As the UK economy begins to emerge from lockdown, thoughts are turning to recovery. And with different sectors and regions impacted differently by the pandemic, the effect will be far from uniform. But data science can help us uncover some likely trends – as our analysis of three clusters of the economy shows.

How different sectors have coped – from ‘struggling’ to ‘handling’

To understand what recovery will look like, we first need to understand how different sectors have been impacted by Covid – and to identify any common trends.

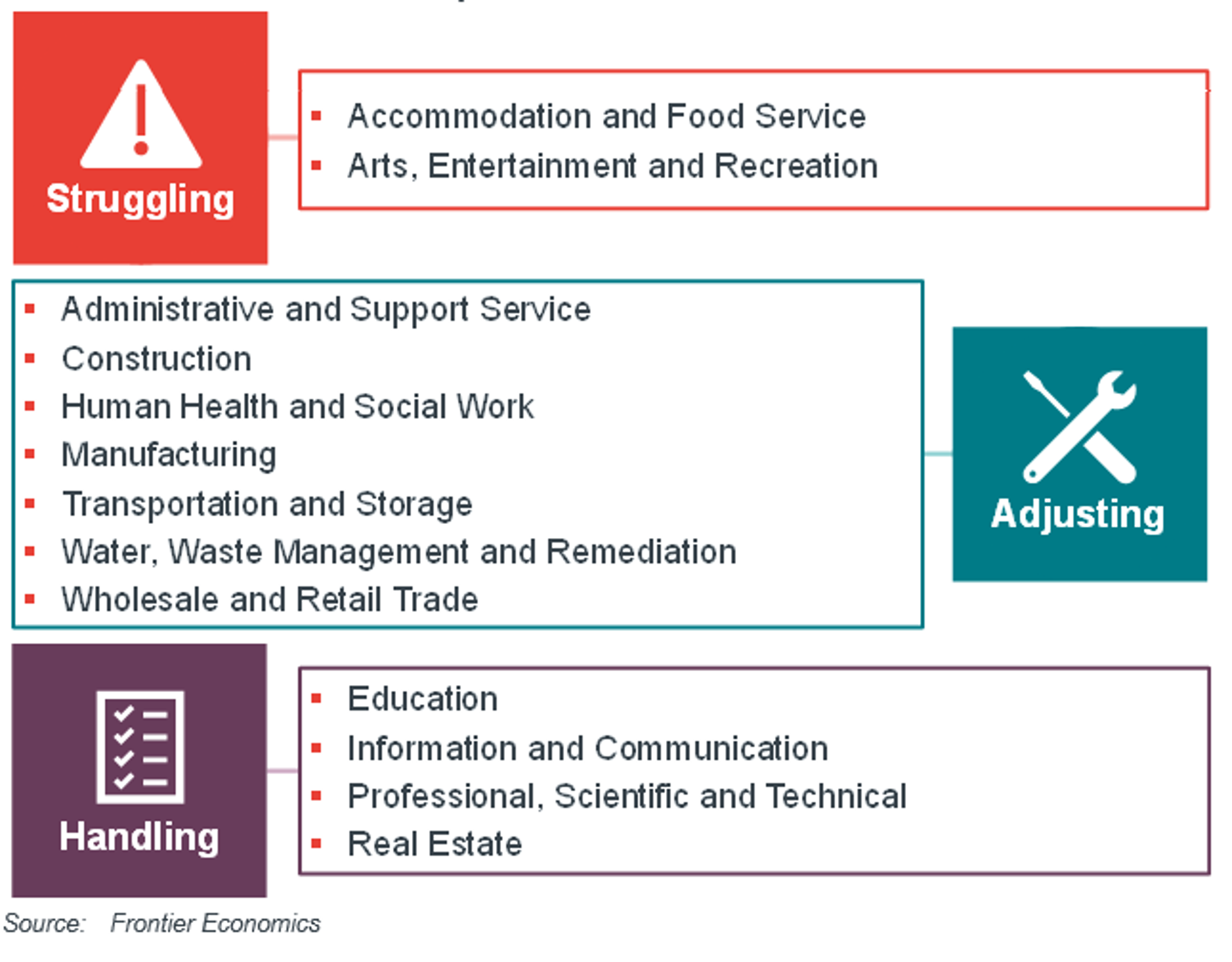

To do this, we applied ‘K-means clustering’, a machine-learning technique, to the data in the ONS Business Impact of Coronavirus Survey (BICS). Our algorithm identified three distinct clusters of the economy, each including a number of different sectors who have seen a similar level of impact – from those that have been hit the hardest, to those who have suffered the least:

- ‘Struggling’ cluster: hard-hit sectors which have had few chances to recover.

- ‘Adjusting’ cluster: suffered in the initial phase, but slowly returning to business as usual.

- ‘Handling’ cluster: transitioned quickly to working from home, and affected the least by lockdowns.

‘Struggling’ businesses included those in tourism, hospitality and the arts. And those ‘handling’ the pandemic were likely to be in information, scientific and professional services.

How the clusters are made up

The common factors in each cluster

The shared characteristics that create these clusters lie across two dimensions: impact on turnover and impact on workforce.

Those sectors hit the hardest are characterised by the biggest drops in turnover and the highest proportions of staff on furlough. Businesses in the ‘handling’ cluster, on the other hand, have suffered smaller hits to turnover, placed fewer employees on furlough, and have been able to transition more easily to working from home.

Take a look at the interactive chart below to see how turnover and working status have changed for each cluster over the course of the pandemic.

Business impact of Covid-19 by cluster

Source: Frontier Economics analysis of ONS BICS data (waves 2-25)

Note: Cluster averages calculated as a weighted average of sector-level responses using gross value added weightings

Mapping clusters to regions

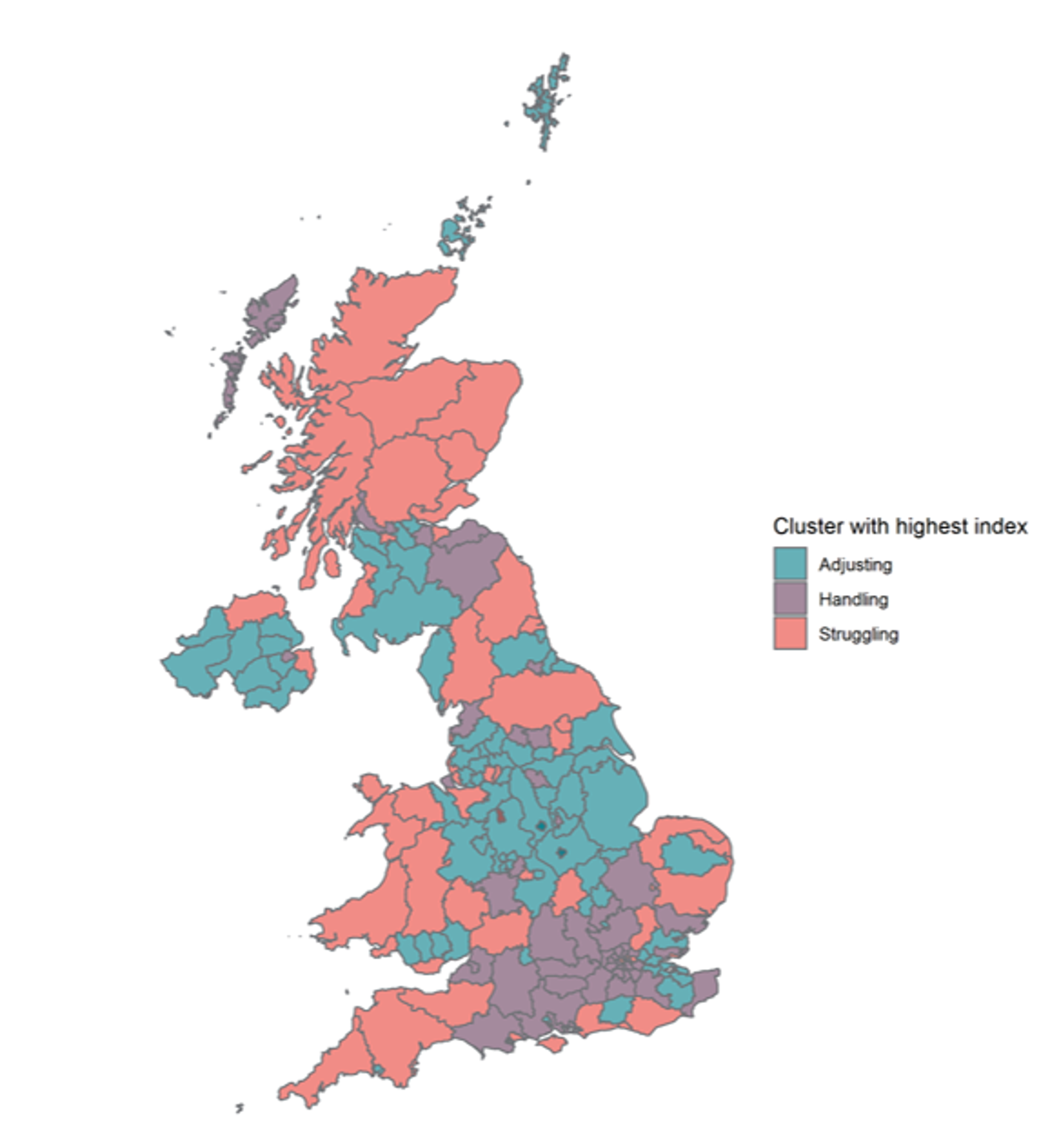

Establishing these three clusters allows us to move to the next stage of our analysis: mapping the impact of the pandemic by region.

We looked at how much each cluster contributes to the economy of each UK region, and compared that with how much it contributes at an overall, nationwide level. That way, we were able to see which clusters ‘over-indexed’ in each region – in other words, which types of business predominate in each area of the country.

Predominant cluster in each UK region

Source: Frontier Economics analysis of ONS BICS data (waves 2-25); ONS data on gross value added by sector and NUTS3 region (2019).

Note: Index based on z-standardisation of 2018 regional gross value added by clusters.

For each region, the map shows the cluster whose share is furthest above the typical nationwide level. We can see that:

- Businesses that are ‘handling’ the pandemic are particularly prevalent in London and south-east England. These regions form an important hub for the information, scientific and professional services sectors. Businesses in these industries have been able to cope relatively well, since most of their work can continue almost as normal from home.

- Businesses that are ‘adjusting’ are concentrated in the Midlands, south Yorkshire, the north-west of England, the Scottish Lowlands and Northern Ireland. This is thanks to the predominance of industrial businesses in these areas, particularly in the Midlands and the north-west. After an initial shock, the industrial sector has gradually adapted to Covid-19. Many businesses have been able to return to normal working practices.

- Businesses that are ‘struggling’ tend to be concentrated in south-west England, Wales and the Scottish Highlands. These are the regions where tourism and hospitality are most important to local economies. These sectors were by nature poorly equipped to handle the pandemic, and the impact of restrictions has been severe.

What will recovery look like?

Now that we’ve assessed impact, and how it is spread across the UK, we can deal with the question of recovery.

Just as there have been three broad levels of impact, we’d expect from our analysis to see three broad levels of recovery.

‘Struggling’ – the longest wait, but the sharpest growth

Even in the less difficult months of last summer, when employees could return from furlough and government support was at hand (such as the Eat Out to Help Out scheme), many ‘struggling’ sectors still reported drastic reductions in turnover.

Regions that depend on these sectors will therefore have the biggest mountain to climb. The inability of staff to work from home means that recovery may only start in earnest once nearly all social restrictions are lifted.

But once this has happened, these regions stand to benefit considerably. The question remains as to how much permanent scarring the pandemic has left on some businesses – but many could see a sharp uptake in fortunes.

‘Adjusting’ – a further boost

Since the initial months of the pandemic, when much of the workforce in these sectors was furloughed, more and more staff have returned to work as normal, or have transitioned to working remotely.

In April, almost half of these businesses saw turnover decrease by at least 20%. By August, only a quarter of businesses reported such a drop.

Many of these businesses, therefore, have found a way to function in the ‘new normal’, and recovery is already underway. That said, the lifting of lockdown will provide a further boost, and recovery will quicken over the coming months.

‘Handling’ – no dramatic growth

Throughout the pandemic, businesses in this cluster have furloughed fewer staff, transitioned more easily to remote working and seen less impact on turnover than sectors in the other two groups.

In London and the south-east of England, therefore – and in other regions where ‘handling’ businesses predominate – there will be a gentler path ahead. Starting from a more elevated position, these regions will see less of a boost than the rest of the country – we will not see the dramatic spurts of growth we may do elsewhere.

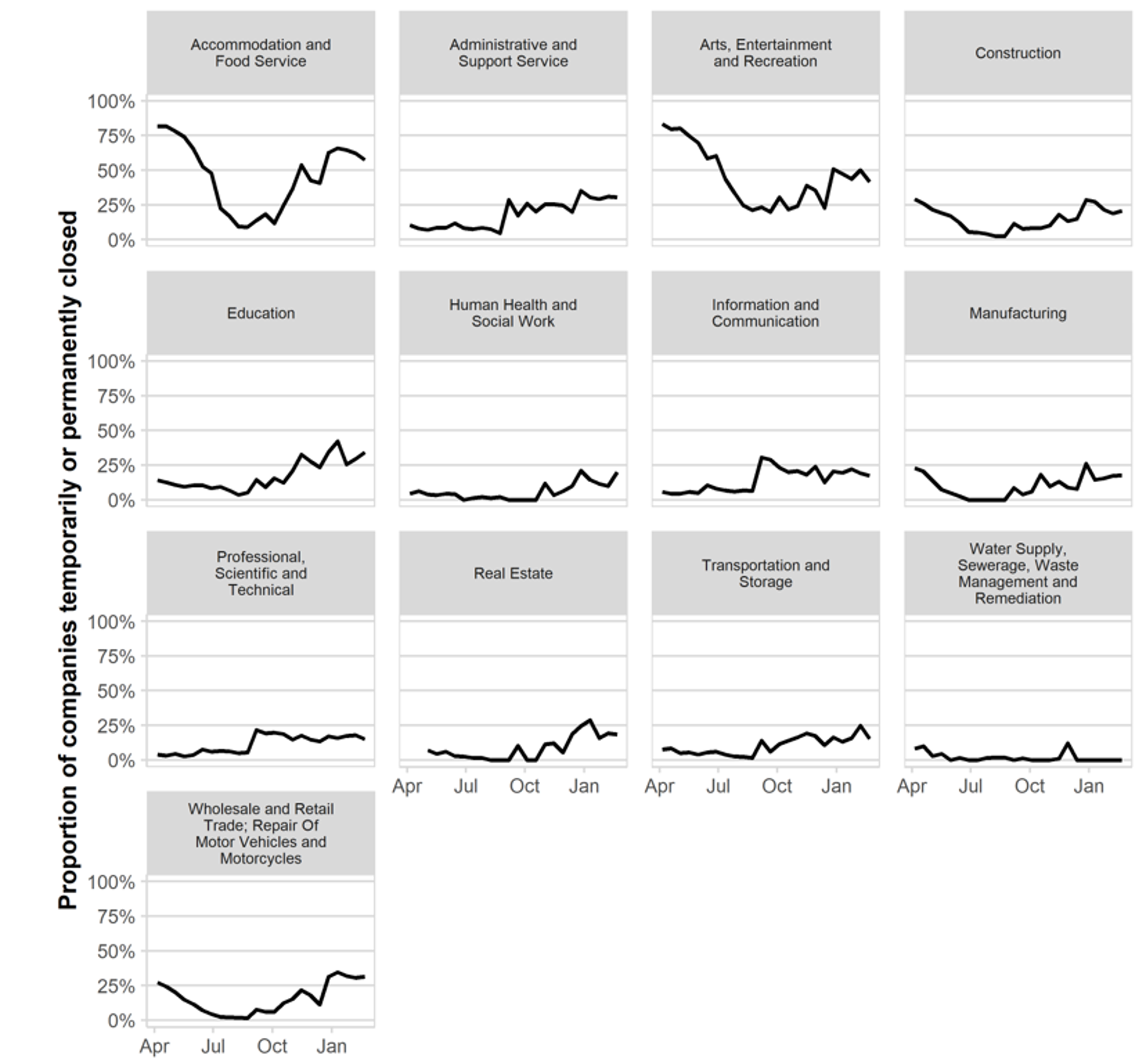

Covid-driven business closures in each sector

Source: Frontier Economics analysis of ONS BICS data (waves 2-25)

Many roads to recovery

Our analysis suggests there will be many different roads to recovery for the UK economy. Those sectors hit the hardest are likely to benefit most from restrictions being relaxed, whereas those who have had a more comfortable ride are least likely to experience surging recovery – but then there is less to recover from.

From a data science viewpoint, the methods we’ve used to arrive at these conclusions are relatively rudimentary, but have still generated clear insights that can be used to guide our understanding of Covid’s economic impact in a flexible, evidence-based way.

Much more advanced tools and richer data sources are available. And if we want to ensure we’re well prepared for what happens next, we must make sure that we leverage them.