Revisions to the EC's state aid guidelines must strike a careful balance in order to be effective

The European Commission has announced significant funding which could be used to ensure equality of broadband connectivity across the continent – at higher speeds than ever before.

And, for the first time, the Commission is considering opening this type of funding to mobile networks. But proposed projects will likely need to pass a number of checks in order to get the green light. In this article, we examine the Commission’s proposals and their implications for subsidised network roll-out and expansion.

Europe is facing a digital divide

Digital infrastructure has been recognised as having an important part to play in supporting Member States in the economic recovery from the COVID pandemic and in pursuing broader policy priorities. For example, the Commission has acknowledged the role of the digital sector in achieving its climate goals, noting that the “Union’s 2050 objective of climate neutrality … cannot be reached without a fundamental digital transformation of society”.

The Commission has set challenging roll-out targets for telecoms networks to hit by 2030 under its Digital Decade vision:

-

100% household coverage of Gigabit networks

-

100% populated area coverage of 5G networks

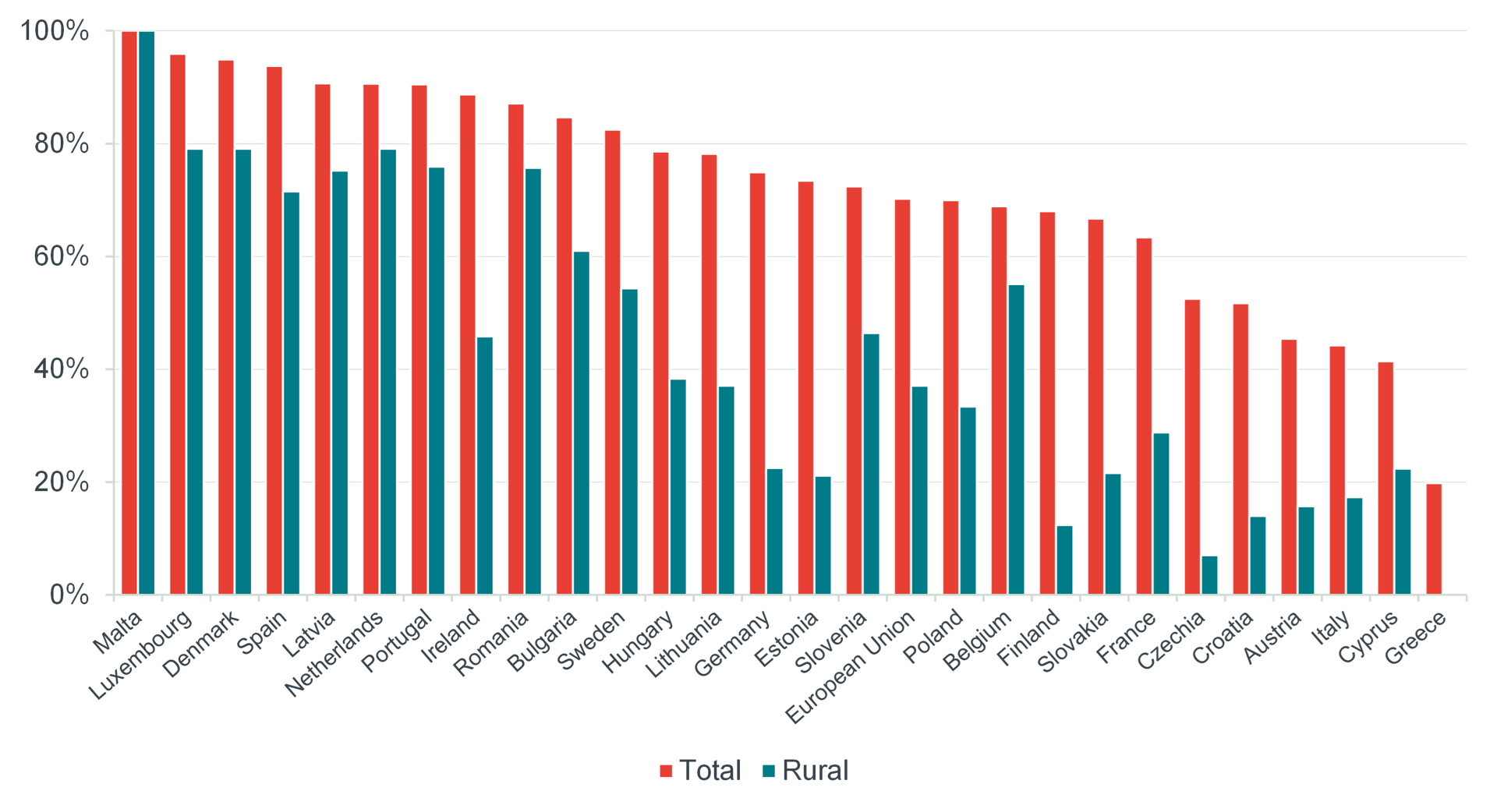

However, the risks inherent in the deployment of new technologies mean that these targets will not be met by private investment alone. For example, data on household coverage of Gigabit fixed networks in Europe shows that coverage of rural areas trails significantly behind urban coverage. The Commission has recognised this disparity, noting in relation to unequal connectivity outcomes that “well-targeted State intervention in the broadband field can contribute to reducing the digital divide”.

Figure 1 Fixed Gigabit coverage (% of households), 2021

Source: Frontier Economics, based on Eurostat

Put simply, the Commission wants to see high-quality fixed and mobile networks for everyone, everywhere. But who will pay – and where are the incentives?

Show me the money

At the heart of NextGenerationEU – the EU’s post-COVID recovery plan – is the Commission’s Recovery and Resilience Facility (RRF). To access the €700bn of grants and loans available, Member States must submit national recovery plans setting out their proposals, with a focus on supporting digital and climate initiatives. At the time of writing, the Commission had approved recovery plans for 22 Member States. Focusing on the digital side, the plans must demonstrate an allocation of at least 20% to “the digital transition or to the challenges resulting therefrom” (see Article 18, paragraph 4(f) of this EU regulation, which clearly defines investment in telecoms networks to be within this scope) in order to qualify for the funding. Economic think-tank Breugel has collated data on Member States’ recovery plans and estimates that they have earmarked around €34bn for broadband roll-out.

Terms and conditions apply

The RRF represents huge firepower for Member States to subsidise investments in broadband networks needed to narrow the digital divide. However, a fundamental principle of the EC is the need to ensure any state aid does not undermine the single market. In particular:

-

That subsidies do not crowd out private investment;

-

That the subsidies are consistent with the policy goals to narrow the digital divide; and

-

That the state aid does not distort competition.

There is an existing block exemption for investments in broadband networks along with supporting guidelines. These set out the characteristics of state aid broadband programmes which are deemed consistent with the EU Treaty without being notified to the Commission on a case-by-case basis.

However, the current block exemptions and guidelines came into force almost a decade ago, in 2014 and 2013 respectively. The Commission conducted an evaluation in 2021 to assess whether the guidelines were still fit for purpose. It found that, although the overall framework remains suitable, the guidelines should be updated to reflect technological developments and revisions to the Commission’s policy objectives. The Commission has also proposed a number of changes aimed at improving the clarity of its guidelines. As such, the Commission is now consulting on a set of revised guidelines.

Moving the goalposts

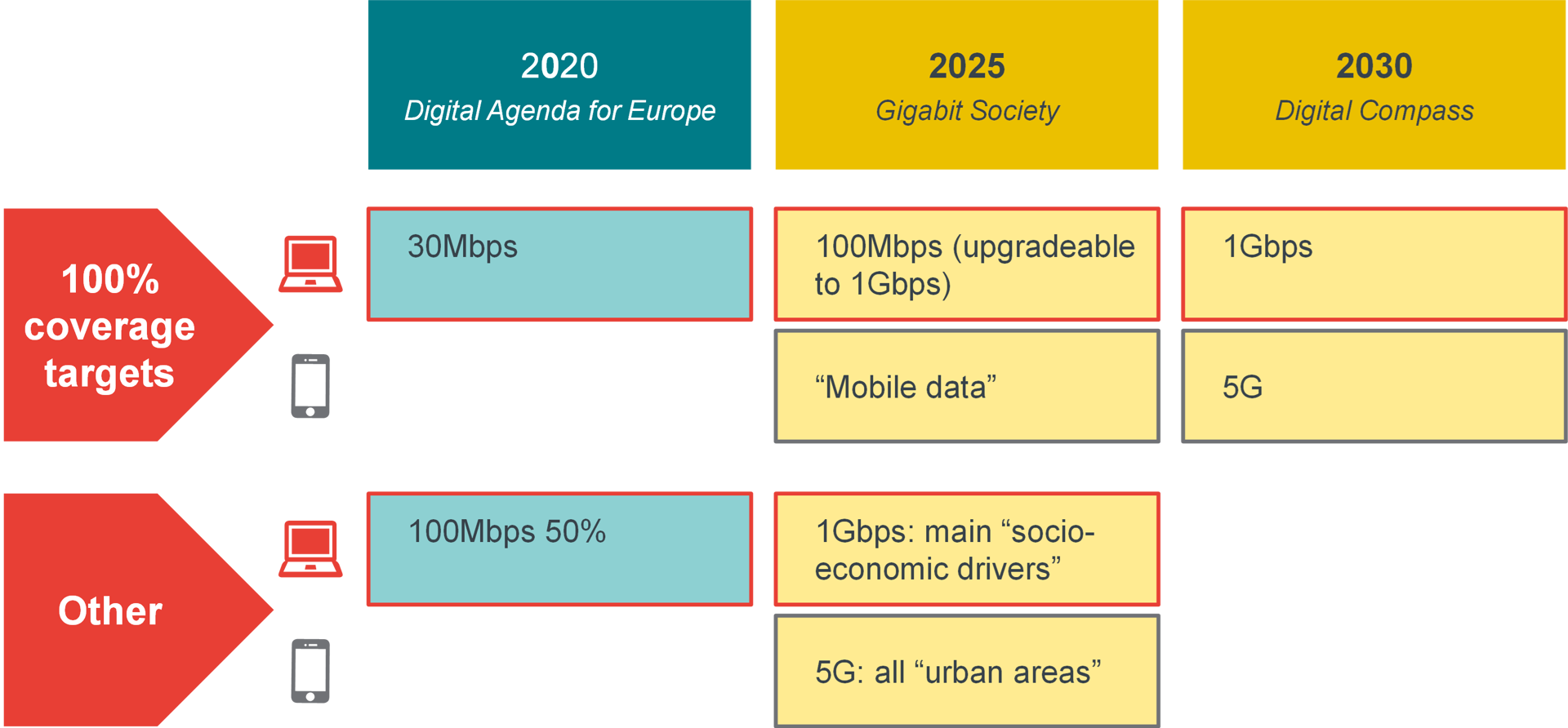

The review of the block exemptions and state aid guidelines has been motivated by the need to keep pace with developing policy. When the current instruments were developed, EU-wide fixed broadband coverage targets under the Digital Agenda for Europe stretched to a mere 30Mbps and there were no mobile targets in place (see below). Looking forward, the Gigabit Society and Digital Compass initiatives mark out an ambitious path to ubiquitous Gigabit and 5G mobile coverage. The potential increase in funding available under the RRF must be seen in the context of the step change in investment needed to meet the Digital Compass targets.

Figure 2 EU connectivity targets have evolved significantly

Source: Frontier Economics

Recognising that the current guidelines are inappropriate for the targets Member States now face, the Commission has proposed a number of key changes:

-

Introduction of a block exemption for mobile networks

At present, the block exemptions relate to fixed broadband only, on the assumption that private investment and instruments such as coverage requirements attached to mobile licences are generally sufficient. Any state aid for mobile networks therefore needs to be assessed on a case-by-case basis. But the key role of mobile networks in achieving the Commission’s current targets – and its acknowledgement that the targets are unlikely to be reached without intervention – suggests that more specific guidelines are warranted.

-

More specific guidelines for demand-side measures

The evaluation recognises that fully ending the digital divide requires not only network coverage but also take-up of services, which may require some stimulation of demand. The Commission has cited affordability as a key take-up barrier, particularly in rural areas where incomes are, on average, lower. Measures to address affordability, such as voucher schemes for certain groups, may be a feature of new subsidy programmes.

-

Changes to speed thresholds of existing broadband networks, and a step change required by funded networks

The current guidelines effectively permit the funding of broadband roll-out in areas which do not have – and will not soon have – a 30 Mbps service. Subsidies currently allow for the funding of networks which only just meet this threshold (albeit with some ‘future proofing’ required to ensure such networks can be upgraded in future). As the 2030 connectivity targets require 100% Gigabit coverage, the eligibility criteria and requirements for funding networks will need to reflect this much higher threshold, potentially leading to much greater subsidy needs.

Until the consultation process has concluded, the exact detail of these changes remains unclear.

So, where are we heading?

The Commission has already approved some specific interventions under the RRF, including €2bn for 100Mbps fixed broadband infrastructure in Austria and a further €2bn for 5G deployment in Italy. In both case the schemes fell outside the current block exemptions and were hence assessed individually. However, the approval of the Austrian scheme – which concluded just weeks after the end of the state aid consultation period – reflected “the 2013 Broadband Guidelines, taking into account, where justified, adjustments needed to reflect technological and market developments”.

The new block exemptions and guidelines are expected to be published later in 2022, following some delays. How will the Commission balance the effectiveness of the measures and the timely provision of funding with the need to achieve good value for public money and avoid competitive distortions?

This is an important issue for a wide range of affected stakeholders. In addition to its own views, the Commission will have to consider more than 80 submissions from Member States, operators and industry bodies in the consultation process.

If the Commission strikes the right balance, its Digital Decade ambitions may be within reach.