How does it affect costs and revenues?

On 14th July 2021, the European Commission adopted a package of proposed measures to reach the new climate protection target of reducing net greenhouse gas emissions by at least 55 % in 2030 compared to 1990. The target was agreed under the European Green Deal (see also: Meeting the EU’s 2030 climate and energy goals). The proposals adopted by the Commission on 14th July are currently open for consultation until 28th October, 2021.

The package includes a number of proposals for regulations and initiatives that impact the economic viability of green hydrogen and its derivatives. This article summarises the main impact of the ‘Fit for 55’ package on the business case of green hydrogen derivates in the transport sector, so called Renewable Fuels of Non-Biological Origin (RFNBOs), Power-to-Liquids (PtL) or E-Fuels.

In the following, we explain:

- how the regulatory framework affects costs and revenues of RFNBOs in the transport sector; and

- what the main impact of the ‘Fit for 55’ package on costs and revenues of RNFBOs is likely to be.

Costs and revenues of RFNBOS are substantially driven by the regulatory framework

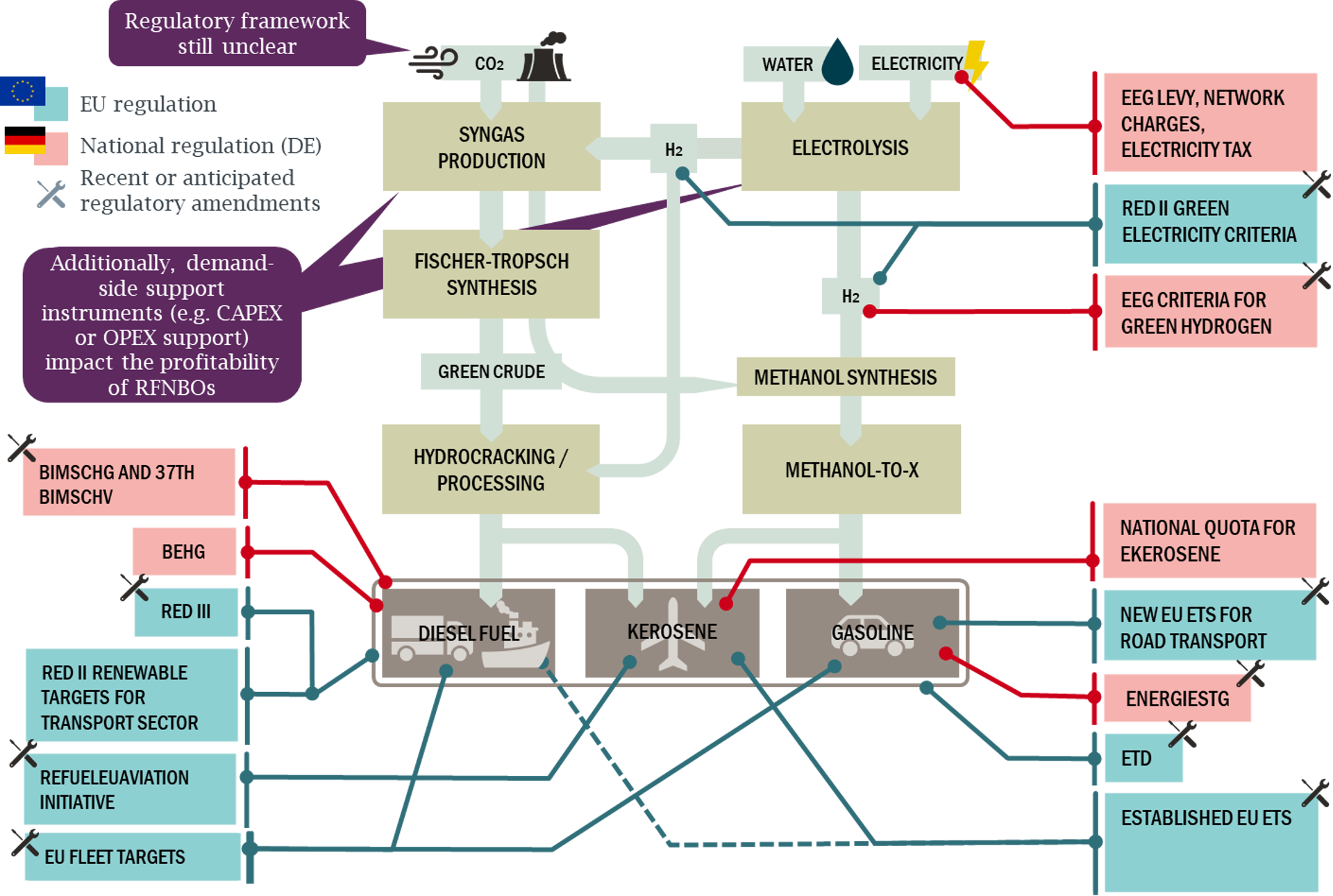

The regulatory framework affects both costs and revenues of RFNBOs:

- On the cost-side, regulation especially has an influence on the costs of renewable electricity used for the production of green hydrogen. The way, the green electricity criteria are defined (i.e. how the criteria of “additionality”, “temporal correlation“ and “geographic correlation”, set out in the Renewable Energy Directive (RED) II, will be defined in the Delegated Act this year), has a substantial impact on the costs of green hydrogen, as Frontier Economics has recently shown (see also: RED II green electricity criteria). In addition, the costs of renewable electricity used for hydrogen production, depend e.g. on whether or not it benefits from exemptions from state-induced price components (such as the EEG levy in Germany).

- On the revenue side, a number of regulations either affect the price level of conventional “grey” fuels, which is a lower bound for the revenues, the green products can obtain (e.g. the EU ETS system), or stimulate demand for green fuels e.g. by setting quotas for the green products. These measures can create a substantial “green value” of the fuels beyond the prices of the conventional fuels.

As the Figure below indicates, many of these regulations are currently under review (e.g. as part of ‘Fit for 55’ package).

Costs and revenues of RFNBOS is affected by 'Fit for 55'

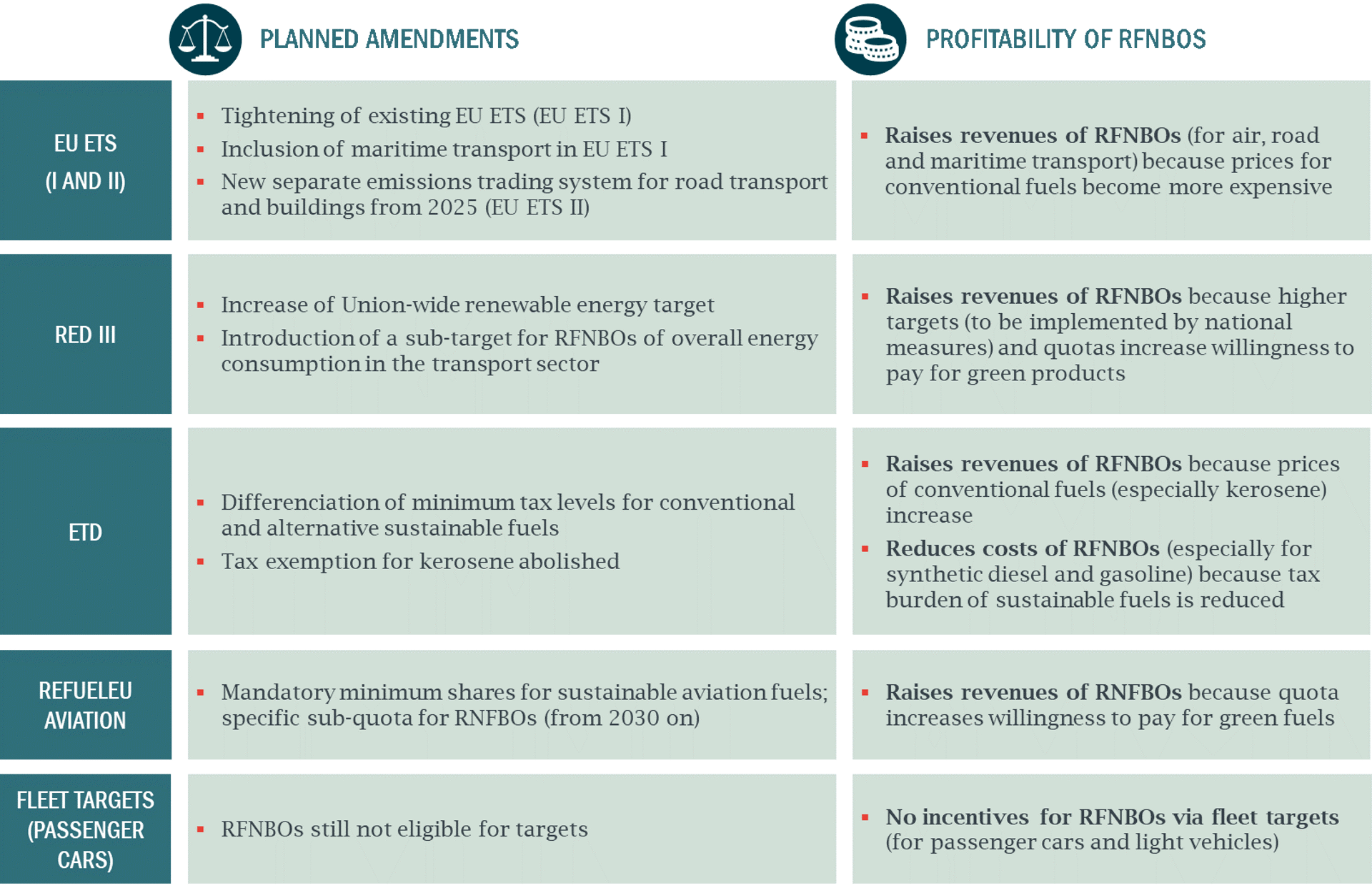

The ‘Fit for 55’ package includes several regulatory initiatives with impact on costs and/or revenues of RFNBOs in the transport sector:

- Revision of the current EU ETS (“EU ETS I”)– The proposed tightening of the emission reduction targets in the existing EU ETS and the inclusion of the maritime sector into the EU ETS will lead to increasing costs for conventional “grey” fuels in the aviation and maritime sectors and thus to an increase of the minimum revenues, green fuels can obtain in these areas of application.

- Establishing an emission trading system for road transport and buildings (“EU ETS II”) – The proposed emission trading system for road transport (and buildings) will increase the price of grey fuels in road transport and thus improve the business case for alterative green fuels.

- Amendment to the Renewable Energy Directive (RED) to implement the ambition of the new 2030 climate target – The amendment of the RED foresees (among other measures) the introduction of a specific target for RFNBOs in the transport sector. Principally, this should stimulate demand for RFNBOs and thus lead to an increase of revenues producers of RFNBOs can generate. Measures to reach the RFNBO-target in the transport sector need to be implemented by the Member States.

- Revision of the Energy Tax Directive – The proposed differentiation between taxes for grey and green fuels will be one component to improve the business case of RFNBOs, as the tax burden of the green products is reduced.

- Proposal regarding the “ReFuelEU Aviation/Maritime“-Initiatives – An obligatory quota for sustainable aviation fuels should be introduced from 2025 on. Until 2030, this quota can be entirely fulfilled by biofuels; from 2030 on, a sub-quota for RFNBOs is introduced. Principally, the introduction of such a quota stimulates demand and the willingness-to-pay for RFNBOs in aviation. However, details – such as regarding the level of a penalty payment – are still unclear.

- Revision of the Regulation setting CO₂ emission performance standards for new passenger cars and for new light commercial vehicles – Fleet targets for new passenger cars and new light commercial vehicles are foreseen to be tightened. According to the Commissions’ proposal, alternative fuels (such as RFNBOs) will remain unaccountable to these targets.

Thus, any vehicle with combustion engine will continue to be treated as polluting (within the fleet targets), even when it is in fact running on carbon neutral fuel. In 2020, Frontier Economics prepared a design proposal on behalf of The Federal Ministry of Economics and Energy (BMWi) for taking renewable fuels in EU fleet targets into account (see also: Accounting for renewable fuels in EU fleet targets – One path to lower CO2 emissions). Unfortunately, this proposal has not been considered in the Commission’s proposal.

Conclusion

In summary, many regulatory changes proposed under the ‘Fit for 55’ package – with exception of the revision of the fleet target regulation - will principally lead to an increase in revenues for RFNBOs compared to the status quo. By what extent revenues increase and whether these revenues are sufficient to cover costs of RFNBO production needs to be analysed in depth.

Frontier Economics regularly carries out business case analyses in the field of hydrogen and Power-to-X / Power-to-Liquids.