A big increase in EV take-up is required to meet the UK’s 2050 net zero carbon emissions target

There is broad consensus that a switch to low-carbon vehicles will be a critical part of the strategy to tackle climate change. In 2019, the government set a legally binding target requiring the UK to bring greenhouse gas emissions to net zero by 2050. According to the Committee on Climate Change, the government’s official advisory body, this means that all new cars and vans will need to be ultra-low-emission vehicles by 2035 at the very latest, and preferably by 2030. But last year sales of electric vehicles (EVs) made up only around 2% of the market. The share of low-emission alternatives (e.g. hydrogen) was even punier. A major effort therefore needs to be made this decade to accelerate the transition from conventionally fuelled vehicles.

Lack of public charging infrastructure a barrier to EV ownership

Low provision of public charging infrastructure in the UK is widely seen as one of the main barriers to growth of the domestic EV market. Drivers are understandably concerned about battery capacity and the availability of conveniently located charging points (known as range anxiety). More than one-third of households in England do not have access to off-street parking and so will need to rely on public chargers if they are to switch to EVs.

Policies to encourage charge point investment are in place

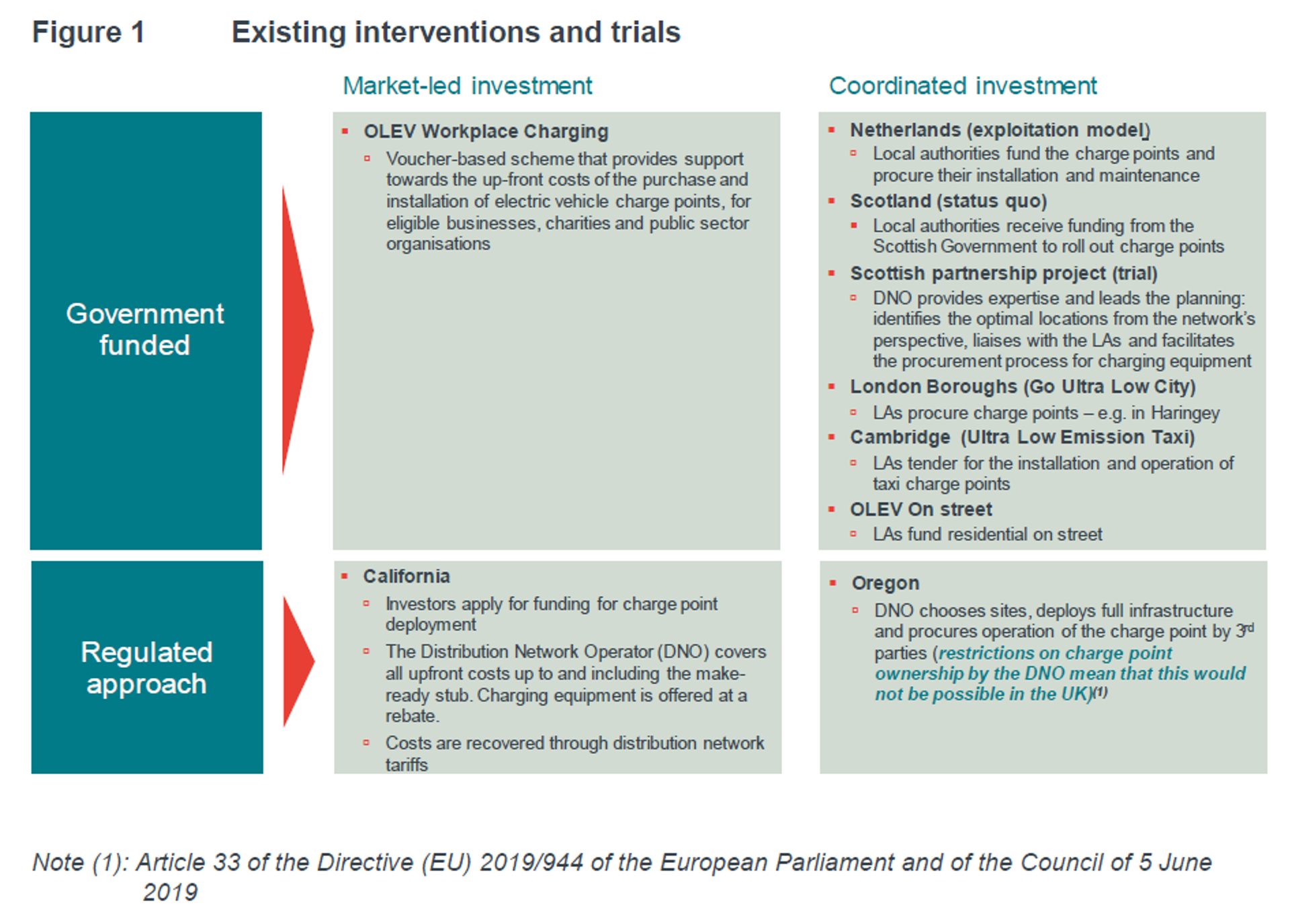

Various policy interventions are being trialled in the UK and internationally to speed the rollout of public charging infrastructure (Figure 1). These are generally aimed at reducing the upfront costs of charge points for investors. Funding comes from taxation or in California and Oregon, through customer bills via regulation.

The market failures directly associated with replacing petrol and diesel vehicles with EVs are well understood. These include positive externalities from reductions in emissions affecting air quality (and therefore human health) as well as reductions in greenhouse gases, which affect climate change. Various policies are in place that aim to tackle these market failures, including Low Emission Zones and grants for plug-in electric vehicles.

But there is also a series of market and policy failures specifically associated with the charge points themselves that justify the interventions set out in Figure 1 We considered these recently as part of research commissioned by UK Power Networks.

Rationale for intervening in charge point investment

Our analysis suggests that there are several barriers to the market alone reaching an optimal outcome on charge point investment.

Investing in charge points can often involve high capital costs, including network reinforcement costs, sole-use connection assets and the charging infrastructure itself. Most of these costs are sunk.

In this context, our analysis suggests there are three sets of barriers preventing the market alone from achieving a level of investment in chargers that is optimal for society:

-

Market failures – network externalities.

-

Policy - uncertainty.

-

Regulatory – coordination and cost recovery.

We now consider each of these in more detail.

Network externalities

There is an interdependency between the market for EVs and investment in charging infrastructure. Currently the number of EVs on the road is small, so demand for charge points is limited. Low EV take-up renders some chargers unprofitable and/or makes potential developers hesitant to invest. At the same time, the paucity of charge points influences the decision whether to buy an EV.

The market failure arises because, at low levels of charge point coverage and EV penetration, early investors in charge points have a first mover disadvantage compared to those who enter later: low EV ownership rates cap their revenues. To be sure, their investment will tend to increase EV take-up and hence future charging demand, but these first movers cannot fully monetise that demand. This is because people who have been induced to buy an EV early on because they have access to one of the limited number of chargers can potentially use other charge points once the market matures. Since investors may not be able to capture adequate returns from the first installations, markets may provide less investment in charging infrastructure than is socially optimal.

Solving this chicken-and-egg problem will be crucial in order to enable the EV take-up required to meet climate targets.

Policy uncertainty

Policy uncertainty is also an issue. Although there is a clear, overarching 2050 target, comprehensive measures to make progress towards this goal in the near term are not place. In particular, there is some uncertainty over the speed at which transport should be electrified in the 2020s. A delay of a few years in EV take-up could make a substantial difference to the business case for investing in chargers. This uncertainty may in turn affect investment decisions.

In addition, policy uncertainty creates the risk that infrastructure today could be designed in a way that is not optimal from a long-term net zero perspective. For instance, charge points may not be designed with two-way charging capability given the lack of clarity about the future path of the electricity sector.

Regulatory barriers

There is also a need to examine regulatory barriers. There are significant economies of scale associated with reinforcing electricity networks. This means that a coordinated approach to development of the EV charging infrastructure could reduce charge point investment costs, for example by planning the rollout of charge points alongside network upgrades which would take place in any case. In addition, coordination of the provision of sole use assets could also reduce costs, for example by ensuring that works affecting roads are coordinated.

In an ideal world, network charges and other signals would give charge point investors the incentive to co-ordinate their actions in a way which minimises network costs. However, in reality such coordination is difficult to achieve, even where charges are very well designed. This could lead to higher costs for investors and, as a result, to investment that is sub-optimal for society. It could also lead to higher costs for consumers.

A further complication arises from the need for network charges to recover sunk costs as well as to reflect ongoing marginal costs. To the extent that these charges and tariffs reflect recurring costs, an efficient outcome should ensue (absent other market failures). But if, in addition, the charges incorporate the recovery of sunk costs, investment decisions could be distorted, leading to an inefficient outcome. This is an issue likely to affect charge point investors, who will tend to be price sensitive.

Conclusions

Electric vehicles have begun to find favour. The EV market share rose by 35% between June 2018 and June 2019. But the widespread take-up required to meet the UK’s target of net zero carbon emissions will require a significant, sustained increase in ownership over the next decade, including among the third of households that lack access to off-street parking. Market failures, policy uncertainty and regulatory barriers have the potential to keep the expansion of public charge point infrastructure below its socially optimal level. There are therefore good reasons to continue testing and applying policy interventions, such as those being trialled in the UK and beyond.