In March 2020, the UK government issued a consultation on changes to Contracts for Difference (CfD), the support contracts which low carbon plant receive, one component of which pertains to the support provided when wholesale electricity prices are negative.

Under the support contract for the last two allocation rounds (AR2 and AR3), when the reference price (which for intermittent renewables is essentially the day ahead power price) for the CfD is below zero for six or more consecutive hours, no difference payments are made for any generation during the period. For support contracts going forward (i.e. from AR4 and subsequent rounds), the government has proposed that no payment is made during any hour when the day ahead price is below zero.

The argument which the government put forward for doing this is that “generators should not be encouraged through the CfD to generate in ways that are unhelpful to the overall system”. This broadly mirrors the situation which would be seen were the carbon price driving despatch and investment: contributions to the payback of investments would be seen during periods of relative scarcity and when more carbon-intense generation is on the margin. In contrast, the market price would not encourage additional generation in conditions of over-supply. The government also suggests that the change should reduce balancing costs, because CfD generators are less likely to bid negatively to be turned down.

However, the impact of the government’s proposed formulation of the rule may have some significant unintended consequences which jeopardise the achievement of these objectives and increase the risks faced by CfD auction bidders.

What does it all mean?

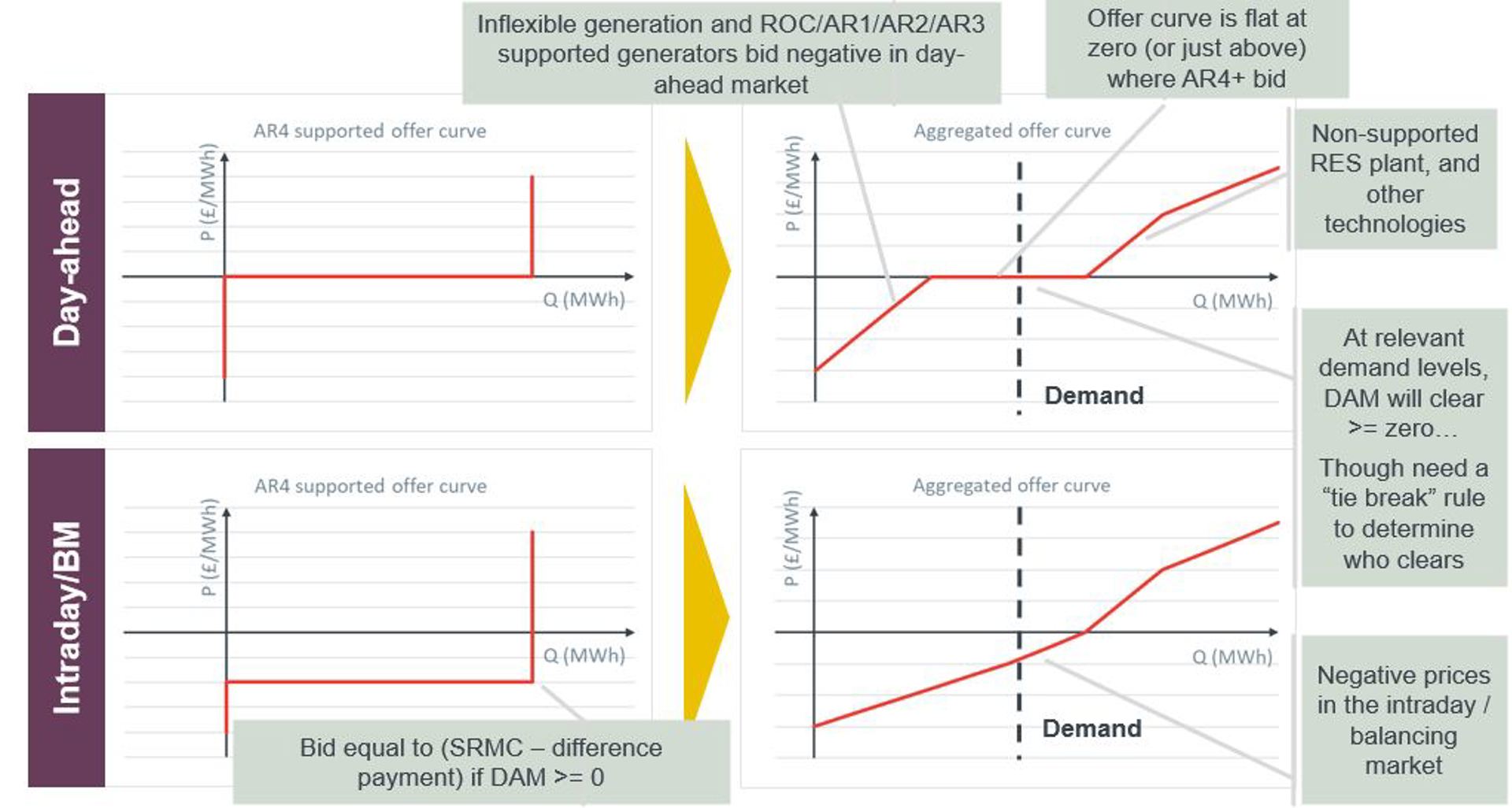

At first sight, the rule might appear to give plant with AR4+ contracts an incentive to bid to try to ensure that the day ahead price clears at zero or above. For relevant levels of demand in the day ahead market, this could in theory be achieved if all AR4+ plant submitted offer curves to the day ahead market which only reflected a willingness to sell at prices at zero or above.

Figure 1 Illustration of bidding behaviour and outcomes

Source: Frontier Economics

If the AR4+ plant succeeded in achieving a day ahead price of zero or above, under the government’s proposed rule, their support would continue. This would then influence the way these plant bid into intraday and balancing markets. They would continue to be willing to generate at negative prices, and so intraday and balancing markets could therefore still see negative prices. The goals of not encouraging generators to generate when unhelpful to the overall system and of preventing negative balancing bids would not be met.

There may be a further impact of this outcome. If buyers in the day ahead market anticipated it, some of them may choose to avoid contracting at a zero price day ahead, given that they might be able to contract at negative prices intraday. That said, differences between the day ahead and intraday markets (e.g. in terms of format, and in terms of potential depth and volatility) may limit the scale of such response on the demand side.

So will AR4+ generators succeed in ensuring the day ahead market clears at zero or above?

It is clear that they all collectively have an incentive to achieve this, so that support continues. But for any given level of demand in the day ahead market, generators individually have an incentive to try to clear in that market, and hence perhaps bid just below zero to achieve that.

This is because, assuming AR4+ plant are at the margin, a generator can secure one of two outcomes if they clear day ahead (with a price at or above zero):

- they produce and secure payments under their support contract; or

- they “buy back” their day ahead sale in the intraday market at a negative price (securing some profit) as a result of an AR4+ generator with a higher support contract offering to sell energy intraday and then producing.

Both of these outcomes secure more profit than if the AR4+ plant does not clear day ahead. If they do not clear, even if they have a high support contract (meaning they would be willing to pay to produce), absent an increase in demand, they will only be able to sell energy and produce if they sell intraday or in the balancing market. And with negative prices likely in both markets, in doing so they will lose some of the value of their support contract – which would not happen had they cleared day ahead.

Put another way, if the day-ahead price is to outturn at zero, only a subset of AR4+ will be able to clear. The remainder will not clear either because they bid higher (or did not bid) or as the result of a tie break rule in the auction. And those that are left out have an individual incentive to bid lower (i.e. marginally negatively) in order to improve their chance of clearing and secure the resulting higher profit.

So the answer to what might actually happen is that “it’s complicated”!

As a result of the way the rule is formulated, there is certainly a potential outcome in which AR4+ plant and demand collectively secure an outcome in which day ahead prices clear at or above zero and support continues, leading to the potential for negative intraday and balancing market prices. This “collectively rational” outcome is made more likely because this is a “repeated game”: players bid, observe the market outcome, and then get an opportunity to bid again the next day having observed a link between their and others’ behaviour and the market outcomes.

If this is what happens, the government’s stated policy objectives will not be achieved.

But there is also a credible outcome in which AR4+ plant and demand fail to secure this outcome, and the day ahead market clears at a negative price as a result of individuals bidding to try and clear, while hoping others bid to sustain the price. In this case, the government’s objectives will be met.

Which outcome we see dominating might change over time. The “collectively rational” outcome is arguably more likely with smaller numbers of AR4+ generators (which in turn is more likely following the early allocation rounds, as more rounds can be expected to add more AR4+ participants).

Why does it matter?

Some may say that if the rule achieves its purpose at least some of the time, it is not all bad. However, the rule means that, for bidders into the CfD auction, there is an additional policy-driven source of uncertainty which needs considering. A bidder has to assess which outcome they think is likely over time, because clearly they will receive more support (and hence be able to bid a more competitive lower £/MWh strike price) were a collectively rational outcome to emerge.

The scale of impact clearly depends on the evolution of the rest of the system. For a stylised solar plant, if we compare strike price bids assuming a collectively rational versus an individually rational outcome, in our modelling we see differences in strike price bids in the order of £2.50/MWh. This is clearly significant in the context of a competitive auction process.

This uncertainty – and the desire to avoid winners’ curse – will weigh on bidders’ minds. The rule as structured risks only partially achieving the government’s policy objective, while increasing bidders’ cost of capital and so the overall cost of securing a given level of renewable energy capacity.

What to do?

The government wants to avoid creating incentives to produce when electricity is not needed. This objective itself raises a policy tension between the desire to reduce the cost of capital for renewable investors and a desire to move to a situation in which despatch and investment decisions approximate more those which would be driven by an undistorted market.

The government also says that they also want to strengthen incentives for renewable plant to be flexible, including by co-locating storage (although it is not obvious why co-location specifically should be a policy objective). For this to be achieved, existing barriers around co-location of storage with a CfD plant (for example, ability to import “brown” power from the grid) would need to be considered in addition to the government’s proposals to date.

Our analysis suggests that even if these objectives are taken at face value, the approach taken by the government does not appear well targeted to meet them effectively and efficiently. The next CfD allocation round is not far away (it is currently scheduled for 2021) and bidders need certainty over the proposed contract terms very soon. This points to the need for some speedy work to think how to achieve these objectives in a more effective manner.

We wrote this article in collaboration with Chris Matson and Kyle Martin from LCP.