Options to improve the robustness and consistency of risk measures for regulated infrastructure

Understanding the level of financial risk faced by utilities can help regulators to design incentive mechanisms and calibrate the rate of return. It can assist companies and investors to gauge their risk exposure and ensure financial resilience.

UK regulators have focused on the Return on Regulatory Equity (RoRE) as a central yardstick of risk. RoRE measures the return that equity investors will earn in specific upside and downside scenarios and is assessed against the cost of equity component of the Weighted Average Cost of Capital (WACC).

But RoRE is not without its drawbacks. We consider how to improve RoRE and other options for measuring risk.

How RoRE has been calculated

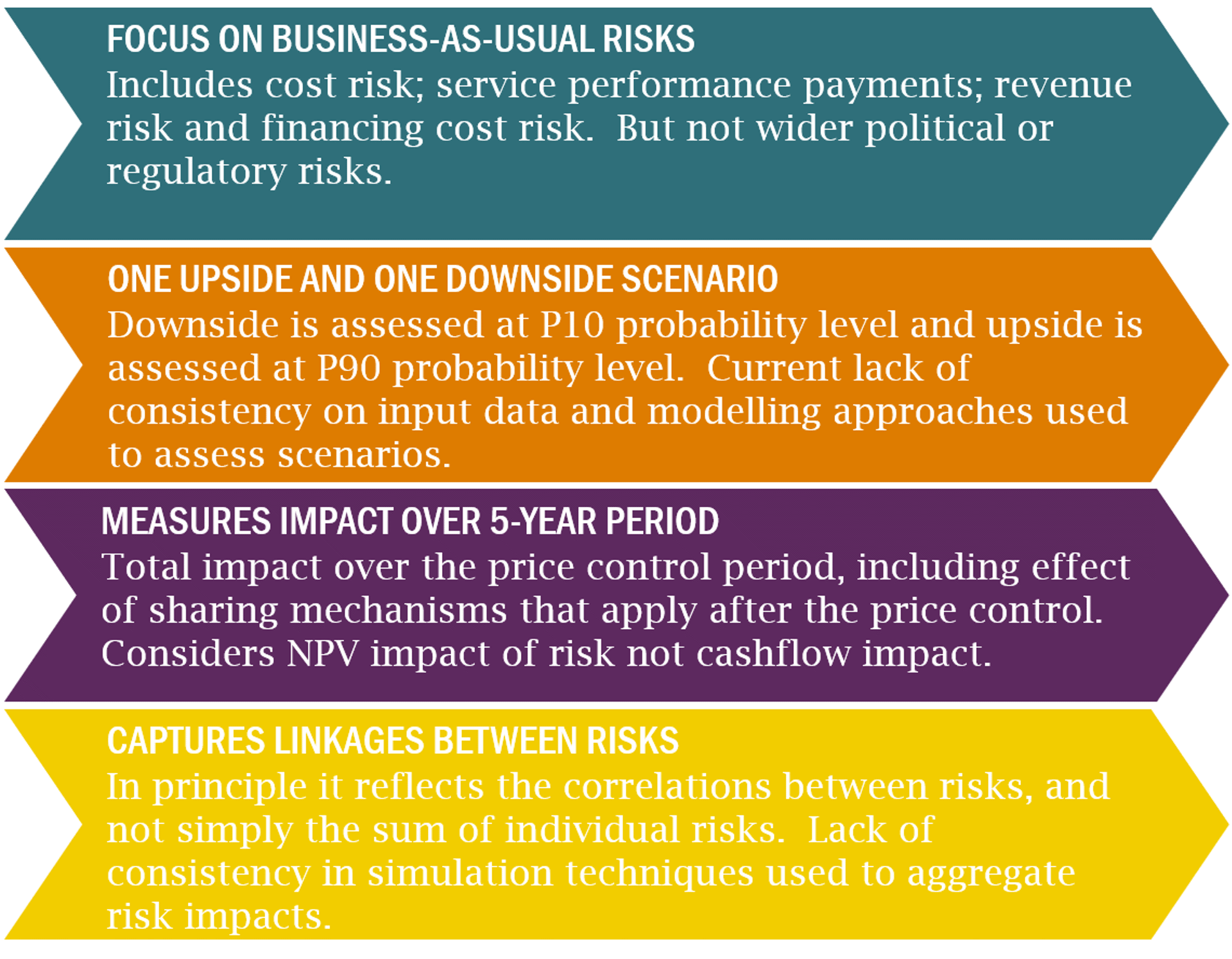

RoRE represents a measure of risk for equity investors. As applied in the water sector, it has the following features:

Figure 1 Key features of RoRE

The RoRE ranges published by Ofwat in the PR19 final determinations showed that the downside return on equity by company ranges from -4% to 0%, while the upside return ranges from 7% to 11%. So some companies are exposed to materially more risk than others. However, in Ofwat’s final determination this does not appear to affect the other elements of the regulatory settlement. This raises questions about the role of RoRE and whether there is a case for other measures of risk.

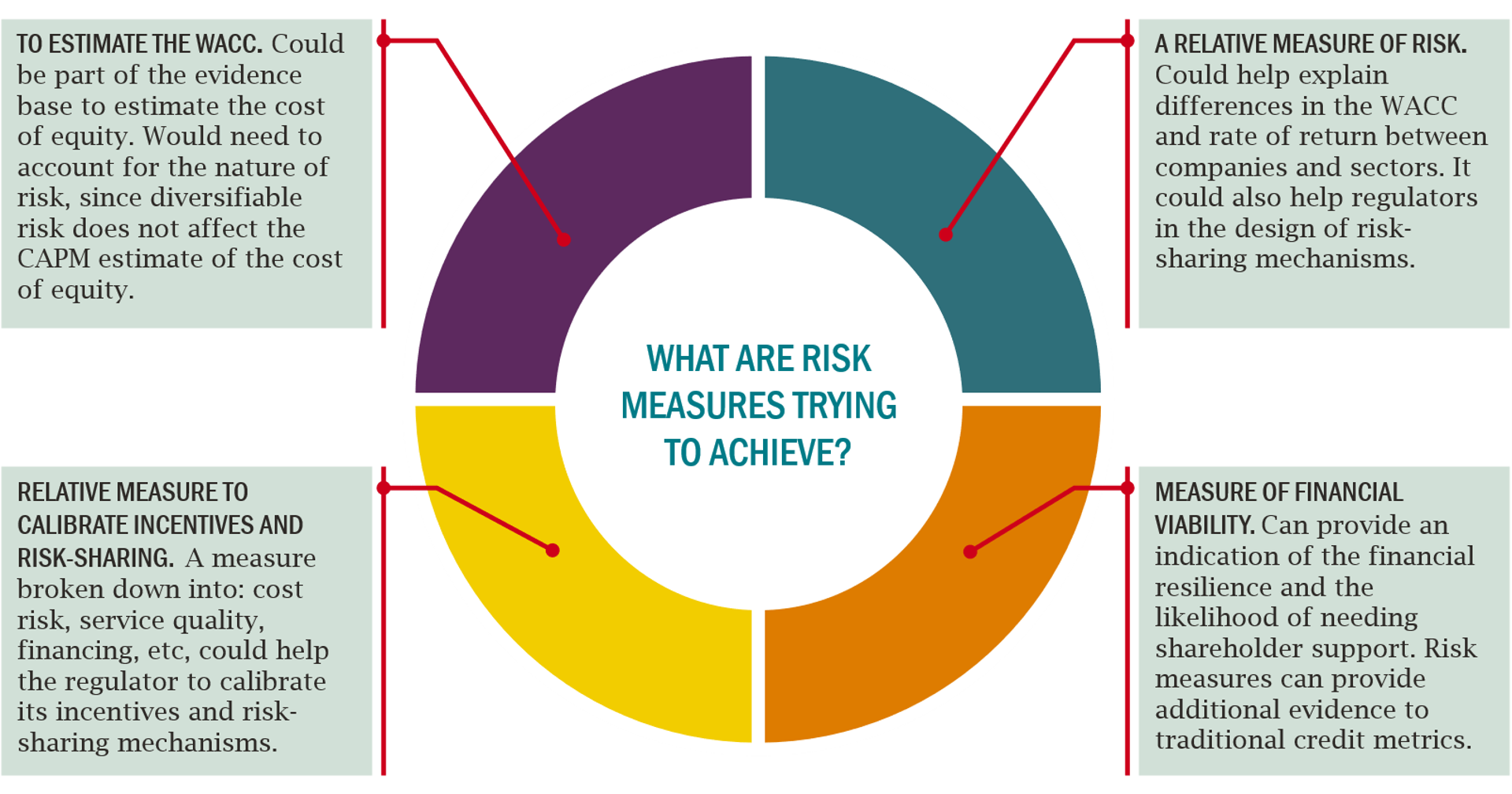

What is the risk measure trying to achieve?

While there are a lot of practical ways of improving RoRE, it is important to step back and think about the overall objectives of a risk measure, see Figure 2 below.

Given the different objectives, a single risk measure will not perform well against all of them. The current measure of RoRE is best designed as a measure of relative risk that aids the calibration of incentives and risk-sharing mechanisms. As a measure to estimate WACC it is limited as it does not encompass the full set of risks (e.g. political or regulatory risks) and it does not take account of diversifiable risk. Further, it is a poor measure of financial viability because it reflects changes in value rather than cashflow.

Way forward

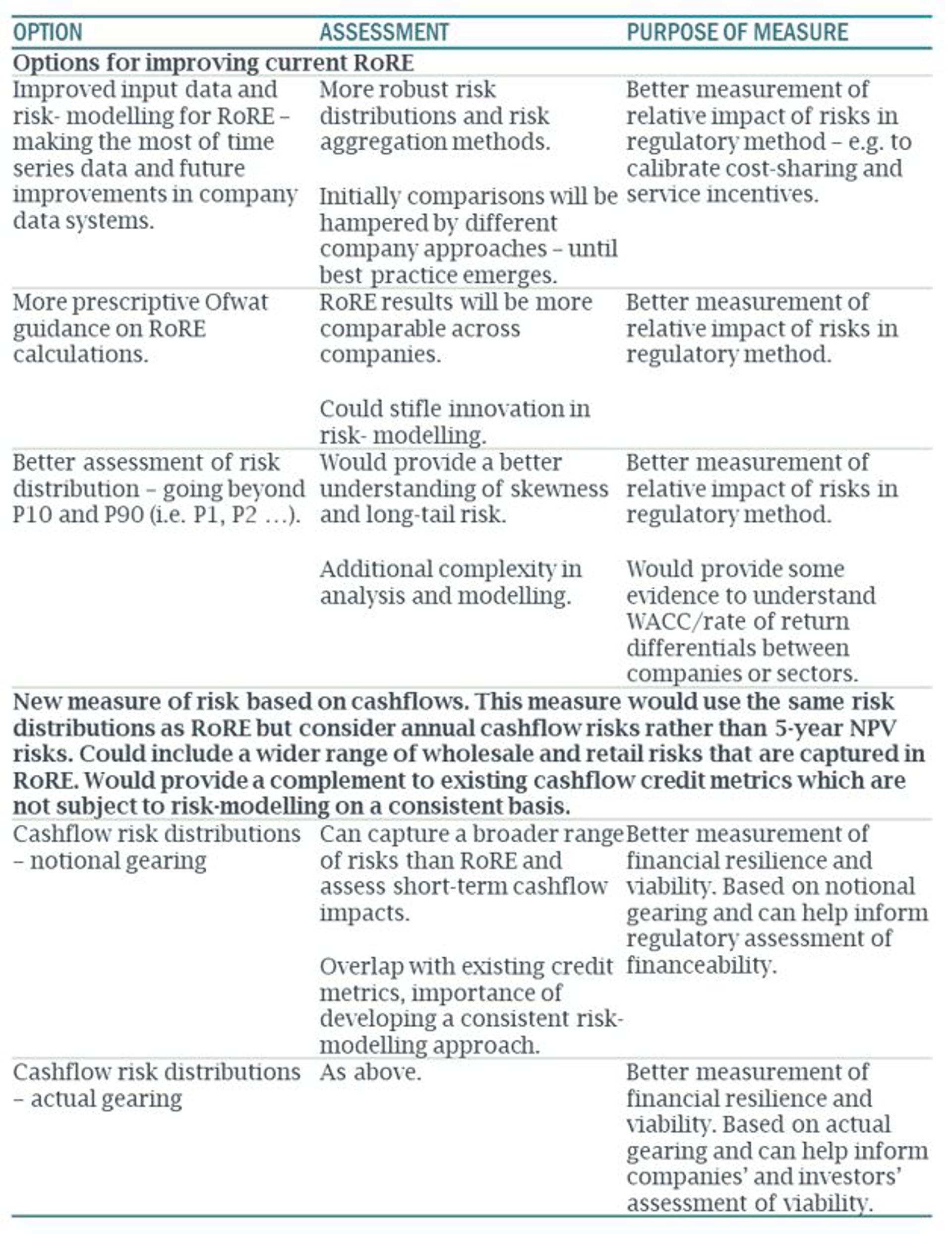

In this light, we have considered two broad areas for further development:

- First, options for improving the existing RoRE to provide a more robust way to support the design of incentives.

- Second, options for cashflow measures to assess financial resilience, combining features of RoRE and existing credit metrics.

These options are summarised below.

Figure 3 Summary of way forward on risk measures

Click the link below to read our full analysis.