Results of the first phase-out auction are in - why are modern power plants the first to go?

The German Coal Phase-out Act adopted on 3 July 2020 provides for the gradual phase-out of coal-fired electricity generation in Germany by 2038 at the latest. The operators of lignite-fired power plants will receive compensation payments for early decommissioning, based on negotiations between the plant operators and the government. Compensation payments for hard coal-fired power stations, on the other hand, are to be determined in annual tenders which are organised as pay-as-bid sealed-bid auctions.

The first tender was conducted by the Federal Network Agency in September 2020. The Federal Network Agency recently announced the results, which can be found here.

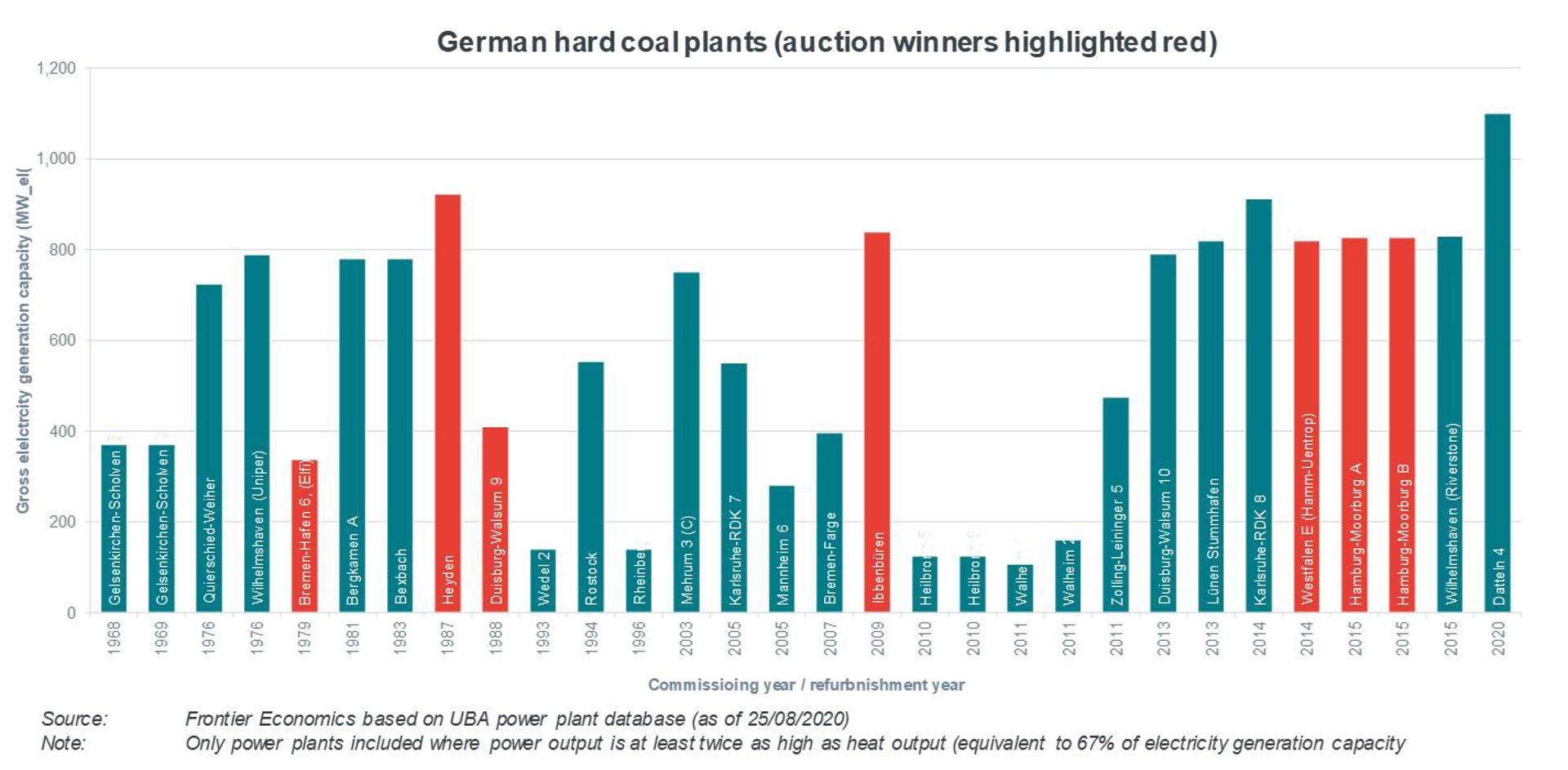

- First auction covered 20% of hard-coal capacity – A total of eleven hard coal-fired power plants with a total capacity of almost 4,800 MWl – equal to almost 20% of Germany’s coal plant capacity – were awarded a tender. These plants are due to be taken off the grid by the end of the year, subject to a review by the transmission system operators.

- Modern plants amongst the winning bids – Around two thirds of the capacity was awarded to modern, efficient hard coal-fired power plants without significant heat output and which only came into operation or were extensively modernised since 2009

- Oversubscribed tender – According to the Federal Network Agency, the tender was significantly oversubscribed. The volume-weighted average award bid was € 66,259 per MWel, which is well below the highest allowed bid of € 165,000/MWel.

From an economic and environmental perspective, it appears more sensible to shut down older, less efficient hard coal-fired power plants first, as older plants will emit more CO2 per unit of electricity produced. Below we explain three possible reasons why modern plants came out on top. Understanding the reasons would help design better auctions in future.

An awkward award rule with a CO2 adjustment mainly explains why modern plants are decommissioned first

A key reason for decommissioning three of the most modern power plant units is the questionable award rule:

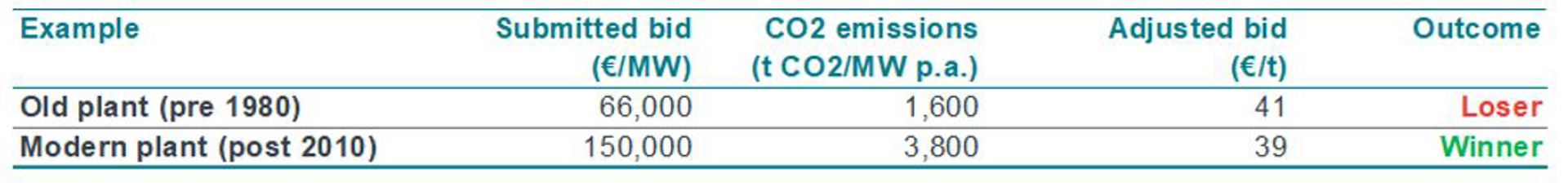

- Price bids were to be submitted by power plant operators in Euro per megawatt capacity (€/MWel) – this equals the compensation payment for winning bids (pay-as-bid).

- For the award decision, however, the bids were not – as would be usual practice – ranked directly, by the bid parameter. The bids were instead converted into €/tonne of CO2, based on the average annual CO2 emissions per MWel observed for each plant over the previous three years.

- As modern power plant units are more efficient (and emit less CO2 per megawatt hour of electricity generated), they were operated more frequently than older and less efficient units. As a consequence the bids of younger units are divided by a higher total amount of CO2 which moves them up the bid ranking compared to older units.

The impact from the CO2 adjustment rule can be illustrated by a simple example, based on hypothetical bids (consistent with bids observed in the first coal phase-out auction) and realistic CO2 emissions:

The old plant loses against a modern plant that submits a bid more than twice as high (when measured in €/MWel), reflecting the much higher opportunity cost of a modern plant to close early.

There are two further reasons why modern plants might have been eager to win the first auction:

- Decreasing bid caps – Bid caps are set to decline from auction to auction (with a jump down from 155,000 €/MW for closures in 2022 to 116,000 €/MW in 2023). This creates an incentive to try and win in an early auction, in particular in the first three rounds (with closures in 2020-2022). This effect was reinforced by the first auction, as plants in the South (which are potentially critical for the stability of the power system) were excluded and some bidders may have expected less competition in that first auction.

- Declining utilisation of hard coal plants – The auctioneer is obliged to adjust bids for the average CO2 emissions over the last three complete calendar years, i.e. 2017-2019 for the first round. The higher historical emissions in that relevant time window are, the more are bids adjusted downwards in the auction ranking. This means that high recent CO2 emissions enhance the chance of winning and allow bidders to bid higher (less aggressively). If the recent trend of declining utilisation (and CO2 emissions) of coal plant continues, the evaluation of bids submitted by modern plants will be disproportionally more affected (i.e. the reduction of emissions from year to year in absolute terms is likely to be higher). This creates an additional incentive for modern plants to bid in an early auction, when the emission record for a modern station is still high, rather than later.

All these effects together explain why some modern plants came out on top in the first coal phase-out auction.

The flawed auction design leads to inefficient early closures of modern plants and higher cost for consumers...But may also have some positive side-effects

In consequence, units that emit less CO2 per unit of electricity are closed first, while older and less efficient units remain operating. This increases the cost for consumers in two ways:

- Compensation payments, which are born by tax payers, are higher when there is no CO2 adjustment (see example above). This effect might be reinforced by strategic consideration of bidders: modern plants can bid less aggressively as the CO2 adjustment moves them up the bid ladder.

- Closing more efficient modern plants first will also increase the power price in the coming years as modern plants with lower generation costs will be replaced by more expensive plants in the merit order.

The net effect on the CO2 balance is unclear: The remaining older units will ceteris paribus produce (and emit) more in future as they fill the generation gap left by the younger coal units that exit. The net effect on the CO2 balance will also depend on how many CO2 certificates the German government cancels from the European Emission Trading System (EU ETS) in response to the auction outcome to avoid the ‘waterbed effect’ (saved emissions from the coal phase-out shifting somewhere else in Europe in case of no cancellation of permits). The CO2 adjustment rule might also create an incentive to increase emissions strategically in the short term: this moves plants up the bid ladder and could generate higher compensation payments. This incentive is however, dampened, as the auctioneer will consider emissions over the previous three years. Strategically increasing output over three years to affect the auction outcome, may be a significant gamble.

However, there are also some positive (unintended) side-effects: Coal generation might be phased out quicker than expected if older plants also exit the market in short order (possibly even without compensation if continued operation leads to net losses). Modern plants leaving the market voluntarily (with compensation) reduces the risk of future litigation against the State since from 2027 onwards plants will be forced to be close without any compensation (gradually, ordered according to age).

A better auction design with 'menu bids' could have avoided these shortfalls

Frontier has advised the German Energy and Water Industry Association (BDEW) on auction design during the consultation of the Coal Phase-out Act. At the time, we warned that an auction design with CO2 adjustment of bids could lead to inefficient early closures of modern power plant units and could result in higher compensation payments. We have proposed a design with flexible ‘menu bids’ for closures at multi-year decommission periods:

- In this case, the auctioneer invites bids for different decommissioning dates (‘menu’) for a certain deadline (possibly every year or every two years), aligned with the target path in the Phase-out Act.

- Bidders signal their individual decommissioning costs for different decommissioning dates through their bids. This ensures that the targets are met at minimal compensation cost.

It will be interesting to see how bidders adjust their bidding strategies in the upcoming second auction on January 4th 2021:

- Will further modern plants take the opportunity to close early at relatively high compensation payments?

- Will older plants react by bidding more aggressively?

We believe that a more robust auction design would have avoided relying on such strategic considerations in phasing out one of Germany’s main sources of electricity generation in the past. We will be following the situation closely as the auctions continue, watch this space for our insights in the future.