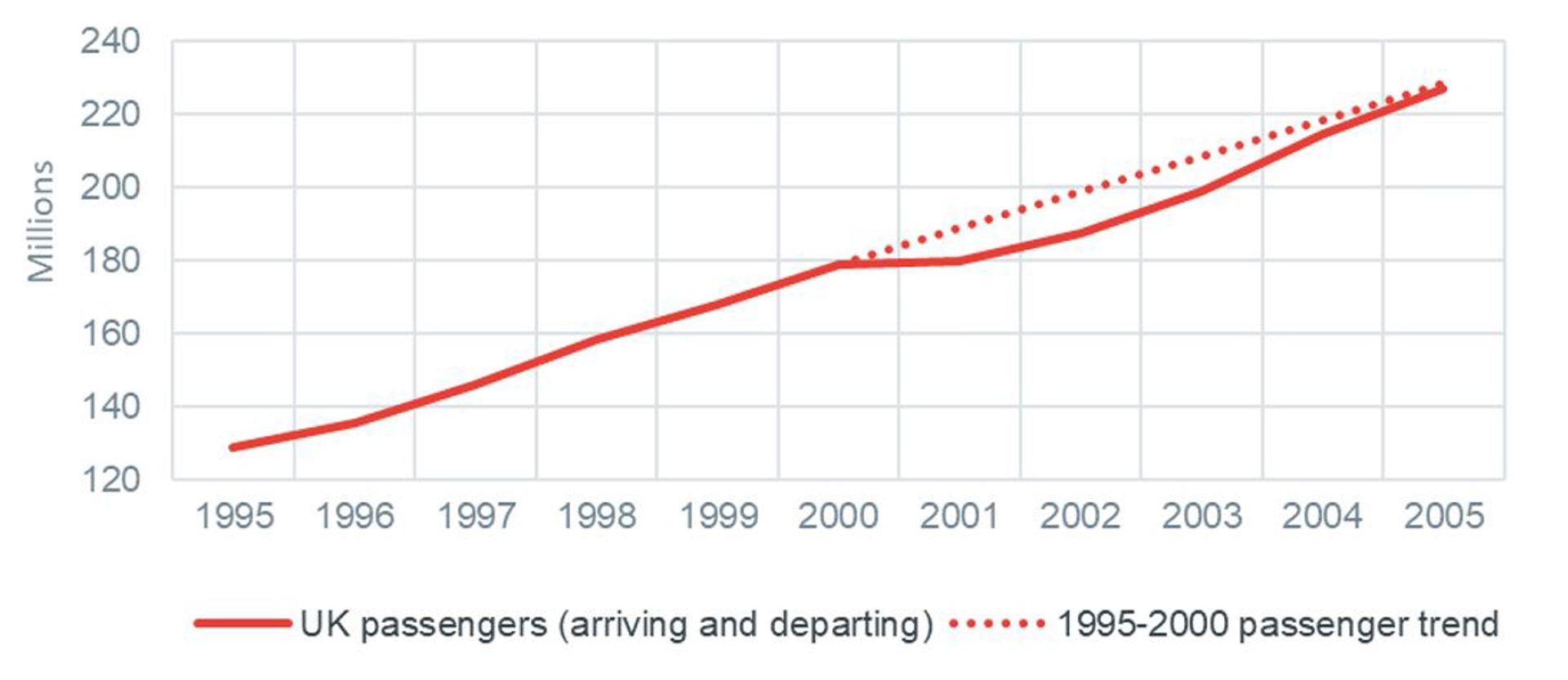

Demand has also been periodically hit by events that strike fear into the travelling public, such as the 9/11 terrorist attacks, or indeed global public health issues such as the SARS outbreak at the beginning of the century. Evidence suggests that these effects are more than short term: they can persist, sometimes for years.

Figure 2 – Impact of 9/11 on UK air travel

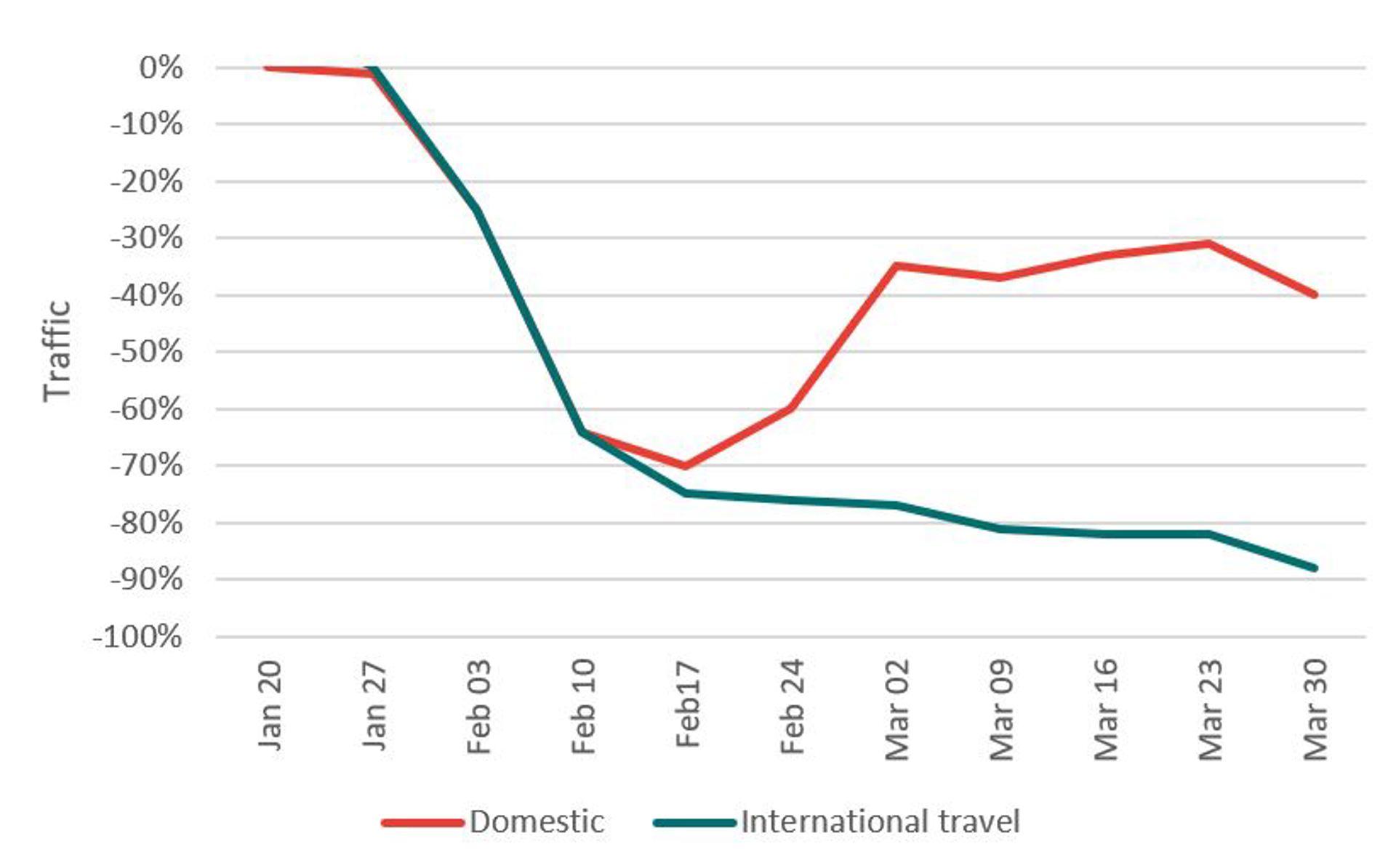

But the aviation industry has never seen anything like this. By mid-April 2020, international air traffic in Europe was down by 95 per cent from its 2019 level. Almost the only international movements are repatriation flights and cargo freighters.

Nobody can say with any confidence when international aviation will be able to resume and, when it does, how quickly demand will recover. Even the broader questions about economic recovery have no clear answers: will it be V-shaped, U-shaped or (the current favourite of scenario planners) “bathtub” shaped, let alone L-shaped - i.e., flatlining at its fallen level.

To begin with the focus has, appropriately, been on bailouts and short-term measures to support grounded airlines and their staff. This article, however, is focused on the medium term. While the form bailouts take may affect the structure of the post-C-19 aviation industry, wider economic and health issues will be the most powerful factors. We will also broaden the discussion from the grounded planes that have dominated television news to the industry’s infrastructure, and airports in particular.

How the aviation industry emerges from the C-19 crisis will depend not only on economic recovery but on whether the persistence of the virus leads to continuing restrictions to protect passengers from contagion (and of course on whether treatment or vaccine breakthroughs lessen the virus’s threat). The operational implications would have a significant impact on airline (and airport) economics, adding costs and reducing demand in ways that could mean recovery in aviation severely lags behind the general growth rate.

Dampened demand

On the demand side, weakness is driven by the same conditions that explain why the industry has been so badly affected in the first place. Epidemiologists have been at pains to stress that controls on aviation do not prevent the worldwide transmission of the virus, only slow it. (Bubonic plague went right around the world in the fourteenth century in only a few years). But slowing it buys governments time to act; prepare their health services and their systems of testing, tracing and isolating. And a reluctance to lift restrictions on travel to countries perceived, whether correctly or not, to have made less progress is characteristic of national governments under pressure on their own performance in managing the virus.

Both demand and supply are therefore affected. On the demand side, even if prohibitions are lifted, continuing restrictions such as a requirement to self-isolate for 14 days after arrival would choke off virtually all leisure travel and a large proportion of business demand. Even if or when such restrictions are lifted, the perception of risk will weigh heavily. Travellers will take time to return to past behaviours, even in a muted form.

Figure 3 – Impact of initial C-19 crisis on air travel in China

Source: OAG

As the figure above shows, when domestic air travel returned in China after the Wuhan lockdown, traffic recovery stalled at about 50% of pre-C-19 levels.

It is also reasonable to expect that the propensity to travel may have been permanently shifted by a combination of greater experience of technological alternatives and their development during lockdown. For years, pundits have been predicting video conferencing would reduce the demand for business travel, without any discernible trends that way emerging. While technology can clearly provide a substitute for travel in some circumstances, it may actually encourage it in others: worldwide instantaneous communication expands geographic markets, allowing businesses to interact with customers around the world. But now we are all expert Zoomers/Team(st?)ers/Hanger-outers, behaviour may be changed for good. The longer the lockdowns last, the more likely that is to happen.

Overall an extremely sluggish demand recovery is to be expected. Some experts are talking about it taking three to five years for aviation to get back to “normal”.

Shorter supply

A shortfall in demand is not the only problem facing airlines. When the outbreak was in its early stages, national regulatory authorities issued operational instructions to airlines and airports about how to guard against C-19 and deal with cases as they arose. These instructions included the isolation of suspected cases, deep cleaning of aircraft and quarantining of aircrew suspected of having come into contact with the virus. Airports were asked to use non-contact temperature monitoring to try to identify suspected cases and isolate them rapidly.

However, all of this was framed in the context of the presumption that exhaustive tracing of contacts of suspected cases was possible. The difficulties with such an approach, ranging from the incapacity of many governments to gear up to high levels of testing to weaknesses in the tests themselves (with some giving false negatives of up to 30 per cent), and the time needed to develop a vaccine or reliable indicators of immunity, have caused the industry to search desperately for operating practices that will make aviation safe enough to continue. Based as they have to be on social distancing, such practices would put airline and airport economics under severe strain.

easyJet has already suggested it might leave centre seats empty when services are resumed. Even supposing that provided enough distance, which seems questionable, such a proposal would hardly be consistent with the low-cost carrier’s former business model. Low-cost carriers have relied on load factors significantly above two-thirds to generate profitability. Higher prices would seem the only possible response to lower capacity, both reducing load per flight and the number of flights on any particular route.

But the operational problem for airlines goes beyond aircraft capacity. Many of us may have experienced boarding a low-cost flight as something akin to a full-contact sport. If airlines are required to ensure separation between passengers with no reasonable prospect of contact, how is this to be organised? Will aircraft have to be boarded one row at the time? How will that extend boarding times? And how will it affect these airlines’ revenue generation practices, such as payment by “priority boarders”, hopping on to the plane first and sitting at the front, with the unfortunate herd squeezing past them to the cheap seats at the back.

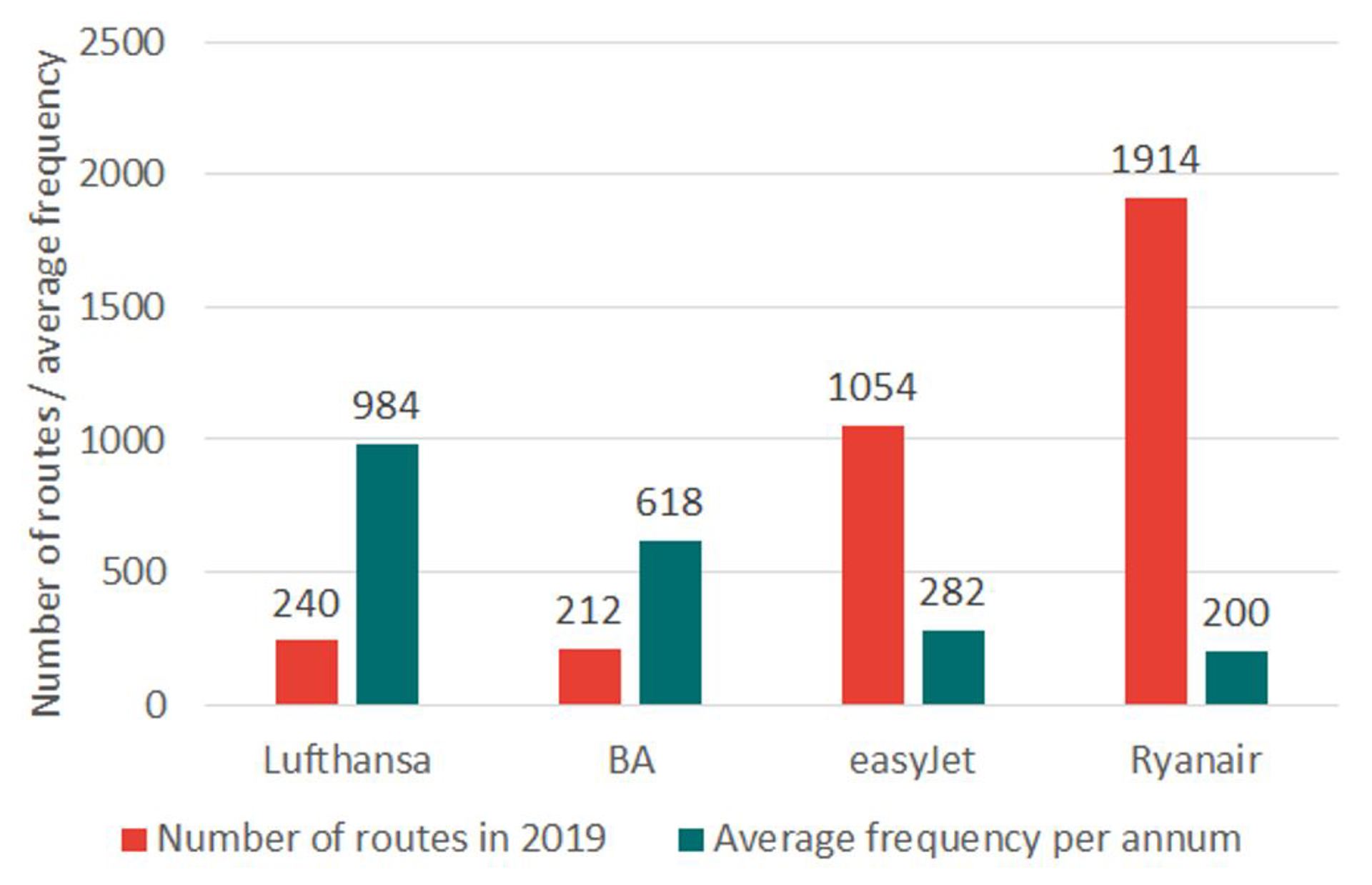

Emptier planes and slower aircraft turnaround mean higher costs per revenue passenger kilometre (RPK), higher prices and fewer flights. Flight frequencies are likely to be reduced and many low margin routes cut out altogether or flight . Michael O’Leary, Ryanair’s Chief Executive, has made this point clearly: social distancing is simply not compatible with his business model. Something will have to give. Even if seats are cheap to begin with, as airlines struggle to entice passengers back, increasing prices and reduced networks look inevitable.

Airport arithmetic

Mr. O’Leary might like us to believe that the problem can be passed back to airports, to improve airline economics by reducing charges. But C-19 has brought them plenty of headaches too.

Without a vaccine or widespread immunity, pre-departure (and/or post-arrival) passenger screening is likely to become mandatory. This has already been put in place in some airports, where passenger numbers (and infection rates) are low enough. But any additional screening procedure raises costs, slows throughput and reduces capacity. Furthermore, airports will need to reserve space both to spread out passengers and to isolate those they have identified as a risk (and their fellow travellers). This would simultaneously raise costs and reduce the number of passengers over which those costs could be spread. Moreover, this reduction could not be matched by closing terminals, given the need for greater space.

Extra processing and risks of being put into isolation would also combine to make the airport experience worse, with some airlines already talking of. 4-hour check-in times. Patently, this would have further knock-on impact on demand.

Large airports also rely on revenues from car parking and renting in-terminal shop space. This is let at premium rates because of the crazily high footfall some these shops can experience. Profits from these ancillary activities reduce aviation charges, either explicitly through fee mechanisms, or indirectly through airport finances. With much lower footfall, and maybe the conversion of shopping space to waiting areas to reduce over-crowding, commercial income is likely to take a further hit.

What price competition?

Most of the press coverage about the financial travails of the sector under C-19 have focussed, understandably enough, on airlines. According to IATA the median airline has about two months’ available cash reserves. Airlines are able to access the same range of support as other businesses: in the UK, for example, government-backed loans, subsidised furlough schemes for employees and tax-payment holidays. But in addition airlines have already sought, and in many cases received, large specific bailouts from governments. For instance, the US has provided airlines with $25bn in grants and low-interest loans.

Meanwhile the use-it-or-lose it slot allocation mechanisms that protect airlines’ positions at major airports have been suspended, which will in theory allow incumbents to pick up where they left off when the crisis lifts.

However, There is a clear risk that public help will be backward rather than forward-looking. Fears have already been voiced that government support will focus too much on the old-school flag carriers, rather than the more dynamic elements of the industry. Alitalia (which had been in trouble for years) has been renationalised. Norwegian (whose low-cost long-haul model was a long way from proven viability) has received a sizeable bailout. Other governments are expected to follow.

But when the dust settles, costs are higher and demand is lower, there will still be aircraft, trained aircrew and slots in plentiful supply. So barriers to entry may never have been lower. The survivors had better get their act together: relying on government subsidy is a well-trod path to business failure.

Routes to nowhere

Higher costs are also likely to have a significant effect on the route network. The growth in low-cost carriers has not just been about passenger numbers. It has also been characterised by a vast proliferation in routes offered, in particular those serving small regional airports. Many of these routes are “thin”, with too few passengers at current prices to sustain more than one carrier, and with highly price-sensitive demand. In the UK, for example, they have been shown to be vulnerable even before C-19.

Figure 4 – LCCs tend to operate more but “thinner” routes

Amongst a number of possible outcomes, two seem most probable:

- Many small regional airports simply lose their services altogether, with powerful knock-on effects on local industries, especially tourism.

- Many networks, particularly in Europe and Asia, may be reconfigured more along the lines of the US hub-and-spoke model. In this scenario, smaller airports may continue to be served, but much less frequently, with smaller aircraft and only from major hubs, making them harder to reach and more dependent on connecting flights.

In any scenario retrenchment is likely. For instance, which before C-19 operated from both of the major London airports is considering withdrawing from Gatwick completely.

Thinking time for the regulators?

Clearly how airports, regulators and governments deal with the current loss in revenue is an enormous challenge. This breaks down into two distinct phases:

- Surviving the immediate shock during which international aviation is essentially grounded, but the basic infrastructure of connectivity has to be kept functioning, and

- A long slow recovery in which it is likely for a prolonged period there will be a major shortfall in revenues compared to expectation and quite likely compared to the level expected to be needed to sustain profitable airport operation.

Solutions for the first phase should not be confused with solutions to the second (even though the transition from one to the other will not be clear-cut).

In the survival phase, insofar as preferential loans represent part of the solution, this may inevitably increase future airport costs to some extent. But airports (and policy makers) should be wary of passing too much of this present cost back to airlines and their passengers in the future. Airlines will understandably point out that competitive aviation markets would not allow them to do that with their own losses.

In the second phase, all the pressures on airports described above will place upward pressure on airport charges at the exact moment increases seem least appropriate from an economic point of view. Higher ticket fares may be able to bear some increase in airport costs, but new mechanisms will also be needed to spread the higher infrastructure costs.

There are alternative ways of dealing with a spike in charges that regulators would do well to consider - although none entirely escapes the danger of distorting the future to deal with the present.

- One solution would be to lengthen the lives of long-lived assets for regulatory purposes, to allow cost recovery over a longer period.

- Another - the solution that tends to be applied to UK infrastructure regulation in other sectors - would be to abandon, for regulatory purposes, the distinction between “opex” (charged to the P&L in the year it is incurred) and “capex” (charged via depreciation over an assumed asset life).

These accounting concepts could be replaced by a decision variable: the essentially, choosing in the short run what fraction of total expenditure (“totex”) is capitalised and what fraction is expensed. In this case the RAB takes the strain to ensure consistency between prices and costs over time.

This approach has worked well to date in other sectors in the UK, but this is a jurisdiction with experienced economic regulators, used to making a distinction between “statutory” and “regulatory” accounts. In many other countries, there is an understandable reliance on the binding nature of national or international accounting standards for a robust assessment of costs. This creates a reluctance to flex cost-based measures over time to smooth out cost spikes. Nevertheless, solutions may be made possible by deferring price rises that might be implied by regulators’ mechanical application of the cost-based approach, placing these deferrals in an accrual to be recovered at a later date.

Conclusion

The Covid-19 pandemic means international aviation is at a standstill, with no clear view as to when it will restart and extreme uncertainty regarding the extent to which previously attained levels of traffic can be regained. Plainly, the path to any kind of recovery is fraught with difficulties. Not only will the authorities be slow to open up international passenger traffic, but the uptake of IT-based alternatives to business travel, and the traveller confidence are likely to have an extended impact on demand.

Short-term measures of support always run the risk of bailing out firms that would have failed anyway. And any preferential treatment for legacy “flag carriers” over the newer challengers risks a retreat in the hard-fought for liberalisation of air transport.

Moreover, in the absence of an effective vaccine, new operating procedures are likely be required of airlines and airports, to stem the transmission of the virus. But social distancing will have a profound impact on the economics of the sector. Airline and airport capacity will be drastically affected. Costs per passenger will rise. The point-to-point low-cost carrier business model will be severely challenged. Fares may be weak to begin with, but the underlying economics are likely to drive them up sharply. Airline operating models will have to change, and route networks likely to contract, reducing connectivity to smaller destinations.

Lower levels of traffic will make it hard for airports to service the costs of recent investment, tending to drive up charges at exactly the least appropriate moment. National regulators will need to think hard about how to address this issue, smoothing the rise while maintaining investor confidence. In this article, we have sketched out two approaches that merit more detailed exploration.