CCUS is expected to be a vital part of the least-cost net-zero energy system of the future.

CCUS describes the process whereby carbon dioxide emissions are captured and then permanently stored underground. Capturing and storing carbon in this way can help mitigate emissions from heavy industry and other hard-to-abate sectors. CCUS can also facilitate low-carbon hydrogen production, which in turn can help abatement of emissions, particularly in industry and transport and through long-duration energy storage. It can also enable direct air capture, whereby CO2 is extracted directly from the air, to counteract emissions that cannot be abated directly.

The industry is at an early stage, with around 30 plants in operation globally in 2022. The US has invested in the most plants, with Norway leading the way in Europe.

The challenge is now to scale up CCUS to the levels required to meet climate targets.

There are several risks and barriers associated with this scaling up that mean government intervention is likely to be required.

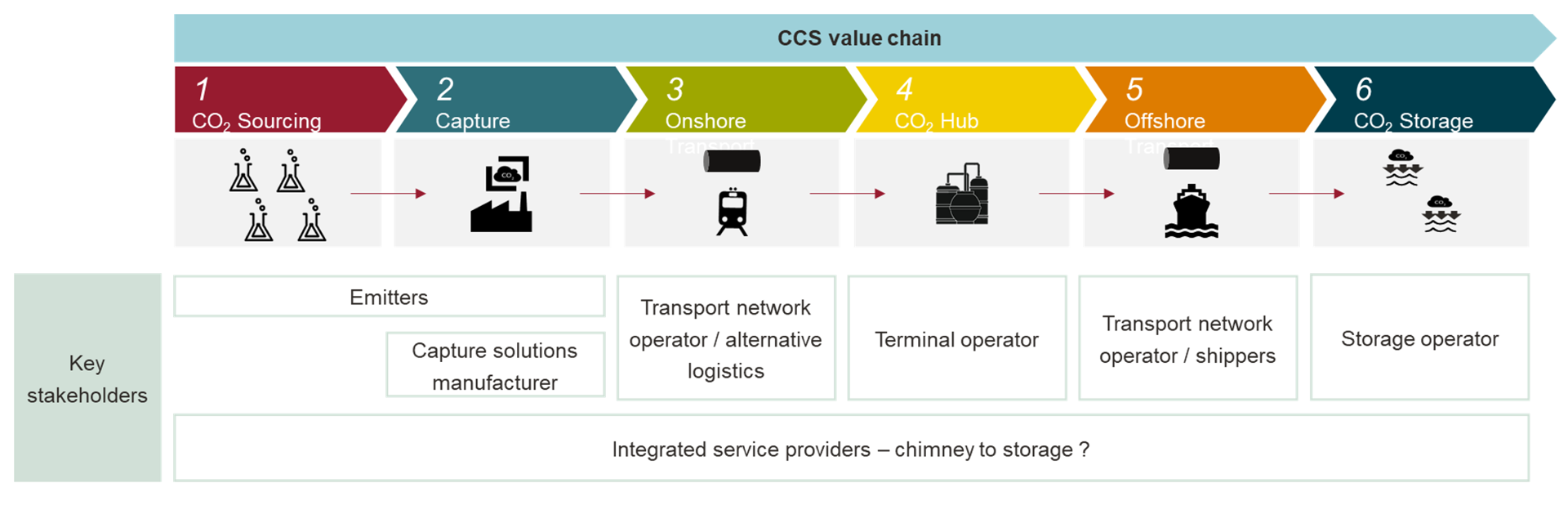

- Coordination requirements across the CCUS value chain (often referred to as “cross chain risk”). Investments are needed in technologies to capture the emissions (usually on the emitter’s site) and to compress or liquify them; pipelines or ships to transport the emissions; and large-scale underground geological storage. Emitters cannot invest in and operate capture technologies until the rest of the infrastructure is in place. At the same time, investors in capital-intensive pipelines and storage facilities require revenue from users of the system to make a return on their investments. Efficient coordination of different stakeholders is thus critical to deploying CCUS extensively and minimising cross-chain risks such as volume uncertainty and timing mismatch.

- Higher costs for early investments, alongside learning spillovers. In most European countries, CCUS has not been deployed at scale. There are likely to be valuable lessons to be learned from the first investments, but, equally, these investments may have higher costs than competing high-carbon alternatives. This could be the case even when the effect of carbon-pricing schemes (such as the EU’s and the UK’s emission trading schemes) and future impacts from the Carbon Border Adjustment Mechanism are taken into account. This means that support mechanisms may be required.

- High capital intensity and economies of scale in pipeline and storage. It may be efficient for some of the pipeline and storage infrastructure to be oversized initially as the industry ramps up. Given economies of scale, it may also be efficient to have only one pipeline system in operation in each locality. This means support for these investments, and in some cases regulation to protect against market power, may be required.

- Risk allocation. It will also be important to allocate responsibility for high-impact, low-probability risks, such as CO2 leakage, in a way that incentivises efficient investment and risk management, particularly in the period when commercial insurance is less readily available. CCS infrastructure will also have to be decommissioned at the end of the asset’s lifetime, so a transparent decommissioning regime to allocate responsibility and ensure sufficient funding may also be needed.

To respond to these challenges, governments across Europe have introduced a range of policies. For example:

- In Norway, direct funding is helping to bridge the gap. For example, the government is covering two-thirds of costs of the first ten years of the Longship project.

- In the UK, the government has opted for a cluster-based approach which can solve some coordination problems and share risks across the user base. The government is in the final stage of negotiating with two clusters over the details of a regulated asset base (RAB) model that will provide the T&S system operator with an economic regulatory licence, revenue support via a set of risk mitigation measures and protection against high-risk, low-probability outcomes. The government support has been designed as a package where the T&S fees that the system operator receives are paid for by the initial users according to the terms of their respective business models. Negotiations are also ongoing over the capital and revenue aid that will be provided to these first users of the network: a dispatchable power agreement (DPA) to support power generation with CCS; an industrial carbon capture business model to incentivise the deployment of CCS by industrial users; and a hydrogen production business model.

- The French government is consulting on plans to support the cost of capture, storage and transport paid for by industrial companies via carbon contracts for differences, with the first call to be launched in H1 2024. Cost-sharing mechanisms to protect T&S infrastructure operators from volume risks are also envisaged (for example, if industrials are not ready on time but the infrastructure to transport/store CO2 is already built). The government is also considering regulating the transport network. This could serve as protection for both the investor (by creating some certainty about the remuneration stream) and the consumer (by ensuring detrimental market power cannot be exerted).

- Policy is at an earlier stage in Germany. The development of a national Carbon Management Strategy is currently underway, driven by a strong push from industry and T&S companies that are already starting to shape the German CCUS market. The German government has recognised that CCS will have to play a role to decarbonise certain industrial processes with unavoidable CO2-emissions. The Carbon Management Strategy will identify such unavoidable emissions and advise on the economic and regulatory framework for the rollout of CCUS in Germany. Promisingly, the recently launched Klimaschutzverträge CCfD-scheme designed to decarbonise industry already recognises the potential for CO2-emissions savings through CCUS.

The diversity of approaches across Europe shows that, to date, a consensus on the right set of policy instruments has not yet emerged. This is partly because the choice of instrument will depend on geography and sector characteristics in a given economy. It also took time for a policy consensus on renewable electricity support to emerge in the last decade. However, clear and stable government policies in the next few years will be crucial if CCUS is to play its expected role in the transition to net zero.