An often cited intergenerational narrative is that, perhaps through their love for the latest Instagram filter, it is the millennial generation who are driving a recent shift in spending away from possessions and towards experiences. But whilst this shift is real, ONS data suggests it was more of a noughties phenomenon than something continuing in 2020, and was in fact driven by older generations rather than the young.

Nownership

A popular narrative suggests that younger people today generally prefer to spend their disposable income on experiences rather than possessions, compared to previous generations who saved to purchase physical assets.

A survey run by Eventbrite claims that British 18-34 year olds are driving the “experience economy”. 66% of respondents (sampled from the age group in question) said they felt:

“more fulfilled by live experiences than purchasing an item of the same value.”

62% planned to increase the amount of money they spend on experiences, not possessions, over the next 12 months. Media articles characterise millennials as following a lifestyle of “nownership”, which places greater value on experiences over owning things.

Looking at consumer spending will allow us to shed light on the “nownership” narrative. Has spending shifted from possessions to experiences in recent years? And is this a millennial phenomenon, or a more general shift in consumption patterns across the economy? We decided to investigate.

Looking at the data

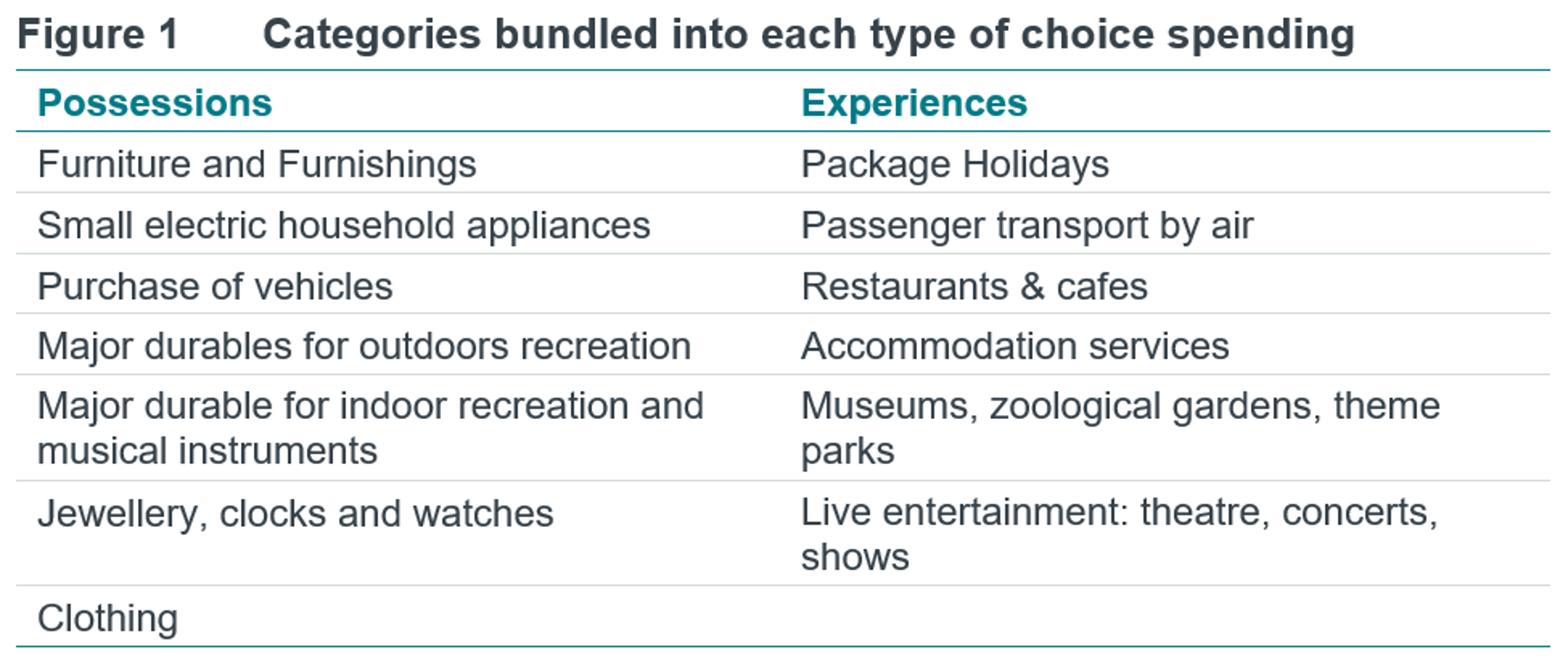

The UK Living Costs and Food Survey (LCFS) shows how households spend their money, broken down by age, income and region. The survey has been running for many years, providing a view on trends over time. To investigate “nownership”, we looked at the share of their total income that a person is spending on different goods and services. First, we abstracted the non-discretionary spending fields, such as household bills, health, education and other household necessities. Within the remaining “choice” spending, we then made a judgement about whether categories in the dataset fit into “experiences” or “possessions”.

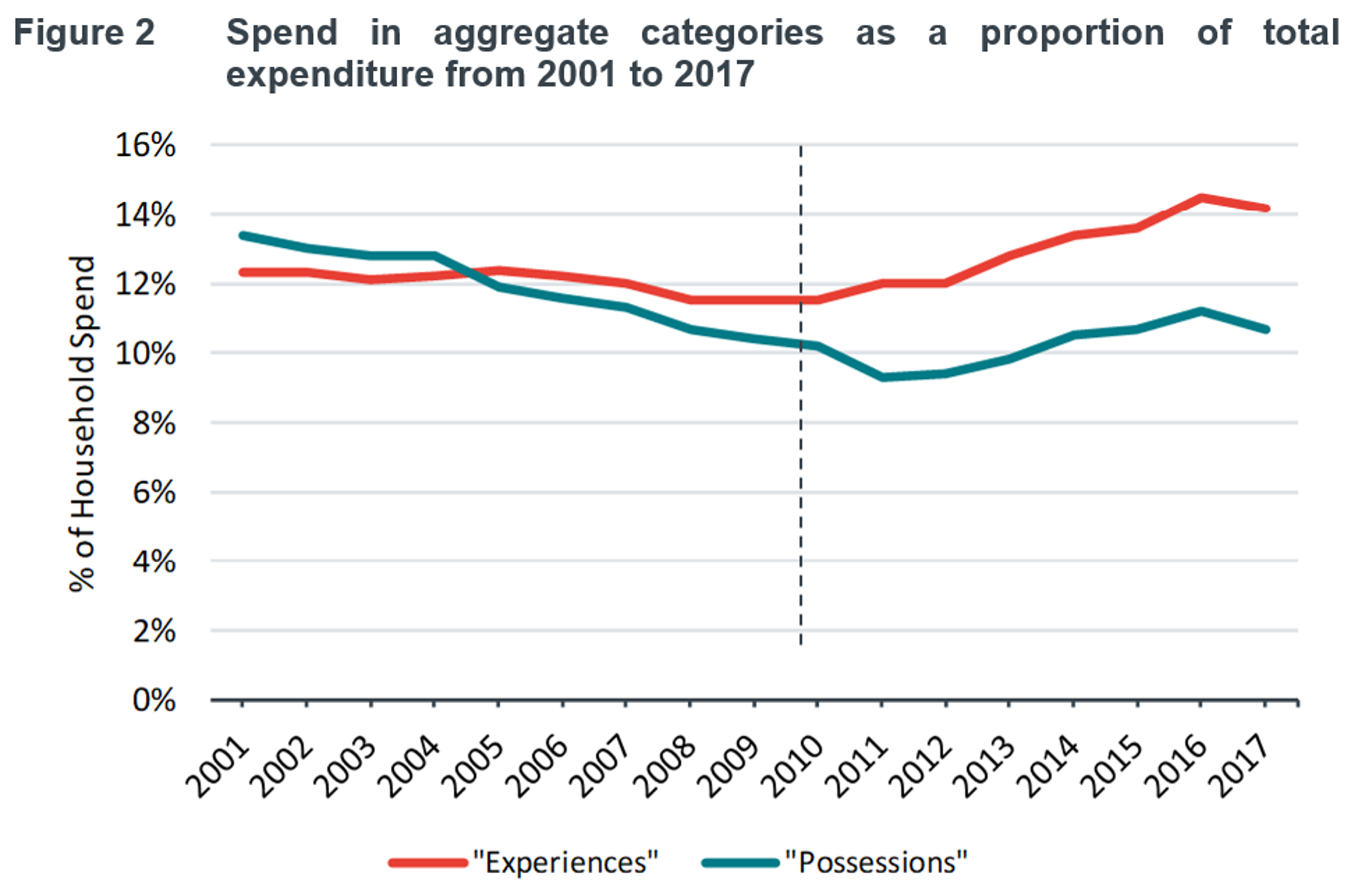

“Choice” spending represents nearly half of the average household spend, and this (and indeed the other broad spending categories) has remained fairly stable between 2001 and 2017. Within this, while the aggregate figure remains broadly stable, as shown in Figure 1 there has been a rebalancing from possessions to experiences: spending on experiences as a proportion of total income increased by 15%, whilst spending on possessions fell by 20%. The former change implies an annual boost to the U.K. “experience economy” of around £750 million.

However, we can see a clear split in the data: from 2001 to 2011 there was a decisive shift away from possessions towards experiences, with possessions spending falling by 31% and experience spending only falling by 2%, in-line with changes in average household spending over the period. During this period experiences also overtook possessions as a percentage of overall household spend.

Over the last decade, spending on experiences and possessions, as a share of total spending, have roughly tracked each other, suggesting that while the spending shift was real, this was very much a noughties phenomenon.

With age comes experience

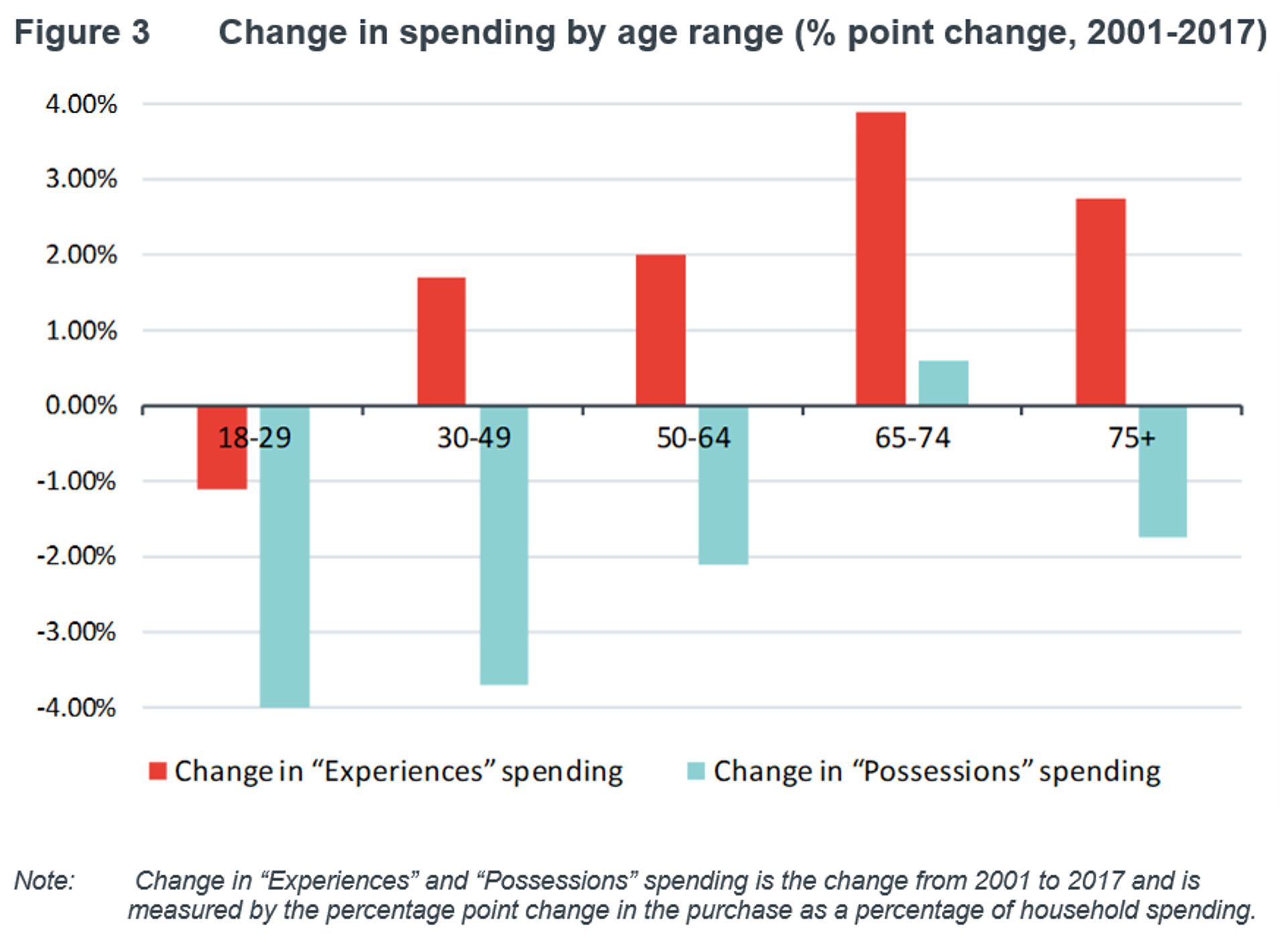

Splitting our data by age groups, we do find that 18-29 year olds have been cutting back on the share of their total income spent on possessions such as on clothes (-2.1%) and on buying cars (-2.4%) between 2001 and 2017. This could be in the hope of more experiences, or could just reflect wider trends of fast, cheaper fashion and expensive car insurance pushing young people away from purchases.

What fails to support the “nownership” narrative, is the fact that this age group spent less, as a share of total income, on experiences in 2017 than their equivalent cohort in 2001, whilst all other age groups increased the proportion of their income spent on experiences.

Furthermore, the increase in experience spending from 2001 to 2017 is highest for those over 65, which suggests the old generation actually drove the noughties shift towards experience spending. This group increased their expenditure on travel related services, as a share of total spending, by 3.0% in 2017 alone.

We also looked at the difference in spending over different income deciles and the divide is even clearer than the split of age groups. The difference in spending on experiences rather than possessions, as a share of total spending, is seven times as large for those in the top decile of income compared to those in the bottom decile.

It could be that these older family members we hear about going on adventures every year (picture Carl Fredicksen from the film ‘Up’) are actually just wealthier than young people, and recent intergenerational wealth trends are allowing older people to spend more on experiences, rather than any increased change in preferences.

Hence, the evidence does suggest a shift in spending towards experiences in the noughties. However, it does not support the narrative that young people today are following a special new lifestyle of “nownership”. Whilst young people shifting their spending towards experiences may seem more prominent from social media, the experience economy is instead being driven by older generations.