After a year of unprecedented economic disruption, a wave of consolidation is forecast as firms in sectors badly affected by the pandemic struggle to survive. But many mergers will face a high hurdle in the form of sceptical competition watchdogs. Historically, authorities in Brussels and London have set a high evidential bar for businesses looking to justify a merger on the basis that they can no longer make it as standalone operations. Where have these “failing firm” claims come unstuck in the past? And how – if at all – might the events of the past year change the equation?

2020 was a year like no other for many firms, with social distancing and lockdowns closing large parts of the economy. Enormous government support programmes have helped keep many businesses alive through the Covid-19 crisis, but there is uncertainty as to how they will fare as this emergency aid is withdrawn. While the roll-out of vaccines creates hope for an economic rebound, the timing and strength of the recovery remain unclear. What’s more, the pandemic may have permanently changed patterns of demand for certain goods and services, in particular where it has accelerated trends that were already underway, such as the shift to remote working and shopping online.

Against this backdrop, some analysts are predicting a wave of consolidation, with businesses in financial difficulty looking to merge to shore up their finances and survive. However, many of these mergers will have be cleared by antitrust authorities. Companies may seek to persuade competition watchdogs to give the go-ahead on the basis that at least one of the merging parties is a “failing firm”. In other words, any concerns that the tie-up might eliminate an independent competitor do not apply since at least one of the two businesses will go into liquidation if the merger does not proceed. The two parties may argue that the merger will deliver a better outcome all round because the disorderly collapse of one of the firms would create difficulties for its customers.

Competition authorities in Europe and elsewhere recognise that such failing firm arguments may have merit in some circumstances. However, businesses must clear a high evidential bar to persuade the watchdogs to approve a deal on these grounds alone.

(Di)stress testing

Admitting failure is an uncomfortable experience for any business. Most companies are not used to talking themselves down in public, let alone putting together a detailed “business case” to show they can no longer survive as independent entities. But the reality is that firms must be prepared for a barrage of forensic questions if they are to have any chance of securing merger clearance on the basis of a failing firm claim.

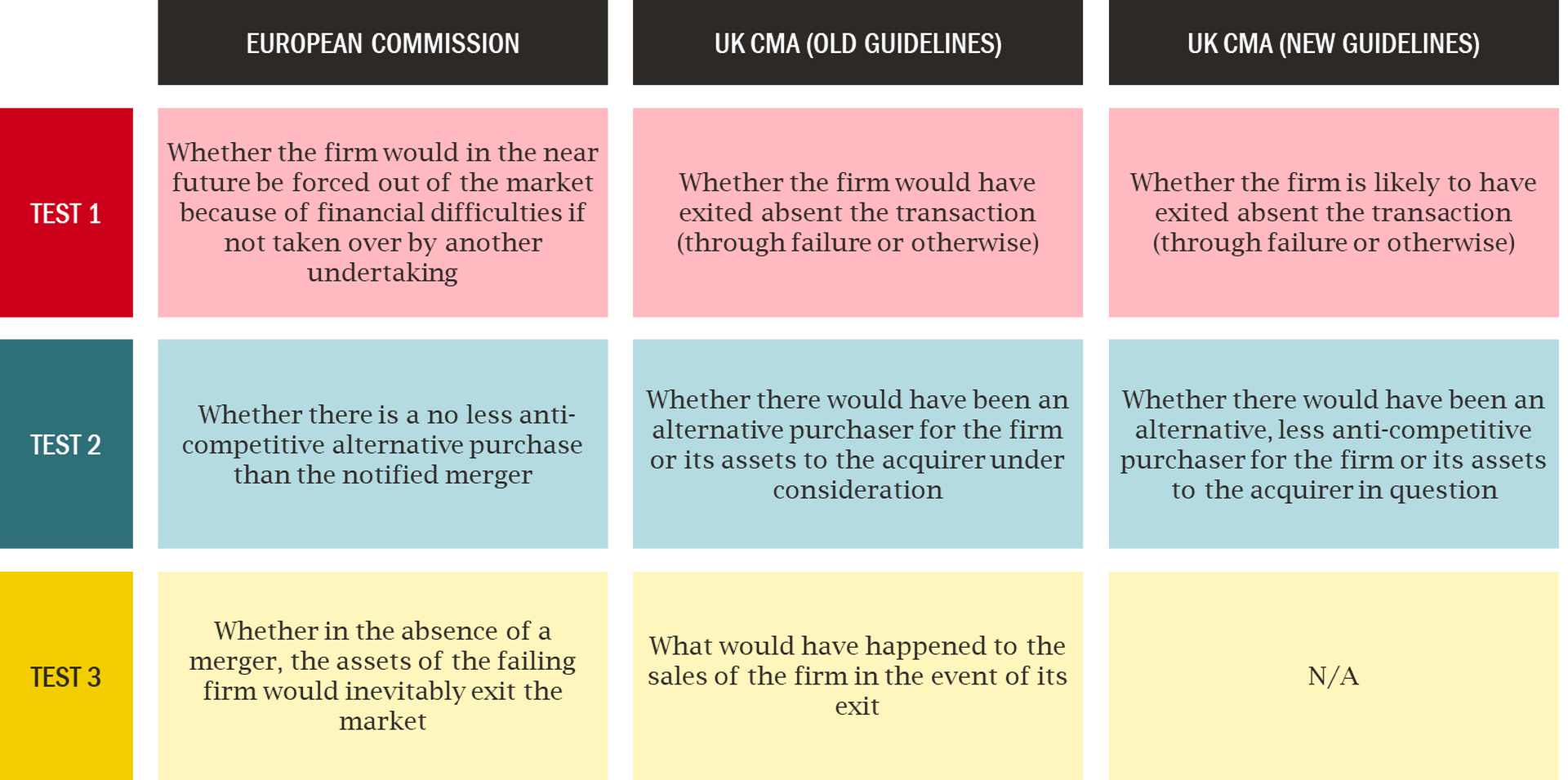

Competition authorities will scrutinise the struggling firm’s financial accounts and internal documents to satisfy themselves that the company really is on course to fail in the near future and that it has exhausted all options for avoiding this fate as a standalone business (for example by cutting costs or restructuring). However, as Figure 1 below shows, this is just the first of three tests that the firm must pass. To pass the second test, the firm has to show that there are no other potential buyers whose acquisition of the business (or of its assets) would produce a better outcome for competition than the merger under consideration. As for the third test, the competition authorities may also assess what would happen if the firm were simply allowed to fail. The precise wording of this third test has evolved over time and varies somewhat across jurisdictions, but the purpose is to rule out the hypothesis that permitting the merger would harm competition more than allowing the struggling firm to go under.

Figure 1: Overview of the three tests applied to assess a “failing firm” claim in EU and UK merger investigations

In practice Tests 1 and 2 are usually the trickiest because they both involve proving a negative: that there are no steps the distressed firm could take to survive as a standalone business and that there were no less anti-competitive buyers to be found. Test 2 can be especially difficult to substantiate, since it requires the merging parties to provide evidence of the financial situation and incentives of a range of third-party businesses. Nor do competition authorities pull their punches in terms of the level of evidence they expect to see. The UK’s Competition and Markets Authority (CMA), for example, emphasises that it is “likely to conduct a stringent assessment of the marketing process through which a business has been sold, and to consider whether other realistic prospective purchasers would have had sufficient opportunity to advance a purchase”. This seems to assume that the business had both the time and the resources to conduct a systematic marketing process in its hunt for prospective buyers. While this may be a reasonable assumption for a large business in gradual decline, it is demanding a lot of a small firm with few resources, especially if a sudden shock to its revenues – as the lockdown may have caused – has created an urgent need to find a buyer.

Times they are a’changing?

The high evidential bar set by competition watchdogs means that – at least historically – it has been unusual for a merger to be cleared solely on failing firm considerations. For example, in the five years that followed the last major economic downturn – the 2008 financial crash – the European Commission (EC) cleared just two cases on the basis of a failing firm argument, despite undertaking more than thirty in-depth merger investigations. Is there any reason to think that things will be different this time? EC has not said anything to signal a change in approach: on the contrary, European Commissioner Margrethe Vestager warned in April 2020 – when much of Europe was in the grip of its first lockdown – that Covid-19 “shouldn’t be a shield to allow mergers that would hurt consumers and hold back the recovery”. And early indications do not suggest a change in thinking on the part of the CMA either.

- In April 2020, the CMA issued a note reiterating the principles of its guidance on how it would assess failing firm claims. This was very much a restatement of the CMA’s existing principles rather than a pointer to material changes in its approach.

- The CMA has acknowledged that firms are operating in a fast-changing environment and that it may need to update its assessment over the course of a merger investigation as events unfold. This is potentially helpful for firms whose finances are rapidly deteriorating, but it can cut both ways. Amazon’s recent acquisition of a 16% stake in food delivery service Deliveroo is a case in point: in the early stages of the pandemic, the CMA took the view that Deliveroo met the criteria of a failing firm, but it reversed its thinking later in the investigation process as it became clear that lockdown was in many ways a boon for Deliveroo’s business model. (In the end, the CMA cleared the deal, but for reasons unrelated to its failing firm assessment.)

- In November 2020, the CMA launched a consultation on a series of proposed updates to its Merger Assessment Guidelines. These included one notable change in relation to its assessment of failing firms – namely scrapping the third test looking at what would happen to the firm’s sales if it exited the market. However, the CMA underscored that in reality the change would merely bring the guidelines into line with its prevailing practice, which has placed relatively little emphasis on Test 3. As noted above, it is on Tests 1 and 2 where failing firm arguments have often foundered in the past, and the CMA stressed that these tests will remain at the forefront of the assessment process.

Viagogo gone?

As noted above, Test 2 can pose a particular evidential challenge for many firms, especially if they have not had the resources or time to run an exhaustive process to identify (and rule out) alternative potential purchasers. How might competition authorities seek to fill this evidential gap when assessing failing firm claims in the wake of the pandemic? In practice, the watchdogs may seek to distinguish between two types of “failure”:

- First, there may be firms that have laboured during lockdown, but they are in industries for which demand is set to bounce back after the pandemic. In this scenario the authorities may take a dim view of failing firm arguments if the businesses involved are direct competitors. If the struggling firm potentially has a bright future, but faces a short-term cashflow crisis as a result of the pandemic, the competition authorities may take the view that there ought to be a range of third-party investors – including businesses that do not compete with the firm – who would be willing to provide the financial support needed to tide it over.

- Second, there may be firms in sectors for which demand may not return to pre-pandemic levels as a result of permanent changes in consumer habits during lockdown. There may simply no longer be enough demand to sustain the number of firms that were competing in the market pre-pandemic. In this scenario, the only potential buyer for a firm in distress may be a rival that is already active in the sector, since it is only by consolidating their activities and economising on fixed costs that the businesses can avoid insolvency. In this situation, the competition authorities may be more inclined to conclude that a proposed merger between two rivals passes Test 2 (although they may still look to assess whether this was the only competitor that could have acquired the distressed business and, if not, whether a less anti-competitive pairing could be found).

The fact is that the post-pandemic prognosis for many sectors remains far from clear. While demand in the worst-affected sectors – such as the creative arts, entertainment, travel and accommodation – is likely to recover as the lockdown lifts, no one is sure whether it will return to pre-crisis levels and, if so, how long the recovery will take. The two scenarios described above may constitute two ends of a spectrum, with many sectors sitting somewhere between the two extremes.

This uncertainty may provide the competition authorities with a degree of discretion when considering where on this spectrum the firms they are investigating are located. And the evidence to date suggests that the CMA at least may be inclined to take an optimistic view of the economic outlook. A recent case in point is the CMA’s probe into the acquisition of StubHub by viagogo, which the CMA ruled in February 2021 would need to be partially unwound because it would give rise to a substantial lessening of competition. Both viagogo and StubHub operate online platforms for buying and selling tickets to live events such as music, sports and theatre, a sector which has been all but shut down by the pandemic. In its decision on the deal, the CMA acknowledged that the crisis had “had a significant adverse impact” on revenue generation in the ticketing industry, but it said the “outlook for live events is now markedly improved, given the emergence of effective vaccines to Coronavirus” and expressed confidence that “live events will return to scale in due course”. It concluded that in the absence of the merger with viagogo, StubHub would likely have been acquired by an alternative purchaser that did not compete so closely with it; consequently, it added, “the pre-Merger conditions of competition provide an appropriate proxy for the competitive dynamics and structure of the secondary ticketing industry in the absence of the Merger.”

The CMA’s ruling casts a shadow over the prospects of mergers in other troubled fields, since it is hard to think of a sector that has been harder hit by the pandemic than the live events industry. The implications would seem to be that:

- The CMA’s working assumption will be that even sectors that have been badly disrupted by the pandemic will eventually recover (over some unspecified time period);

- This means that firms that are active in such sectors should be able to survive as standalone businesses and/or source support from a third-party investor or purchaser to see them through; and

- When assessing mergers between competitors in these sectors, the CMA will therefore assume that, in the absence of the proposed tie-up, both firms will survive and competition in the sector will continue much as it did before the pandemic.

The future’s bright…?

As things stand, substantiating Test 2 looks set to present a significant challenge for many firms, irrespective of the reality of their situation. Competition authorities should provide more clarity on whether the upbeat assumptions about the prospects of economic recovery that informed the CMA’s thinking on viagogo/StubHub will apply to all sectors. For example, would a similarly rosy outlook be realistic for a merger between two bricks-and-mortar retail groups that were struggling to cope with the trend towards online shopping even before the pandemic shuttered their stores? And even if demand for the services in question may recover over the very long term, is it reasonable to assume that anyone other than a trade buyer (i.e. a competitor that is already active in the market) could be persuaded to invest if the strength and speed of this recovery is unknown?

Competition watchdogs are right to favour analytical rigour when assessing failing firm claims, but in a world of uncertainty they need to tread a careful middle path that balances the risk of committing a Type 1 error (blocking a deal that should be permitted) and a Type 2 error (permitting a deal that should be blocked). If the authorities focus too heavily on minimising the risk of a Type 2 error, then they will increase the risk of a Type 1 event – a merger prohibition decision that is swiftly followed by the disorderly collapse of one of the firms – which would be a bad outcome for all concerned.