The Covid-19 pandemic has had a profoundly disruptive effect on international trade. The WTO forecasts that in real terms, global trade could fall by up to 20% in 2020.

The factors behind this drop are the same as those causing fall in economic activity: the effects of the virus itself, and the mitigation measures required to save lives and protect health. The interdependence between trade and GDP means that these factors have second and third round effects. For example, sickness and containment measures reduce GDP growth, which in turn has a negative effect on trade. Slower trade further reduces GDP, and these effects are exacerbated by restrictive trade policies.

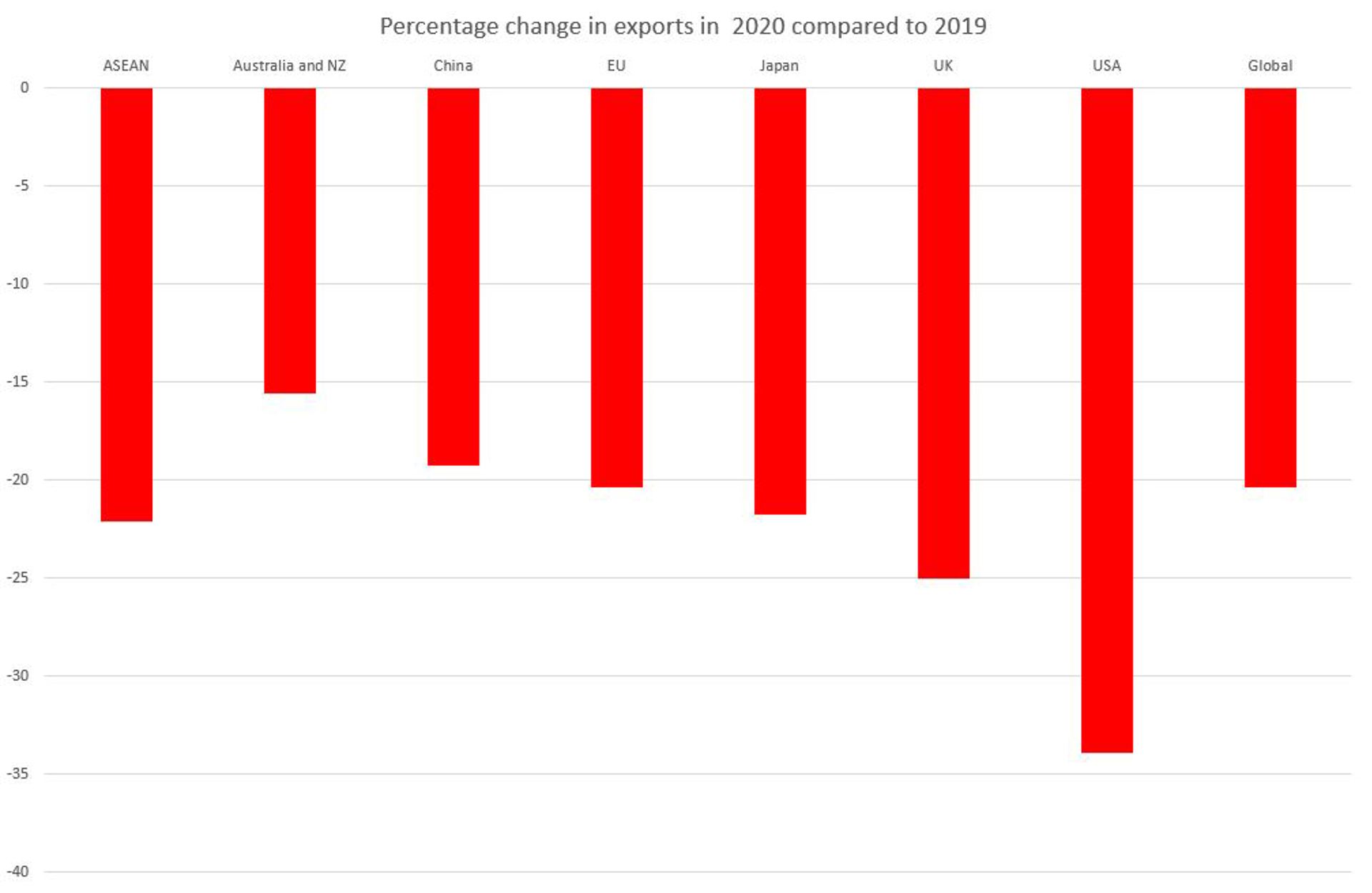

What can we expect for the UK’s trade? On the basis of forecasts made by the Office for Budget Responsibility, and largely echoed by the Bank of England, one estimate is GDP will fall by around 14% in 2020. Combining that with the WTO’s modelling on the responsiveness of trade to growth, we can estimate that fall in trade to be around 25% in 2020. This is greater than the forecast for global trade as a whole, and greater than for other trade partners outside the United States. (Figure 1 below)

The result reflects in part the structure of the UK’s trade. Many of the hardest hit sectors include the manufacture of durables such as motor vehicles and equipment, air transport and travel and professional and business services. These sectors have been hit by falling demand, but also disruptions to supply.

The Covid-19 shock comes at a challenging juncture for trade policy in the UK and globally. For the UK, the shock to trade potentially dovetails with a further shock caused by its exit from the EU single market. If the UK were to leave with only a bare bones trade deal, it faces losses in goods exports of around 15%, and around 30% on services. A no deal exit could double the losses on goods. The main difference between the Covid-19 and Brexit shocks is that the former could to some extent be reversed in 2021. While the Brexit effects will be longer lived unless the UK can negotiate a deeper agreement with the EU. (As explained elsewhere, Trade Agreements with other partners are not likely to make up the shortfall, something the UK government itself recognises).

At a global level, one of the effects of the pandemic has been to generate a near free-for-all in the use of restrictive trade policies, particularly through the use of export restrictions on items such as food, medical equipment and medicines. Paradoxically, a number of countries that have imposed export restrictions have also suspended import duties on these items. Any single country might calculate that this combination of import liberalisation and export restrictions is a clever policy for itself. It is just that if everybody gravitates towards export restrictions, any benefit from import liberalisation is lost and everyone is worse off.

That sort of adverse outcome is precisely why the multilateral trading system was established at the end of the second world war. Rather than engaging in self-interested behaviour that leads to globally suboptimal outcomes, a better solution would be to agree a reciprocal moratorium on restrictions and then to find ways of addressing the key problem (the availability of medical equipment) at source. The UK, as a country badly affected by Covid-19, and as one that has a key stake in ensuring the integrity of rules-based trade has an interest in throwing its energy into negotiating such an outcome.

Longer term, one of the key effects of Covid-19 will be to place the idea of resilience at the centre of trade policy. This is because in value chains of increasing complexity and length, a shock in one 'node' (a country, or, as in the case of Hubei, a region within a country) can cause widespread damage. Resilience is the ability to adapt to and recover from shocks. In this case, it would mean value chains that are less prone to disruption because they are less dependent on a particular 'node'.

Businesses will undoubtedly ramp up resilience planning, because it is in their commercial interests to do so. However, left to their own devices, they are unlikely to invest in resilience to socially optimal levels. Policy intervention will probably be needed The main challenge is to avoid resilience become a fig-leaf for protectionism and geo-political power plays. This will be do little to build actual resilience: to the contrary, a proliferation of protectionist measures and discriminatory trade practices will increase fragilities. The UK, as medium-sized economy exiting a large trade block, has every reason to fear such an outcome and therefore every incentive to prevent it from happening.

You can read more about Covid-19 and trade by consulting our longer article on this topic published here on the Trade Knowledge Exchange website.