The increasing adoption of hydrogen and its derivatives (green ammonia, kerosene, methanol, diesel etc.) will play a key role in achieving ambitious climate protection targets in vital sectors like aviation, maritime, and heavy industry that are notably difficult to electrify.

Fundamental conversion technologies like Power-to-X (PtX) will be used to produce green hydrogen, which is made entirely from renewable sources of electricity. As demand grows, the international trade in PtX-products (and derivatives) will help to facilitate cost efficiencies as the market continues to scale. This is recognised by the German government in its National Hydrogen Strategy, where it states that the future demand for PtX cannot be met without imports because of the limited potential for electricity from renewable energy sources (RES-E) within the country. North-Africa, on the contrary, has vast potential for low-cost RES-E production and could benefit from building up a viable PtX exporting industry.

In view of this, the German Federal Ministry for Economic Cooperation and Development (BMZ) commissioned Frontier Economics to carry out a business case analysis for investments in PtX-plants in North Africa that are built for the purpose of exports to Germany. The study focusses on transport and heavy industry sectors that are either unable or not easily electrified. Within a cash-flow model, we have analysed the costs and revenues of green hydrogen, green ammonia, green methanol, green kerosene and green marine fuel. The calculations are performed for different cost-side and revenue-side assumptions, timings of the investment from 2025 to 2030, scaling of the plants, and further considerations, for instance, the carbon source for the production of power-to-liquids.

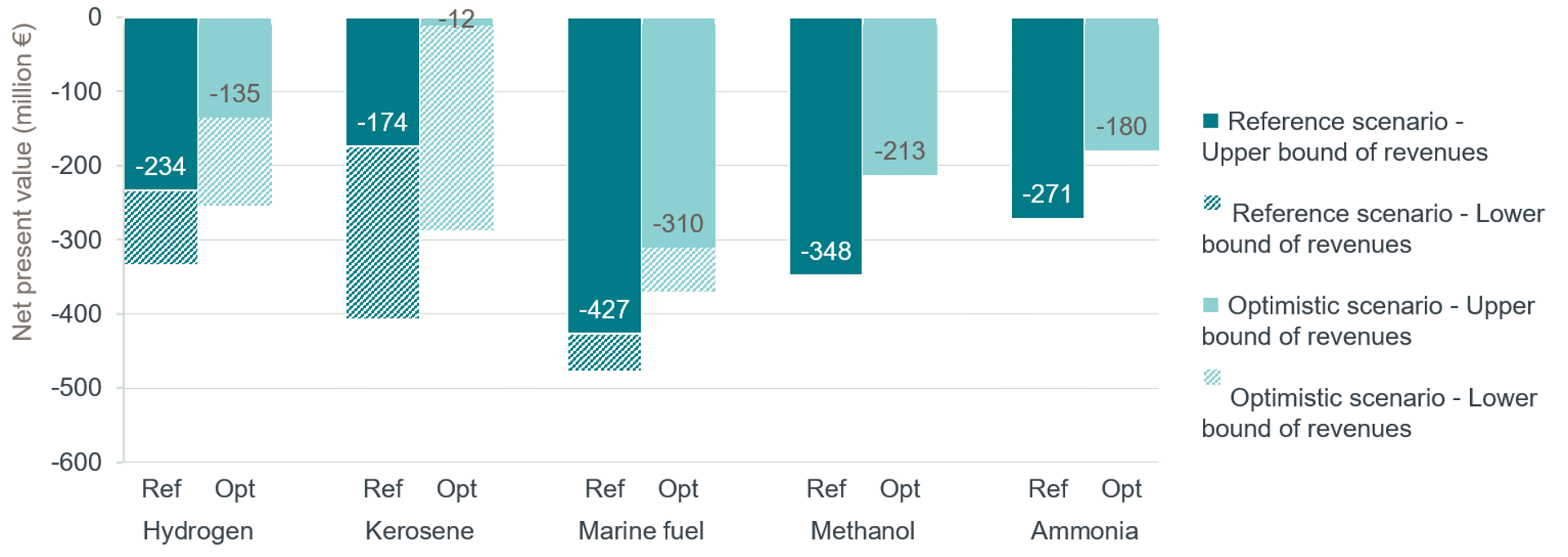

The study concluded that investments in PtX plants in North Africa for exports to Germany will probably not be able to finance themselves entirely in this decade without additional financial incentives. In addition, the economic viability of green hydrogen products is strongly driven by the future prices of the alternative fossil fuels, the production and transport costs and especially by a willingness to pay for the apparent “green value” of PtX products. The higher the willingness to pay for the green value, the more favourable the economic viability of the PtX products, see Figure 1.

Figure 1: Net present value of hydrogen and PtX products

Source: Frontier Economics

Notes: Plant with 100 MW electrolysis capacity and lifetime of 25 years. Investment in 2025.

It can be expected that with the implementation of further political measures following the Fit-for-55 package of the EU, the economic viability of respective PtX projects will improve further significantly.

Frontier regularly advises on investment projects for renewable energies.

For more information, please get in touch on media@frontier-economics.com or give us a call at +44 (0) 20 7031 7000.