The end of the market as we know it?

Gas and other energy prices in Europe and globally are skyrocketing lately.

There is no one key trigger causing this mess. We rather observe a ‘perfect storm’ of steadily declining European gas supply, further impaired by supply shocks around the globe, meeting on a post-Covid-related boom in gas demand particularly in Asia, while European gas storage levels which could normally provide a buffer are at record lows after a cold previous winter and a hesitation to fill them over summer.

Implications are manifold: Consumers facing high prices, energy suppliers going bust particularly in the UK, and calls for policy actions to protect customers, rescue suppliers, measures to guarantee supply security and so forth. And some countries are already responding: France is freezing consumer prices and Spain is taxing ‘windfall profits’ to release consumers.

These measures, however, need very careful design, as otherwise they could exacerbate problems and pose risks to the success of the energy transition going forward.

Governments across Europe are scrambling to contain the political and economic fallout of a dizzying rise in natural gas prices to record highs. On top of any remedial short-term measures, policymakers, retailers and consumers need to think hard about preparing better for similar surges in future. In this article we discuss causes and implications of the current gas price turmoil.

Gas prices in Europe and globally are skyrocketing

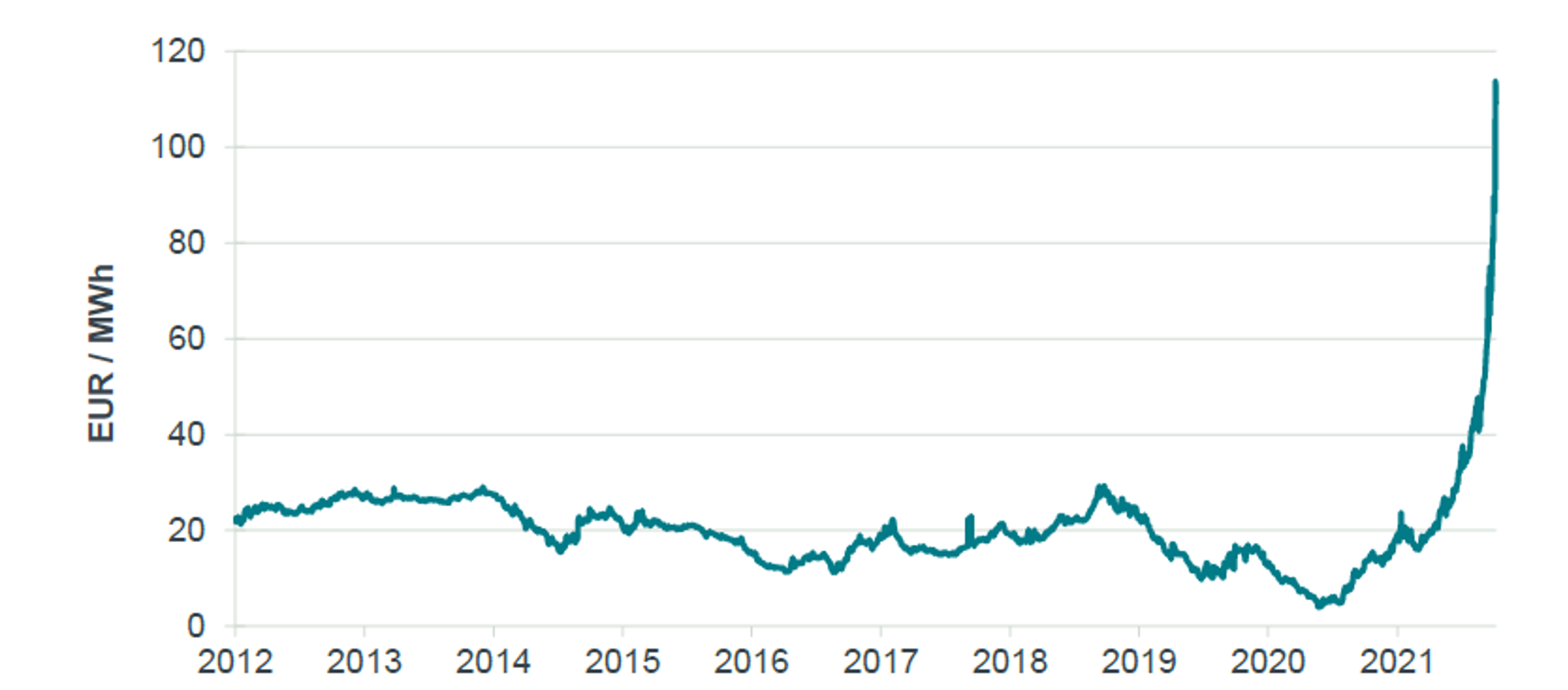

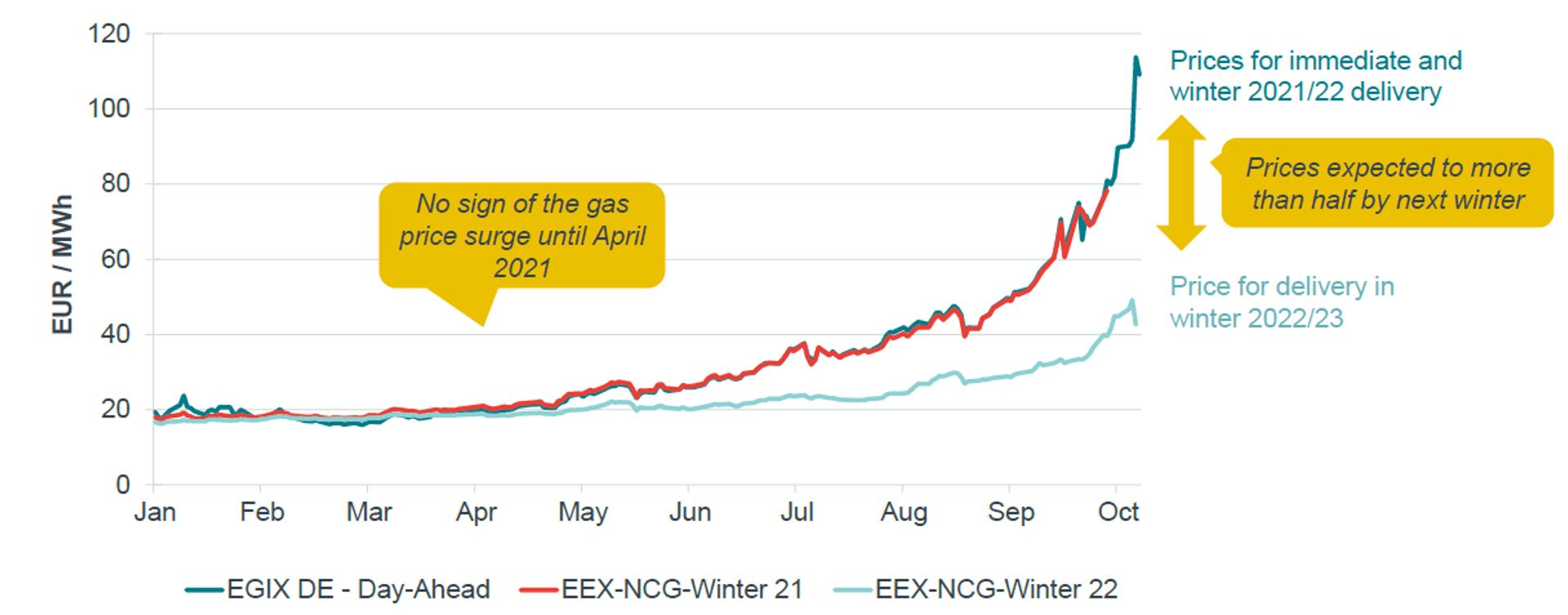

Of course, it’s impossible to know whether prices will spike again as violently as they have in recent months. But that’s the point: all commodity markets are inherently volatile, to an extent unpredictable – and imperfect. As recently as April, the gas market was giving no sign of an impending crunch. Wholesale prices globally and in Europe had been relatively stable for a decade. And then suddenly they took off. In Germany, equivalent to other European countries, the price has soared from levels below 5€/MWh in June 2020 to 110€ in early October 2021.

Figure 1: German day-ahead gas price index EGIX (7 October 2021)

Source: Frontier Economics based on Energate data

Price increases on such a scale and at such speed have the potential to abruptly raise the cost of living for hundreds of millions of people. That’s bound to set alarm bells ringing, especially when market players are aware of the additional pressures another cold winter that could bring, potentially further driving up keep prices. No wonder governments are flailing for solutions. If the price squeeze had a single clear cause, it would be simple to identify solutions. But, frustratingly, it is the result of a range of factors.

Supply shock meets boom in demand

On the supply side, a steady decline in gas output in the EU and the UK has been accelerated by the premature phase-out of the important Groningen gas field in the Netherlands because of security concerns through earthquakes. Production is also on a falling trend in Norway, the leading European supplier, while temporary production and transport outages in the North Sea, Russia and Australia have further reduced supplies.

On the demand side, the post-Covid economic revival has whetted global appetites for gas, notably in China, which has imported record volumes of liquefied natural gas (LNG). As Europe functions as the swing or balancing market for LNG, the diversion of supplies to China and other Asian economies has left the continent – and the UK – with less. Another choke point.

The impact of this supply-demand imbalance could have been cushioned if Europe had had more gas in reserve. But stocks in storage have fallen to historically low levels after cold temperatures last winter stoked demand for home heating. Some critics blame Gazprom, the largest supplier of natural gas to Europe, for not increasing gas supplies via the Belarus and Ukrainian transit route and for exacerbating the storage problem by failing to top up its tanks. The big Rehden underground storage in Germany, for example, operated by Gazprom daughter Astora, is less than 10% full in late summer, filled much lower than in previous years.

Even if some of these short-term pressures ease, as for example just happened by Vladimir Putin’s offer to increase gas supply to Europe on Wednesday, 6 October, the price surge has exposed Europe’s growing dependence on imported gas. Given the imperative of decarbonisation, demand for less carbon-intensive natural gas is likely to grow as the urgency to replace oil and coal increases the attractiveness of gas as a bridging fuel to renewables. This prospect further underscores the need to explore measures to mitigate supply shocks.

A nudge to consumers to go green?

In many European countries, consumers are on fixed tariffs and so are protected in the short term. But they stand to be affected if retailers go bust, as 11 have recently in the UK for example, and/or if sky-high wholesale prices are passed through in later tariff adjustments. Big price rises have been announced in Ireland, while in Germany 13% of retailers have already raised prices for 2022 by around 10%.

For those whose tariffs are indexed to wholesale prices, the impact has been immediate. In Spain, retail bills jumped 35% in the 12 months to August.

What can be done? Beyond keeping a close eye on the market and possibly switching suppliers, the price shock is an incentive for consumers to invest in energy conservation, for example home insulation, and to seriously consider switching to renewable energy sources.

Are retailers sufficiently hedged?

For gas retailers, hedging is critical. A golden rule is to hedge sales with back-to-back purchases of the same volumes. This should be particularly self-evident when selling to fixed-tariff consumers. But it appears that many retailers failed to do so, particularly in the UK, where a dozen retailers have gone bust even before the onset of winter and peak demand.

A harsh winter poses a danger even to those retailers that have carefully hedged their positions. If temperatures plummet more than in a typical winter and households need to turn up the heating more than previously forecast, retailers will have to buy more gas in an already tight market, pushing prices even higher. To counter that threat, retailers may have to make use of additional hedging instruments. They also need to have a sound risk management system in place. Such arrangements, designed to monitor and limit earnings at risk, will trigger the right defensive actions at the right time.

Policy action needed?

Regulators and national policymakers need to consider how to protect retail customers from unreasonable price rises while ensuring that retailers are neither driven out of business through no fault of their own nor necessarily kept alive if they have failed to hedge properly while competitors have made thorough provisions.

Some governments have rushed to the defence of consumers. France has frozen gas tariffs until April 2022 (after a 13% increase) while Spain has imposed a €3 billion windfall tax on energy companies, the proceeds of which will be used to reduce household bills. Belgium seems to follow that example.

Such interventions may make good political sense in the short term but, unless they are carefully designed, they risk punishing well-managed companies.

Take Spain’s windfall tax on profits. The levy will apply to electricity generators such as nuclear operators that may benefit from high electricity tariffs (which have increased due to the surge in gas prices) but do not bear the costs of expensive gas.

The measure may look fair at first glance, but it risks playing havoc with market forces. What about nuclear power generators that sold their electricity at low tariffs under long-term contracts and are now being taxed? Are they being penalised for other market players not hedging their gas sales position? Once investors have had their trust undermined by the windfall tax, will they be willing to pour fresh money into Spain, including into renewables?

More broadly, knee-jerk intervention risks punishing retailers that have prepared prudently for a price crisis like the one now. If they see companies that are badly managed being bailed out, they will have less incentive to invest in careful procurement and prudent hedging, increasing the possibility of new crises down the road.

EU policymakers are an important part of the debate over energy security. France and Spain are seeking sweeping changes to the EU’s energy market rules and are advocating a European strategic gas reserve.

Brussels is preparing an energy policy package to be unveiled in December, including options for greater energy storage and the bloc’s role in the common procurement of natural gas. But EU Economics Commissioner Paolo Gentiloni said Brussels wanted to ensure that that national policy responses, for example subsidies, were temporary and respected EU rules for the single market and state aid.

Conclusion

The word crisis is overused. But when the price of something as essential as natural gas shoots up more than five- fold in six months, the word is appropriate. Prices are still rising fast, so it is too early to draw definitive economic and political conclusions. But it is not too early to see the episode as a reminder of the dynamics and potential volatility of markets. Back in spring, futures prices gave no hint of the storm that was about to break. Those same markets are now pointing to prices staying high over the winter before falling back to around €40/MWh, or half of current levels. But who can know? Years of comparable price stability have given way to much greater uncertainty. Everyone in the gas market, from regulators to retailers to hard-pressed households, needs to adapt to radically changed circumstances.

Figure 2: German wholesale gas prices for different delivery periods

Source: Frontier Economics based on Energate & EEX. Forward for delivery in winter 2021/2022 not traded beyond 30 September (i.e. start of the winter period). Day-Ahead prices are based on EGIX Germany rates until 30 September, and, after integration of German gas market areas NCG and Gaspool to Trading Hub Europe (THE), on THE OTC rates.